- Litecoin price is up 3% in the last 24 hours.

- Market sentiment around the coin remained bullish.

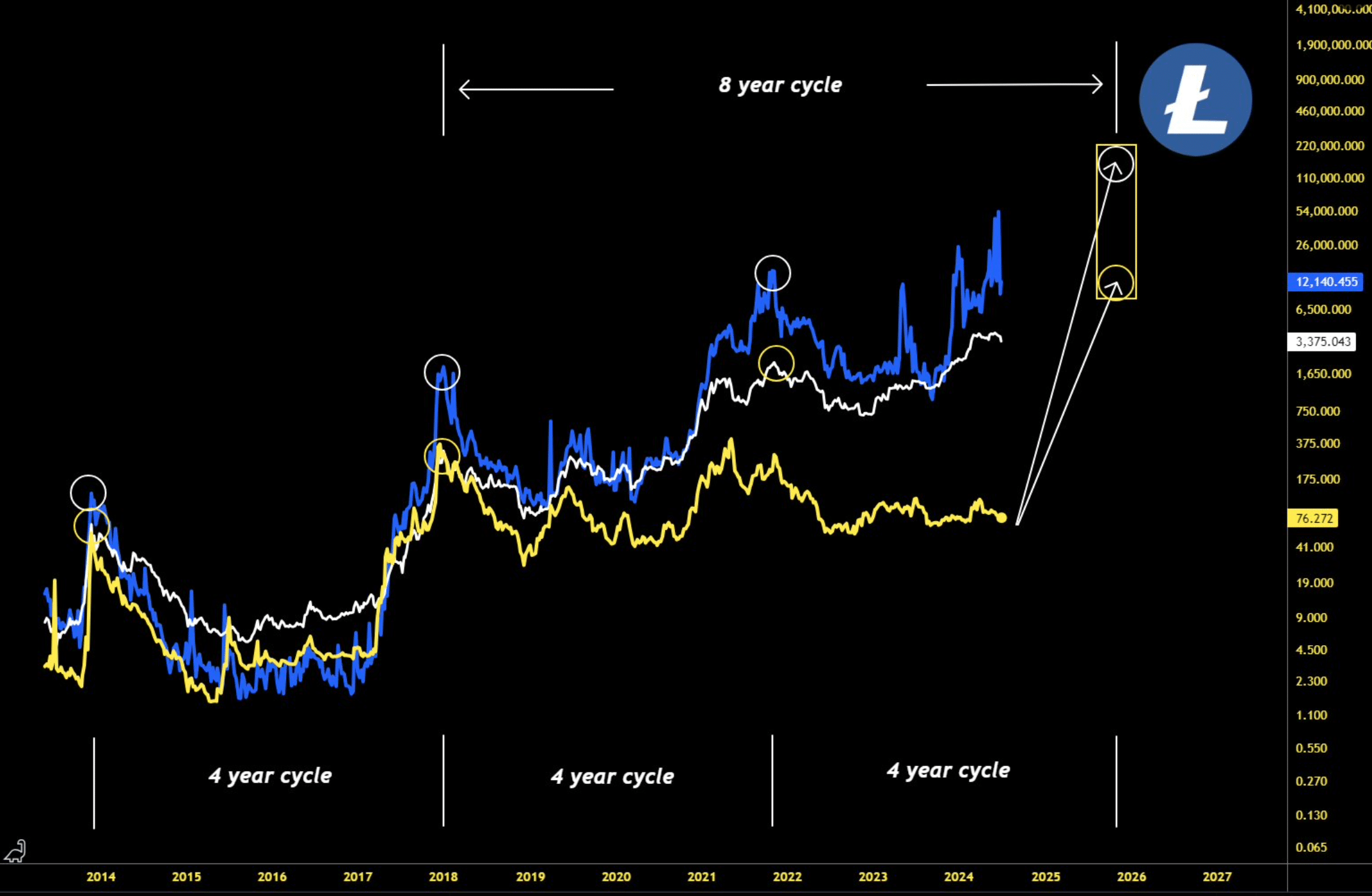

Litecoin [LTC]Like most other cryptocurrencies, LTC has had a tough time in the past month as it has lost a significant amount of its value. In fact, if we consider recent data, LTC may be on an 8-year cycle, which seems alarming at first glance.

However, there is more to the story.

What’s happening with Litecoin?

Coin Market Cap Data Reports revealed that Litecoin’s price has seen a correction of more than 22% in the past 30 days alone, and the downtrend has not stopped over the past week, as it has dropped by 13%.

Although this was disturbing, the latest analysis Popular cryptocurrency analyst Master revealed a different picture. According to the tweet, Litecoin is now in its 8-year cycle.

If this is true, investors will see LTC peak in October 2025. Historically, during every 4-year cycle, LTC has peaked. Specifically during the years 2014, 2018, and 2022.

If history repeats itself, LTC price could range from $65K to over $100K during its next peak.

Source:X

This can be expected in the near term.

Since looking at a 2025 peak is too early at the moment, AMBCrypto planned to check the current state of the coin to see what to expect in the near term.

The good news is that, like many other cryptocurrencies, LTC has also gained bullish momentum in the past 24 hours as its price rose by more than 3%.

At the time of writing, LTC is trading at $64.73 with a market cap of over $4.8 billion, making it the 21st largest cryptocurrency.

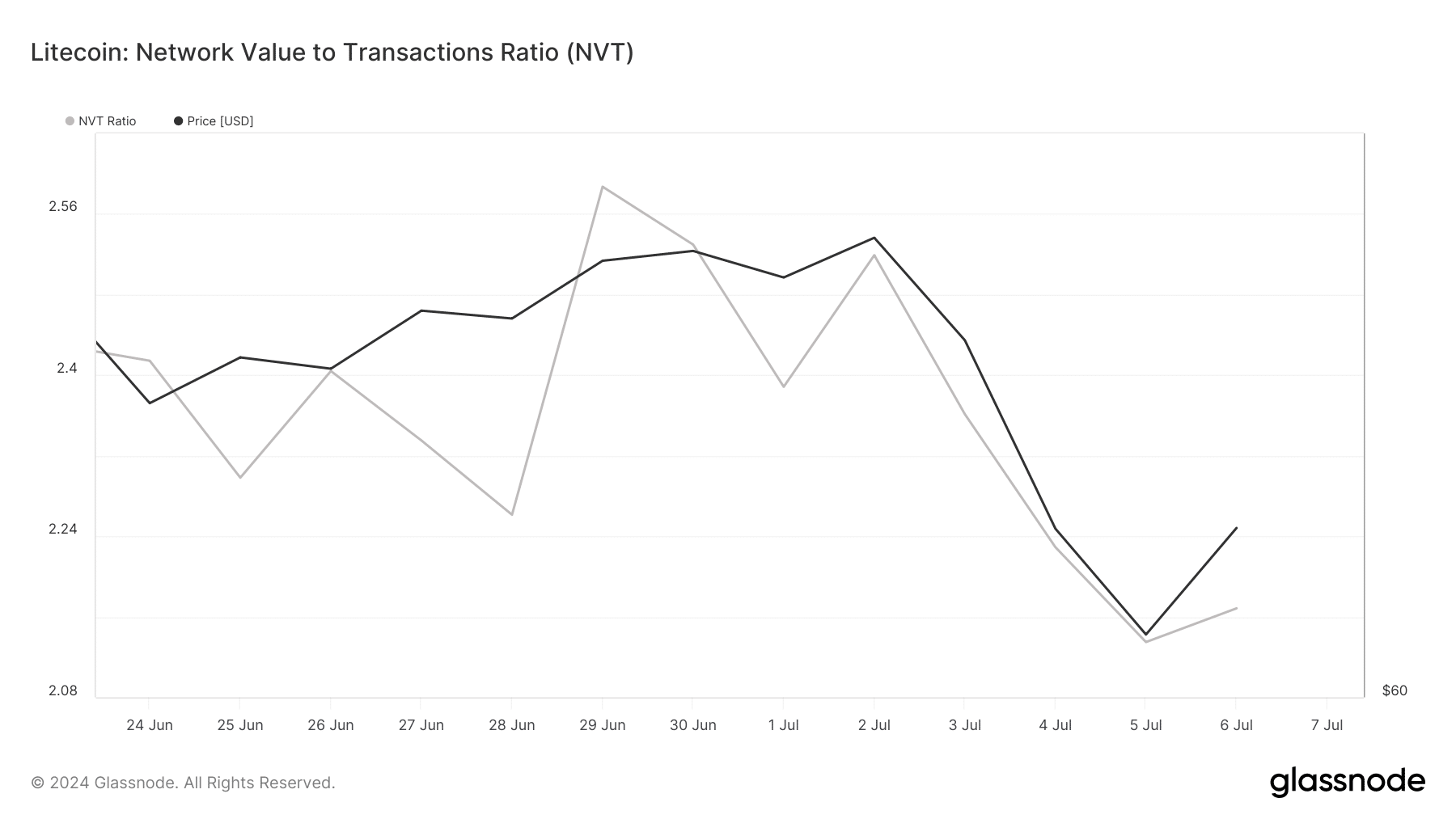

Things may be looking up soon, as the coin’s NVT ratio fell last week. A lower metric means the asset is undervalued, suggesting a rise in prices.

Source: Glassnode

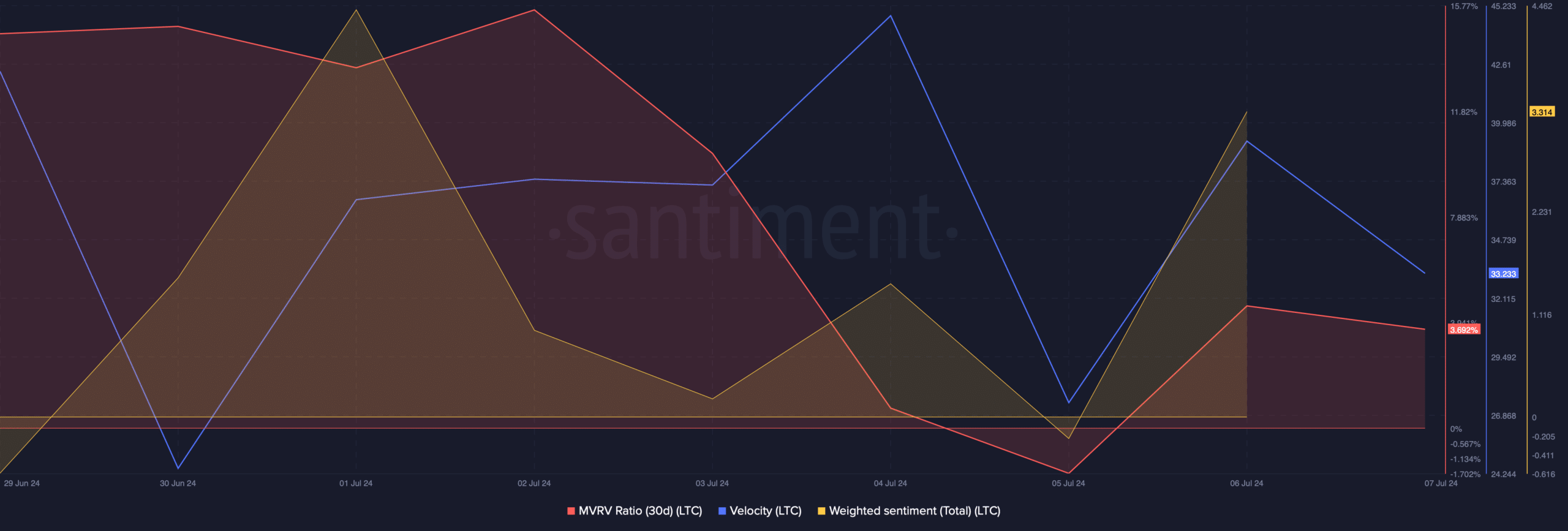

Investor confidence in the currency also seemed to improve as its weighted sentiment rose. This clearly meant that bullish sentiment around the currency was dominating the market.

However, not all metrics were optimistic. For example, the MVRV ratio recorded a decrease. Its velocity also decreased in the past few days, meaning that LTC was being used less in transactions within a given time frame.

Source: Santiment

Is Your Investment Portfolio Green? Check Litecoin Profit Calculator

Our analysis of Coinglass data revealed that the length-to-width ratio has also decreased, meaning there are more short positions in the market than long positions.

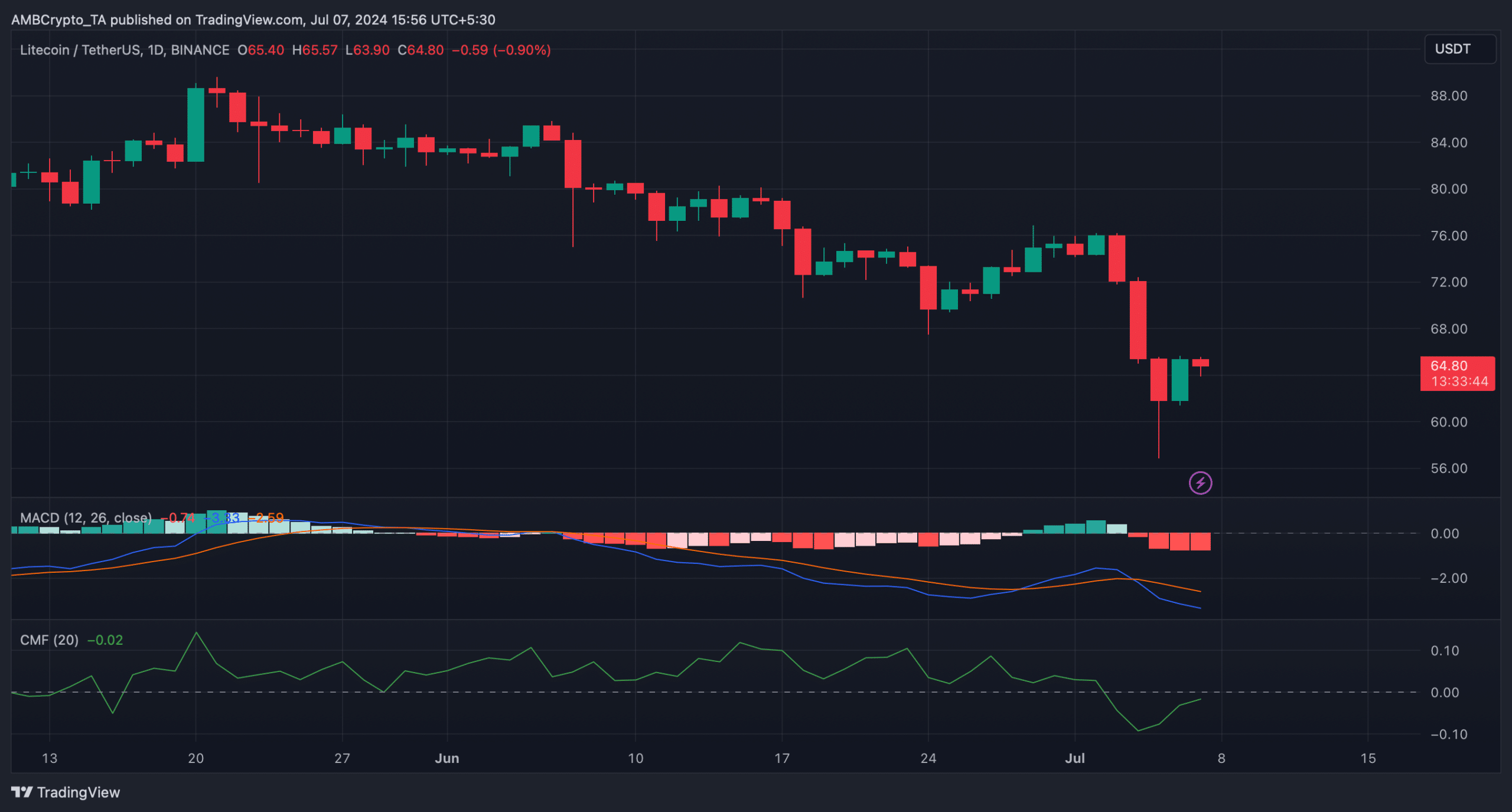

The MACD indicator for the coin has shown a bearish trend in the market. However, nothing can be said for sure as the Chaikin Money Flow (CMF) has registered an increase, indicating that the price will continue to rise.

Source: TradingView

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge