Wake up: Met Gala Monday is arriving soon.The annual event, held at the Metropolitan Museum of Art in New York...

Astronomers celebrated the 34th anniversary of the Hubble Space Telescope by snapping an image of the Little Dumbbell Nebula, 3,400...

Jesse Rogers, ESPN staff writerApril 25, 2024 at 07:00 AM ETCloseJesse joined ESPN Chicago in September 2009 and covers MLB...

If you've gotten back into the Fallout games recently - or tried them out for the first time - you're...

Written by Mary McCallBBC Scotland NewsApril 25, 2024, 07:36 GMTUpdated 51 minutes agoTo play this content, please enable JavaScript, or...

Two years after the start of the large-scale war, the dynamics of Western support for Kyiv is losing momentum: 'Compared...

The US economy continued to grow but at a sharply slower rate early this year, as strong consumer spending was...

Rich Polk/NBC via Getty Images Video footage of an accident that occurred on the set of an Eddie Murphy movie...

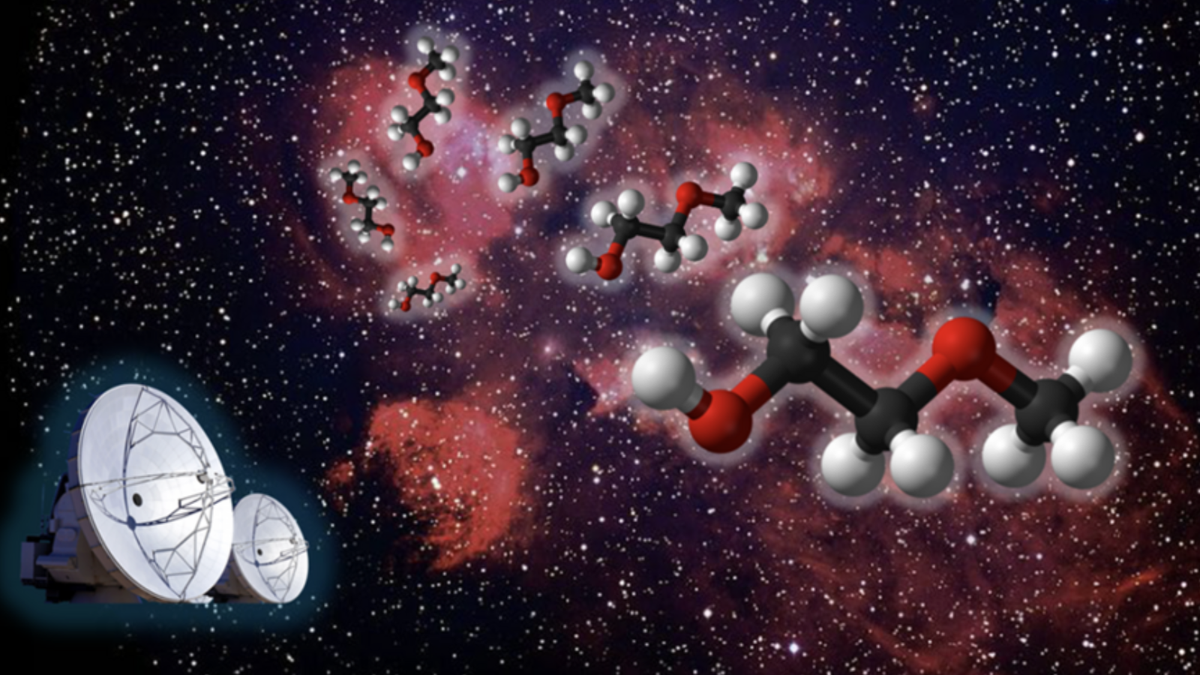

Scientists have discovered a hitherto unknown space particle while examining a region relatively close to condensed star birth, a cosmic...

It's good that Wednesday's press conference began with prayer.The Chicago Bears will likely need some divine intervention to pull off...