Twenty-three painful days have passed since Bitcoin (BTCIt recently closed above $32,000 and the 10% rally that occurred on May 29-30 is currently evaporating as BTC price rebounds towards $30,000. The return to $30K simply confirms the strong correlation with traditional assets and in the same period, the S&P 500 Index is also down 0.6%.

Weaker corporate earnings could put pressure on the stock market due to higher inflation and the upcoming hike in US Federal interest rates, according to For strategist Jimmy Fahey in Citi. As mentioned by Yahoo! Finance, a Citi research note to clients stated:

“Basically, despite concerns about a recession, the forecast for earnings per share for 2022/2023 has hardly changed.”

In short, the investment bank expects deteriorating macroeconomic conditions to reduce corporate profits, which in turn causes investors to re-price the stock market when it is down.

as To Jeremy Grantham, Co-Founder and Chief Investment Strategist at GMO, “We should be in some kind of recession fairly quickly, and true peak profit margins have a long way to go down.”

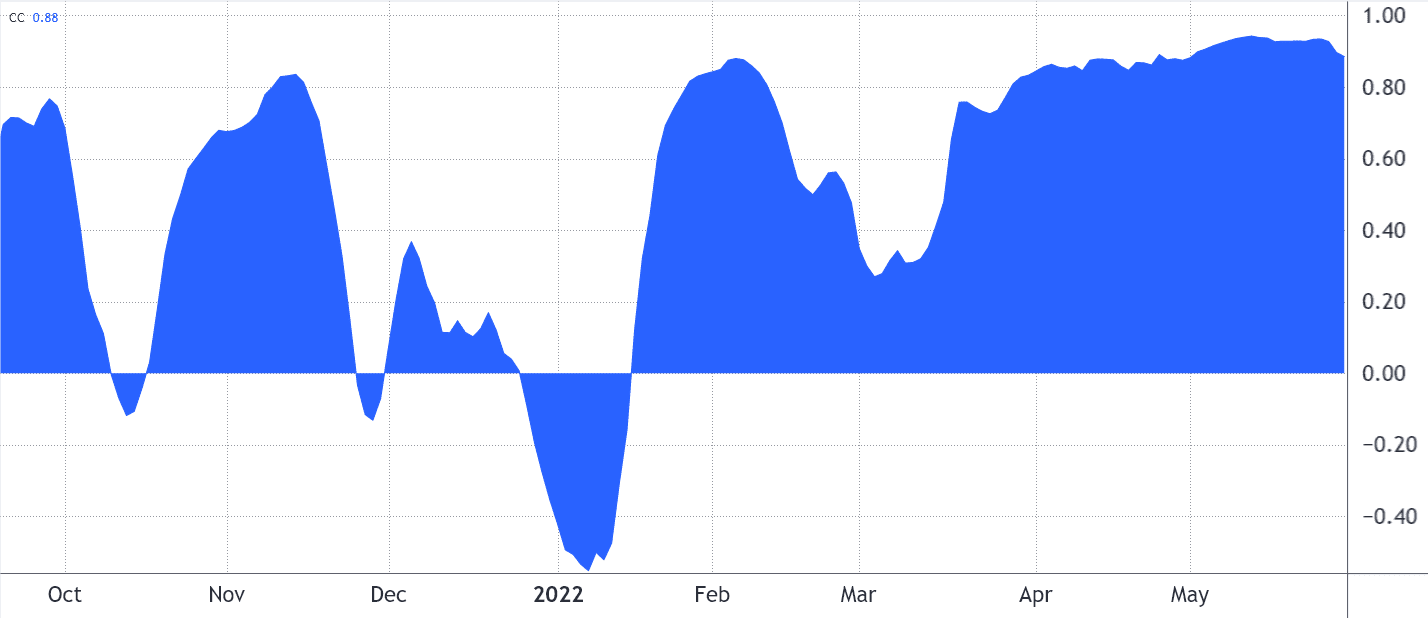

With the correlation to the S&P 500 still incredibly high, Bitcoin investors fear that a possible decline in the stock market will lead to a retest of the $28,000 level.

The correlation scale ranges from negative 1, which means that the selected markets move in opposite directions, to positive 1, which reflects a perfect and symmetrical movement. The variance or no relationship between the two origins will be represented by 0.

Currently, the 30-day S&P 500 and Bitcoin correlation stands at 0.88, which has been the benchmark for the past two months.

Mostly bearish bets below $31,000

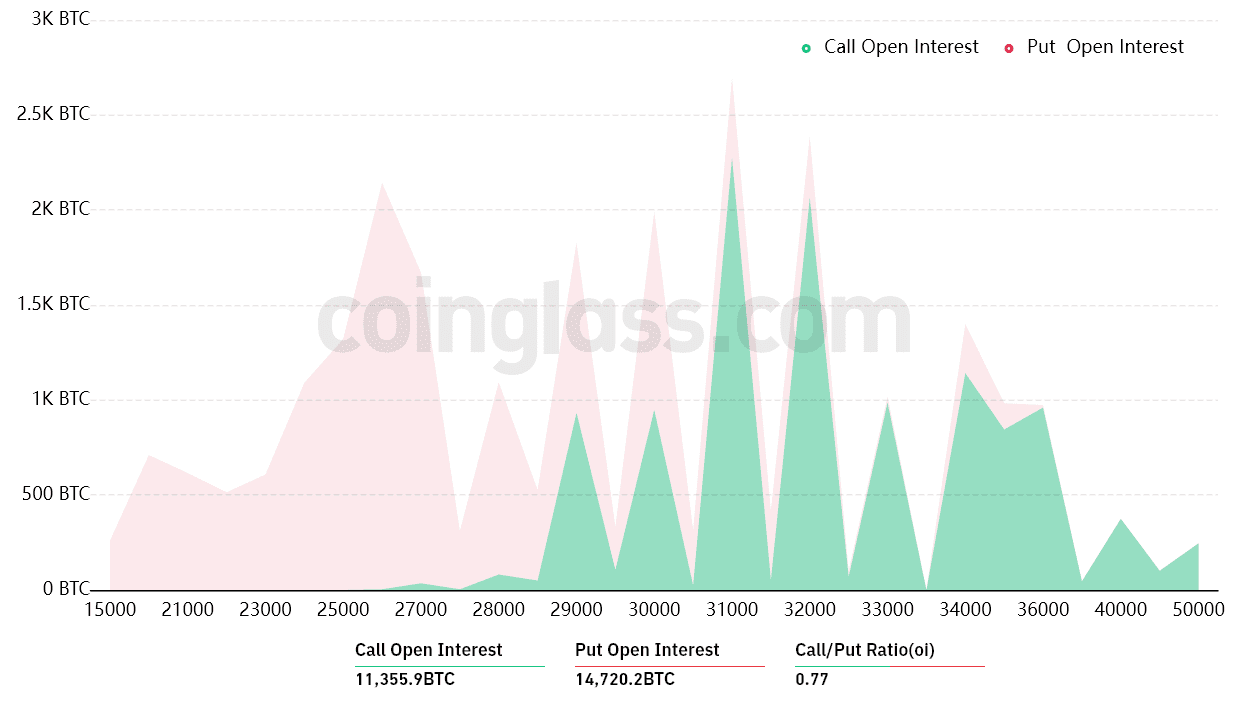

Bitcoin’s recovery above $31,000 on May 30 surprised the bears because only 20% of put (sell) options on June 3 were placed above this price level.

Bitcoin bulls may have been scammed Last resistance test $32,000 Their bets on the $825 million options go up to $50,000.

A broader view using a 0.77 buy-to-buy ratio shows more bearish bets because the open interest is $465 million against the $360 million put (call) options. However, with Bitcoin currently standing above $31,000, it is likely that most bearish bets will become worthless.

If the Bitcoin price remains above $31,000 at 8:00 AM UTC on June 3, only $90 million worth of put (sell) options will be available. This difference occurs because there is no use in the right to sell Bitcoin at $31,000 if it is trading above that level at expiration.

The bulls could get a profit of 160 million dollars

Here are the four most likely scenarios based on current price action. The number of options contracts available on June 3 for the buy (bull) and put (bear) instruments varies, depending on the expiration price. The imbalance in favor of each side constitutes the theoretical profit:

- Between $29,000 and $30,000: 1100 calls vs 5100 puts. The net result favors the Bears with $115 million.

- Between $30,000 and $32,000: 4400 calls vs 4000 puts. The net result is balanced between the buying (buying) and selling (selling) instruments.

- Between $32,000 and $33,000: 6600 calls vs 1600 puts. The net result in favor of the bulls is $160 million.

- Between $33,000 and $34,000: 7600 calls vs 800 puts. Bulls extend their winnings to $225 million.

This crude estimate takes into account buying options used in bullish bets and selling options exclusively in neutral to bearish trades. However, this oversimplification overlooks more complex investment strategies.

Bears Have Less Margin Needed To Suppress Bitcoin Price

Bitcoin bears need to press below $30,000 on June 3 to lock in $115 million in profit. On the other hand, the best-case scenario for the bulls would require a higher payment of $33,000 to increase their winnings to $225 million.

However, Bitcoin bears had $289 million of short leveraged positions liquidated on May 29, according to data from Coinglass. Thus, they have less margin required to push the price lower in the short term.

With this said, the most likely scenario is a drawdown, causing bitcoin to range near $31,000 before the June 3 options expire.

The opinions and opinions expressed here are solely those of author and do not necessarily reflect the opinions of Cointelegraph. Every investment and trading movement involves risks. You should do your research when making a decision.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge