- Dogecoin remains volatile, with most holders making profits despite the long-term downtrend

- The market behavior of DOGE does not seem to have any obvious directional movement

Dogecoin (DOGE), the ubiquitous memecoins chart, was not the best performer this cycle. However, it made some modest gains a week ago amid the Ethereum ETF hype, seeing an 8% surge in one day. However, at the time of publication, the DOGE chart appears to be painted in red. Is the world’s largest meme cryptocurrency gone full throttle?

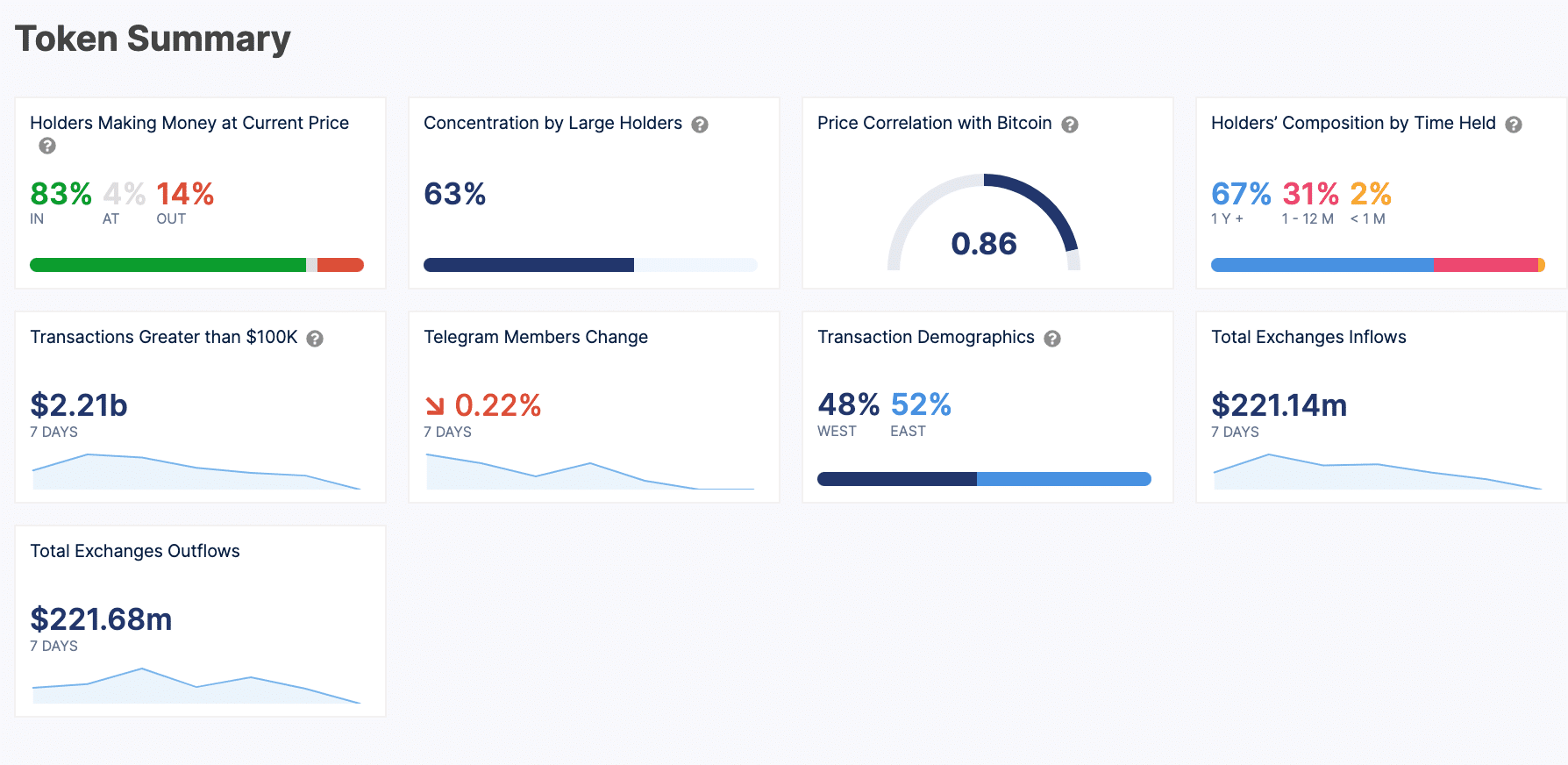

First, let’s take a look at DOGE holders. Information from IntoTheBlock open The vast majority (83%) of DOGE holders are making a profit at its current price. So, despite the recent losses, long-term holders are still in a favorable position. Especially since 63% of Dogecoin supply is also owned by whales.

Here, it is worth looking at BTC as well. The strong correlation (0.86) with Bitcoin is a sign that Dogecoin price movements are strongly influenced by broader market trends, especially Bitcoin movements.

Source: IntoTheBlock

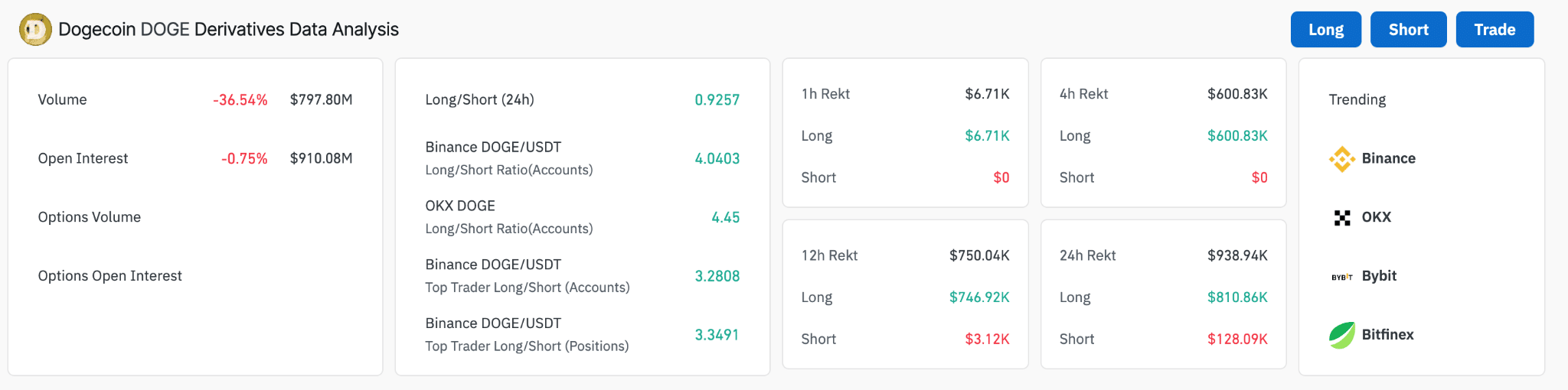

The near parity between inflows ($221.14 million) and outflows ($221.68 million) from exchanges over the past week could be a sign of balanced buying and selling activity among traders. In fact, Dogecoin consolidated its position as neither bulls nor bears had the upper hand on the charts.

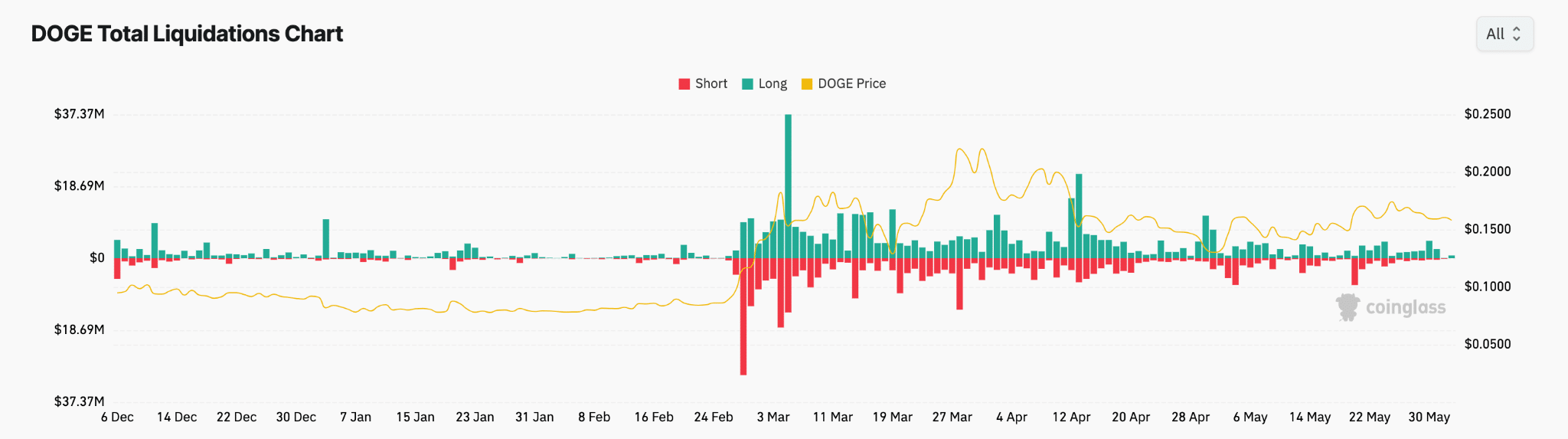

Source: Coinglas

Dogecoin’s rallies, especially on short liquidations, correspond to sudden price spikes, indicating that rapid upward trends have forced short sellers to exit their positions at a loss.

The overall trend reveals a mix of long and short liquidations without a sustained increase in either, indicating a market characterized by speculative trading and sudden shifts in prices rather than a steady directional movement.

Source: Coinglas

This liquidation pattern is consistent with DOGE’s ongoing price performance as well. Despite its resilience, the market remains uncertain, characterized by short-term spikes and corrections. Just like a typical memecoin.

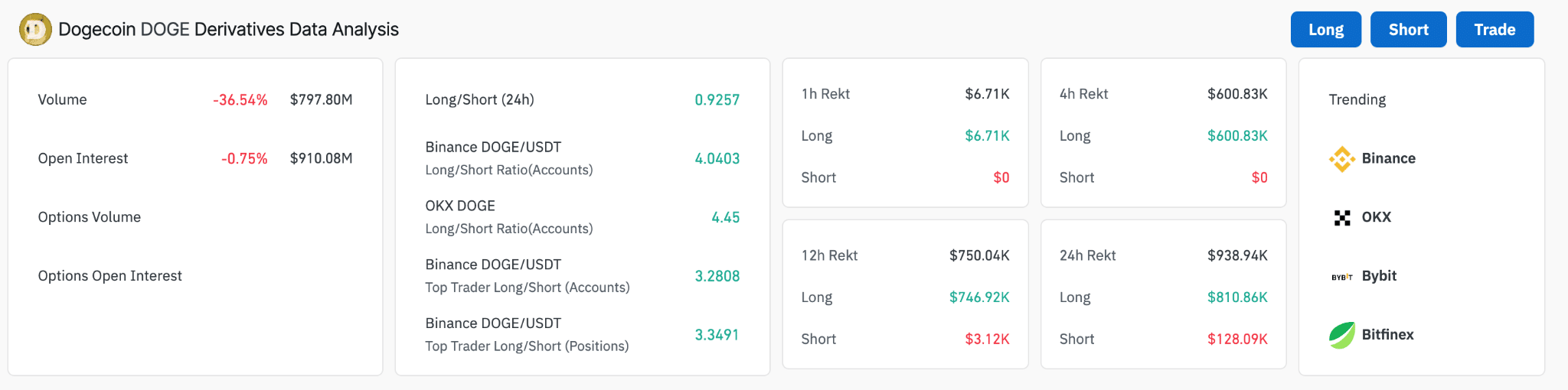

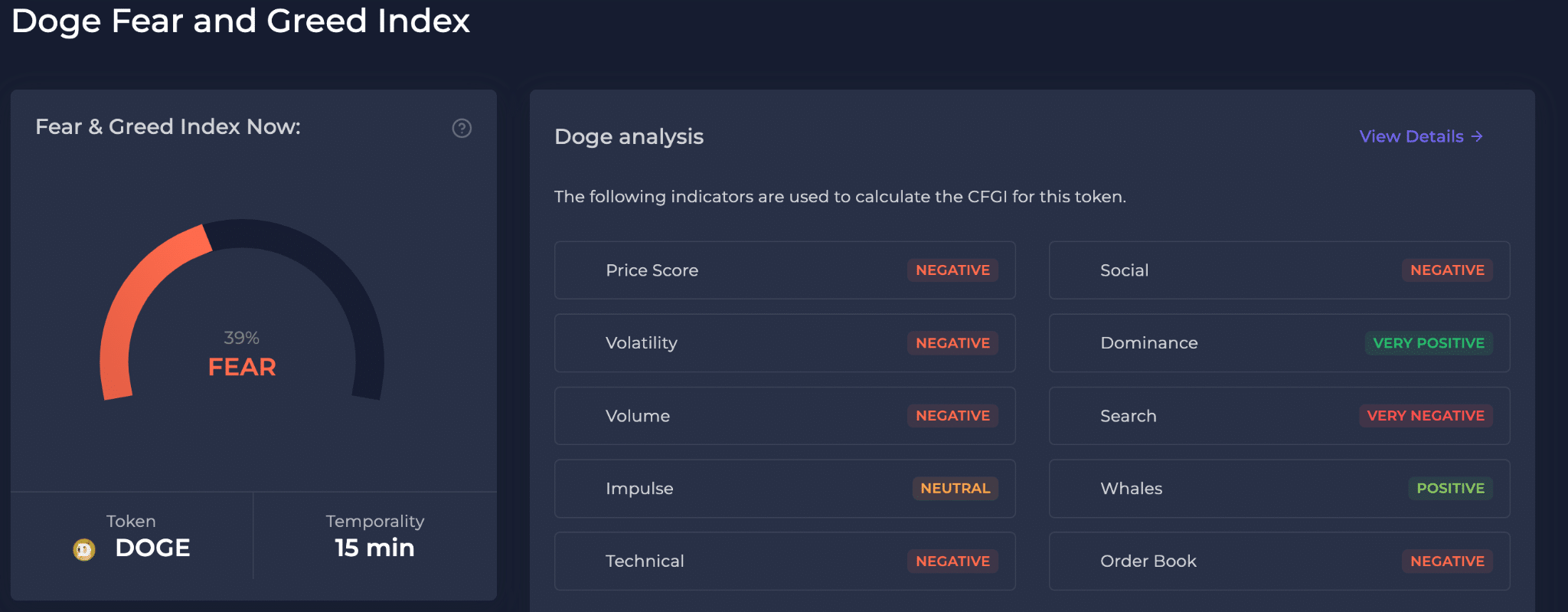

Source: CFGI

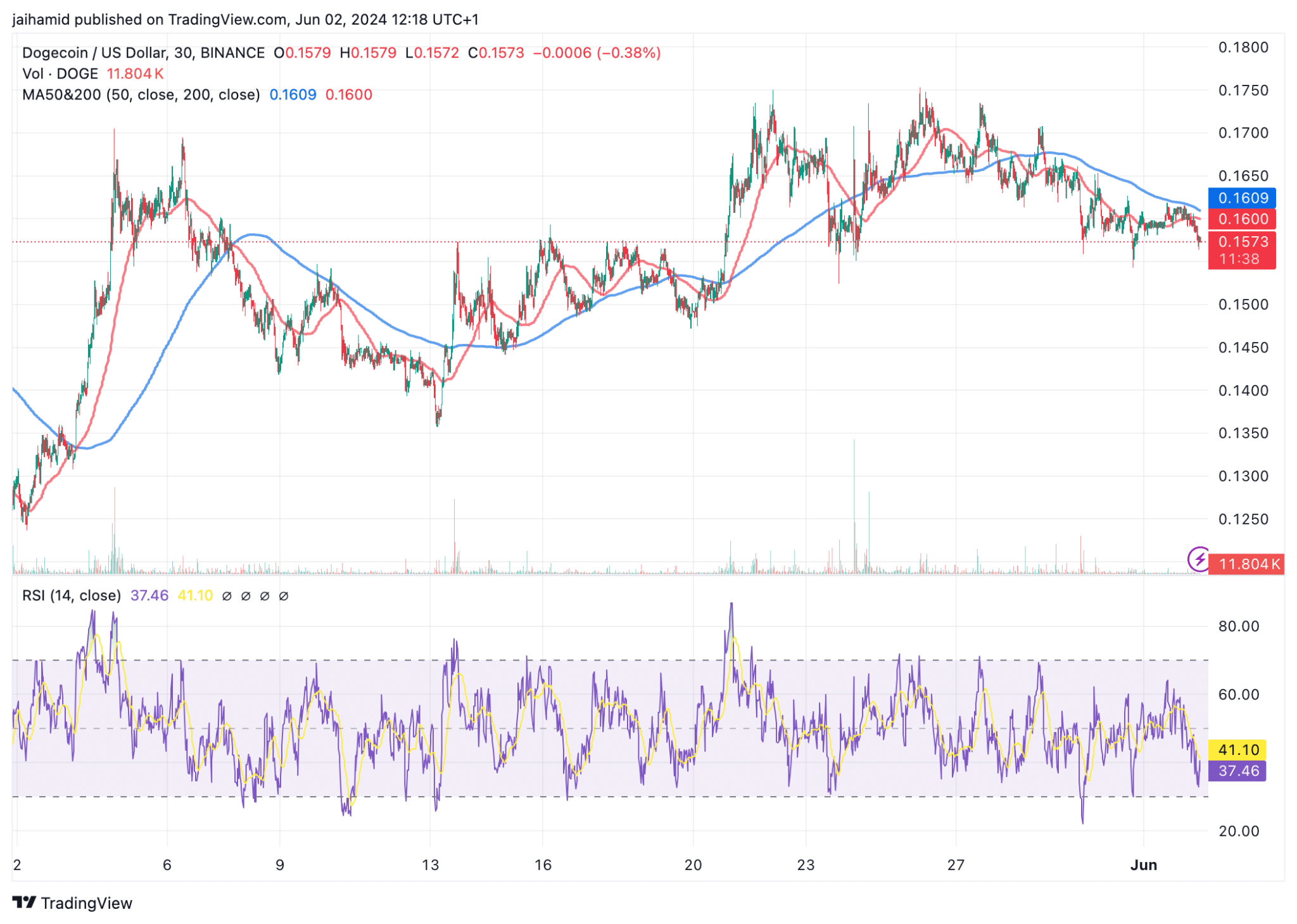

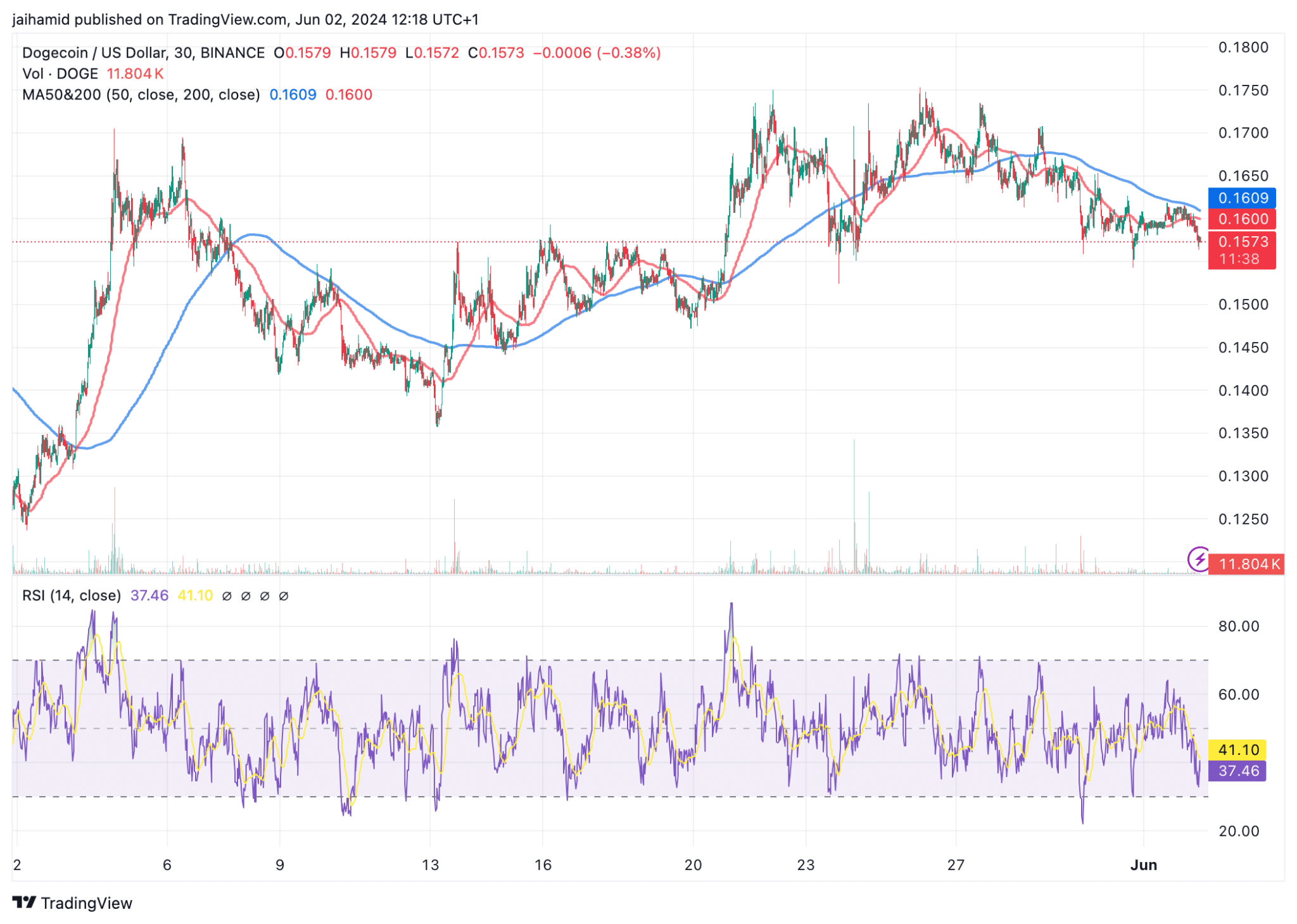

An analysis of Dogecoin’s monthly chart revealed that the cryptocurrency is wrestling with volatility and market sentiment as well. Over the past month, for example, DOGE has shown a range of volatility, but has mainly moved within a restricted price range of around $0.135 to $0.175.

The Relative Strength Index (RSI) was hovering between the 30s and 60s meaning that the memecoin was in neutral to slightly bearish territory on the charts.

Source: DOGE/USD, TradingView

The moving averages appear to share a clearer picture of the medium-term trend on the DOGE chart. In fact, the 200-day moving average has been found hovering above the 50-day moving average most of the time – a sign that despite the short-term recovery, the broader outlook remains quite bearish for Dogecoin.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge