Former Acting Assistant Secretary of the Treasury Gregory Zerzan comments on President Biden’s executive order on government oversight of cryptocurrency.

While the world remains focused on the tragic situation in Ukraine, the Biden administration is preparing to launch the first US government support digital currency. If a new digital dollar is introduced, it could significantly reduce individual rights and give the Federal Reserve and the national government more power over the US economy.

On March 9, the White House issued an executive order covering digital assets, including cryptocurrencies such as bitcoin. Under the far-reaching executive order, a long list of government agencies will develop plans to regulate, study, and/or monitor cryptocurrencies and the various exchanges that consumers buy, sell and trade on.

Austin could be the next major city for cryptocurrency innovation

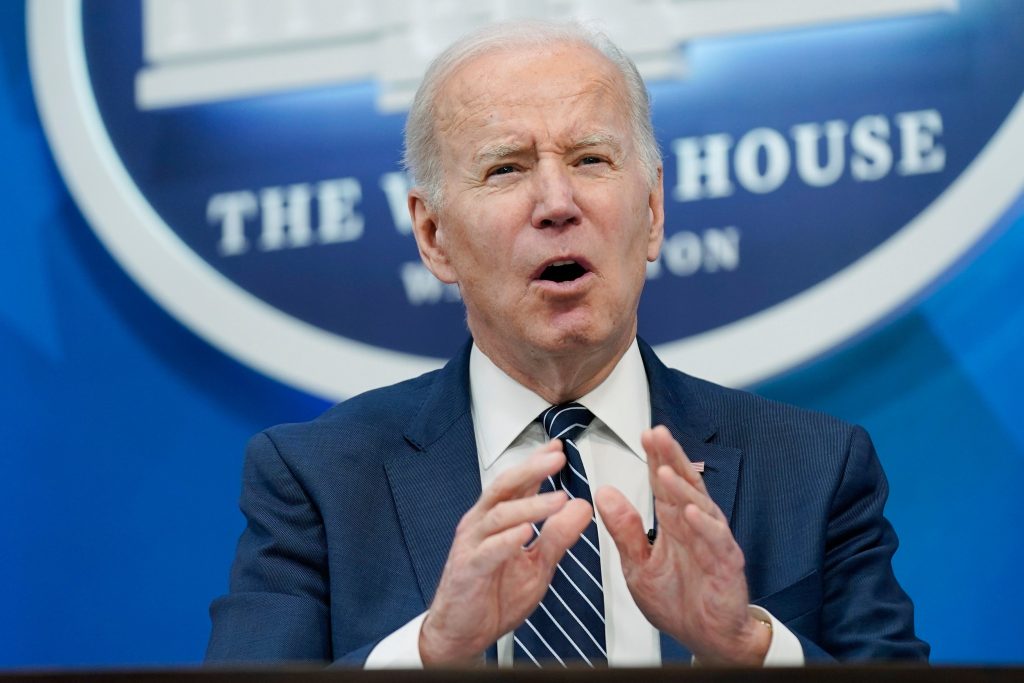

US President Joe Biden speaks as he meets with business leaders and governors at the Eisenhower Executive Office Building in Washington, DC, United States, on Wednesday, March 9, 2022. The Biden administration’s long-awaited executive order of government (Ting Shen/Bloomberg via Getty Images/Getty Images)

The White House’s interference in the use of blockchain technology should be enough to alarm advocates of free markets, but there is an even more troubling part of Biden’s executive order: the potential development of an entirely new digital currency.

The EO states that the White House has placed “the utmost urgency for research and development efforts into potential design and deployment options” for a new central bank digital currency (CBDC). It also directs several federal departments, including the Treasury Department, to work on developing a “report on the future of money and payment systems, including terms that drive widespread adoption of digital assets.”

The Treasury must submit the report within 180 days, which is about six months.

Chia Network’s COO and President Jane Hoffman discuss whether cryptocurrencies represent a sanctions loophole for Russia in “Claman’s Countdown.”

The White House is also asking the Federal Reserve Chair to “develop a strategic plan for the Federal Reserve and broader actions by the United States government, as appropriate, to assess steps and requirements for the potential implementation and release of U.S. central bank currencies of the United States.” Within 210 days of the executive order, the White House must Submit a “Legislative Proposal” of the Convention on Biological Diversity to the President.

This is a really noticeable and deeply disturbing development. If a CBDC is created, it will greatly expand the power and influence of the Federal Government and the Federal Reserve, in ways that most Americans will not understand until it is too late to step back from CBDCs.

Unlike blockchain-based digital currencies like Bitcoin, which are decentralized by design, central bank digital currency is likely to be programmable, meaning that it can be designed so that Americans can only use it for specific purposes. And it would be easier for banks and government agencies to keep track of digital dollars and the people who use them, unlike the printed US dollars available today.

Although some may be inclined to dismiss these concerns as too far fetched to be a serious concern for a country like the United States, there is strong evidence that the White House and Federal Reserve have already considered making a programmable new digital dollar, with their own social and economic goals different.

A representation of the virtual currency Bitcoin is shown in this illustration taken on October 19, 2021. REUTERS / Edgar Su (Reuters/Edgar Sue/Reuters Photo)

For example, Biden’s executive order states that central bank digital currency should be designed to promote “financial inclusion and equity” and with “climate change and pollution in mind.”

A White House “fact sheet” on the executive order also noted that its executive order would “promote equitable access to safe and affordable financial services” and that the government’s report on the development of the digital dollar should include implications for economic growth. and “Financial Growth and Inclusion.”

A senior administration official also told reporters that the White House has and will continue to “partnership with all stakeholders — including industry, labor, consumers, environmental groups, allies, and international partners” when developing plans for a central bank digital currency.

Michael Bond, CEO of the Digital Asset Markets Association, outlines what the legalization of cryptocurrency for the Ukrainian government will do in the “Fox Business Tonight” programme.

Why would unions, environmental groups, and business lobbies be involved in creating a new currency, unless it was a programmable currency?

Central bank digital currency can also transform the US monetary system in important ways. Instead of using interest rates and complex monetary tools to help improve employment and keep inflation at target levels, a central bank digital currency could be created at will, with nothing but the push of a button, and perhaps even distributed directly to Americans—giving the Federal Reserve more control over Economy more than ever.

Perhaps most worryingly, the central bank’s programmable digital currency could be changed at any time in the future, giving it the possibility of politicizing or being subject to greater restrictions.

The United States has become the world’s most successful society by empowering individuals and businesses, especially small businesses. A central bank digital currency can do just the opposite, putting more power in the hands of a small number of banks, government officials, and bureaucrats. Biden’s plan for central bank digital currency should be stopped.

Get your FOX business on the go by clicking here

Justin Haskins He is director of the Center for Stopping Socialism at Heartland Institute and co-author with Glenn Beck of the forthcoming book,The Great Reset: Joe Biden and the Rise of 21st Century Fascism. “

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge