- Activity across the Solana blockchain increased, but the price of SOL decreased

- The correlation between SOL and BTC declined as indicators revealed that SOL could fall below $160

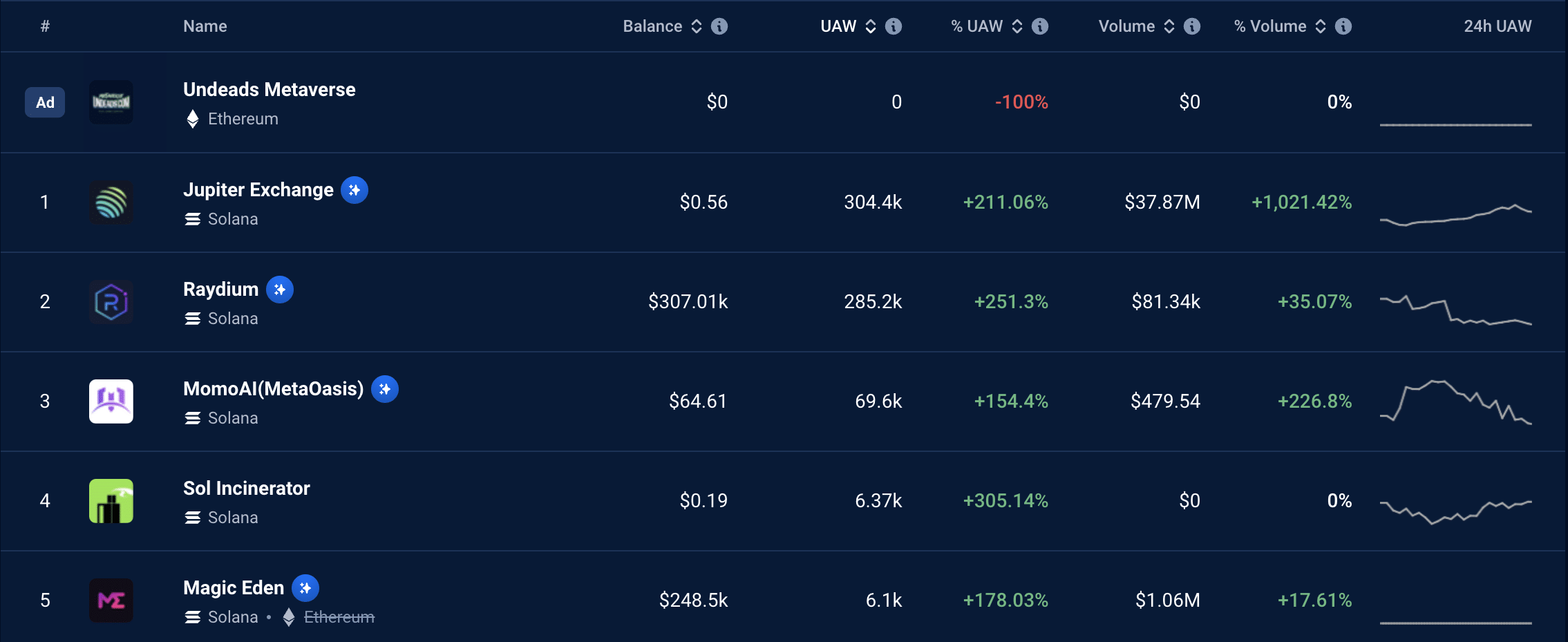

Unique Active Wallets (UAWs) on Solana [SOL] It has registered an incredible rise in the last 24 hours, according to DappRadar. DApps including Jupiter, Raydium, and Magic Eden contributed to the above increase.

AMBCrypto found that the number of UAWs in the Jupiter Exchange pool reached 307,100, representing a 251% increase. For Raydium, the rise was slight to 285,200 while NFT activity rose. Finally, the same price rose by up to 178% in Magic Eden.

Memecoins push SOL up and down

The rise in activity on Raydium and Jupiter can be linked to increased memcoin activity in the market. that appreciation Several platforms have revealed that the tumultuous memecoin story can be traced back to GameStop (GME) and legendary trader Keith Gill, known as “Roaring Kitty.”

On June 7, derivative tokens linked to the trader appeared in large numbers. Also, these Solana-based tokens have jumped to amazing market values within just short periods.

This rise also indicates increased demand for SOL. However, at the time of writing, Solana’s price stood at $162.44, representing a 5.44% decline over the past 24 hours.

Here, it is also worth noting that AMBCrypto found the reason why SOL could not maintain the rise, despite the increased demand.

For many degenerates, the idea of buying a memecoin will not last long. In cryptocurrencies, the term “scalper” refers to an individual who engages in highly volatile and speculative token trading without any fundamentals. As such, when tokens reach a certain level of profit, they exchange them for the native Solana token, selling them for a stablecoin or fiat.

Lately, there have been a large number of these pumps and dumps, and they may not stop anytime soon. If this is the case, SOL may continue to move sideways.

Can a BTC token bank?

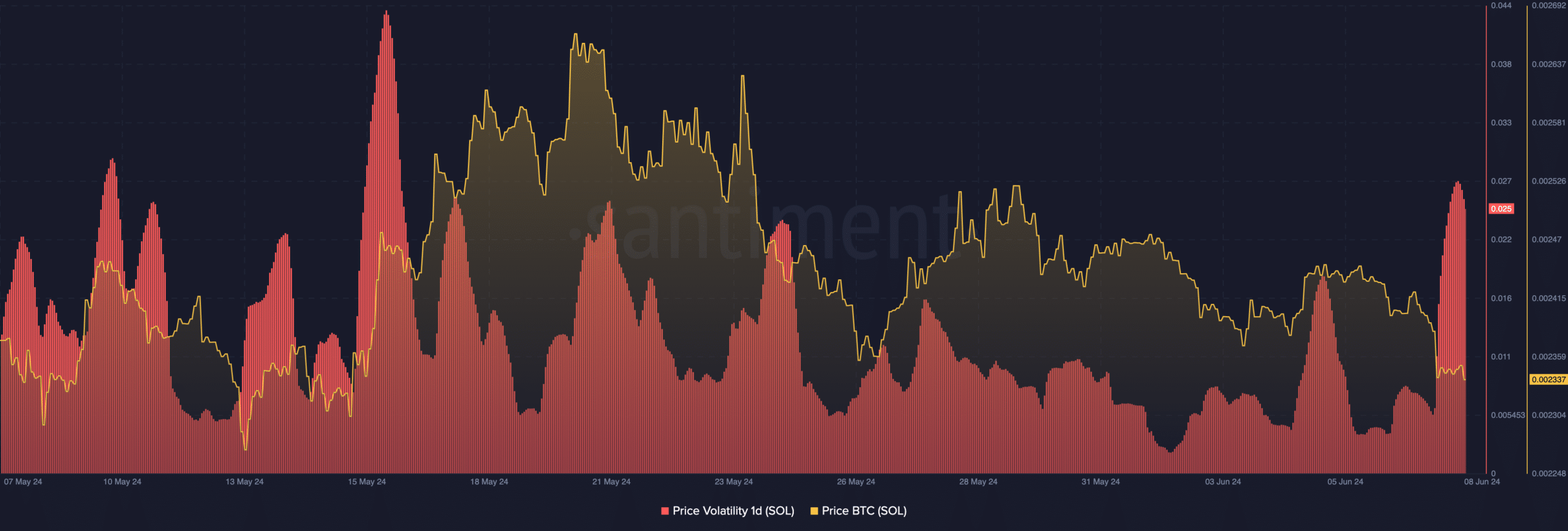

AMBCrypto also found that SOL’s one-day volatility has jumped. Volatility tracks how quickly a price can fluctuate. Therefore, if selling pressure rises amid high volatility, the token may fall on the charts.

On the other hand, high buying pressure accompanied by high volatility can lead to a price breakout. However, looking at things, SOL price may fall below $160 in the short term.

Solana is separating from Bitcoin

Another factor that can affect the price is Bitcoin [BTC]. According to data from Santiment, Solana relationship It has been declining since June 6, which indicates that the price in question may not always move in the same direction.

Therefore, if Bitcoin rises above $71,000 again, there is no guarantee that SOL will revisit $187. However, if the market recovery is more widespread, prices may follow a similar path.

Is your wallet green? Check out Solana’s profit calculator

Whichever way SOL goes, it is unlikely that the cryptocurrency will reach $200 next week. In the long term, there are expectations that the price of SOL will reach $1,000. For this to happen, the market condition must improve.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge