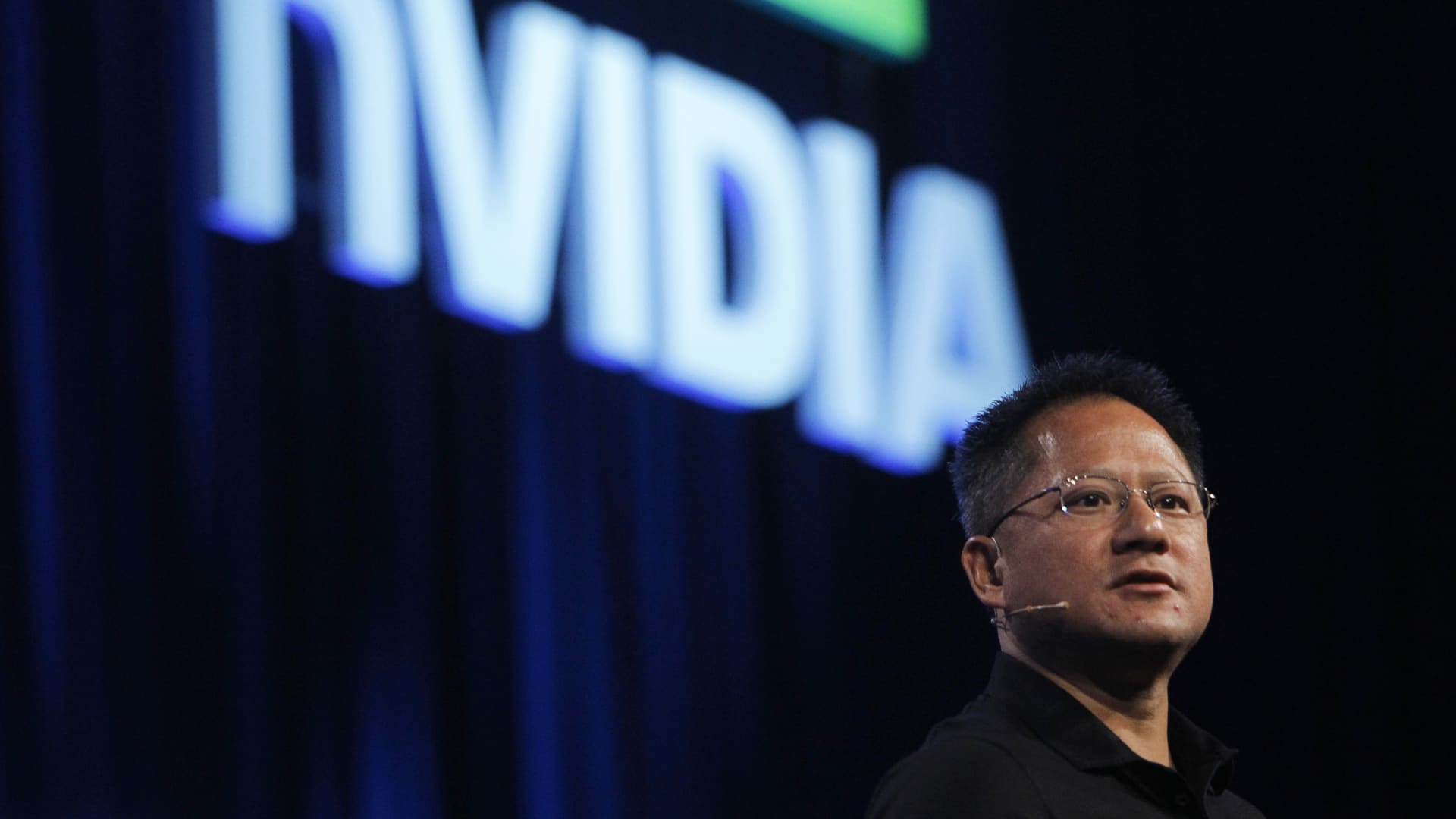

NVIDIA President and CEO Jen-Hsun Huang

Robert Galbraith | Reuters

Recession risks are on the minds of investors, especially since the Federal Reserve remains resolute in raising interest rates.

In these turbulent times, investors are advised to find stocks that are positioned to weather the potential economic downturn.

Related investment news

To help in the process, here are five stocks picked by top Wall Street professionals, according to TipRanks, a platform that ranks analysts based on their past performance.

nvidia

chip giant nvidia (NVDA) is under pressure due to the slump in the PC gaming market. Revenue and earnings were down in the fiscal fourth quarter compared to a year earlier, but the company was able to beat Wall Street expectations due to an annual rise in data center revenue.

Investors welcomed Nvidia’s first-quarter revenue guidance and CEO Jensen Huang’s comment about how the company is well-positioned to benefit from the growing interest in generative artificial intelligence (AI).

Jefferies Analyst Mark Lipassis Nvidia expects data center revenue to accelerate year-over-year after the first quarter and grow 28% in 2023 and 30% in 2024, supported by increased AI spending. (be seen Nvidia stock chart on TipRanks)

Lipassis said, “Unlike INTC/AMD reporting cloud inventory build, NVDA discussed a positive H100 slope (it actually crosses over the A100 only in the second quarter after launch), which accelerates DC [data center] YY cycles after C1Q23, and hinted at better visibility and more optimism for the year due to increased activity around AI infrastructure, LLMs [large language models]and generative artificial intelligence. “

The analyst views Nvidia as a “top pick” after recent results, and reiterated the Buy rating. He raised his target price for NVDA stock to $300 from $275.

Lipacis ranks second among more than 8,300 analysts on TipRanks. Its ratings were profitable 73% of the time, with each rating generating an average return of 27.6%.

Ross Stores

Ross Stores (Rust) positive results for the fourth quarter of fiscal 2022, as the value propositions of the non-price retailer continued to attract customers. However, the company issued conservative guidance for fiscal 2023 due to the impact of high inflation on its low-to-moderate income customers.

Following the results, analyst Guggenheim Robert Dreballwhich ranked 306y Among the analysts at TipRanks, it cut its earnings per share estimate for fiscal 2023 for Ross Stores to reflect the impact of the overall headwind.

However, it expects Ross Stores earnings to return to double-digit growth in fiscal 2023, driven by a higher operating margin, accelerated new store openings and the company’s stock repurchase program.

DarPaul reiterated a Buy rating for Ross Stores and a $125 price target, noting the “favorable environment for the company given the market’s oversupply of branded goods, stronger value proposition, and wider assortment compared to pandemic levels.”

DarPaul has profitable ratings 63% of the time, and its ratings generate an average return of 9.1%. (be seen Hedge fund trading activity from Ross Shops on TipRanks)

Contour brands

Next on our list is another consumer discretionary company – Contour brands (KTB) which owns the famous Wrangler and Lee Brands. Shares of the apparel company soared the day it reported strong fourth-quarter results and issued a solid outlook for 2023.

Williams Trading Analyst Sam Bowser He noted that demand for Wrangler and Lee continues to improve, supported by the company’s brand-strengthening initiatives. Furthermore, he believes that Kontoor’s financial outlook for 2023 “will likely prove to be conservative.” The company’s revenue growth in China is expected to turn positive in the second quarter and then accelerate in the previous quarter.

Poser raised its earnings per share estimates for fiscal 2023 and 2024, reiterating its Buy rating to Kontoor Brands and increasing its price target to $60 from $53. (be seen Insider trading activity for Kontoor Brands on TipRanks)

A combination of better-than-expected results for the fourth quarter of ’22, led by a 20% increase in DTC in the US [direct-to-consumer] Revenue, continued improvements in the positioning of both the Wrangler & Lee brands, and reasonable guidance indicate continued improvements in KTB’s consumer-facing capabilities and overall operations.”

Poser is ranked 134y Among the analysts tracked by TipRanks. Moreover, 55% of his reviews were successful, generating an average return of 17.7%.

Vserv

Vserv (FISV), a payments technology and financial services solutions provider, is also on our list this week. Last month, the company announced its fourth-quarter results and reassured investors that it was ready to deliver its results 38y consecutive year Double-digit adjusted earnings per share growth, supported by recent customer additions, strong recurring revenue and productivity efforts.

Tigress Financial Analyst Evan Fenceth He noted that Fiserv continues to see strong business momentum, thanks to the performance of its payments product portfolio and strength in Clover, the company’s cloud-based point-of-sale and business management platform. (be seen Fiserv financial statements on TipRanks)

“FISV’s diversified product portfolio and industry-leading technology puts it at the forefront of the continued shift to electronic payments and the growing use of connected devices to provide payment processing services and access to financial data,” said Feinseth. The analyst reiterated the buy rating on FISV stock and raised the price target to $154 from $152.

Feinseth holds No. 176y Among more than 8,300 analysts tracked on the site. Moreover, 62% of his ratings were profitable, and his ratings generated an average return of 12.3%.

a work day

a work day (day), a company that provides cloud-based financial services and HR applications, had a subdued outlook for fiscal 2024, which overshadowed better-than-expected results for the fourth quarter of fiscal 2023.

Baird Analyst Mark Marcon He noted that Workday continues to gain market share in human capital management and financial management solutions in the enterprise space, although the upcoming pace of growth “mitigates a bit of the overall uncertainty.”

Marcon also noted that despite long enterprise sales cycles due to overall pressures, Workday acquired seven new Fortune 500 customers and 11 new Global 2000 customers in the fiscal fourth quarter. The analyst said that new co-CEO Carl Eschenbach is “rapidly making an imprint on WDAY” and that the company is expected to re-accelerate subscription revenue growth to the 20% level once the overall backdrop normalizes.

“While our near-term outlook is more subdued, we believe the valuation relative to the long-term potential remains attractive given WDAY’s high net revenue retention (over 100%), high GAAP gross margins, and strong FCF. [free cash flow] And strong growth potential given the move of financial institutions to the cloud,” said Marcon.

The analyst lowered his price target slightly for Workday stock to $220 from $223 to reflect near-term pressures. and repeat Buy rating, given the company’s long-term growth potential.

Marcon ranks 444y of analysts follow them on TipRanks. Its ratings have been profitable 60% of the time, generating an average return of 13.5%. (be seen The opinions and sentiments of the Workday Blogger on TipRanks)

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge