- KAS stock is down 11.80% in the last 7 days.

- Despite the decline, the trend is still upward.

On June 30, KAS reported a 20% surge days later as reported by AMBCrypto. However, a week later, KASPA dropped by 11.80% causing panic among long-term KASPA holders.

Despite the decline, the market remains bullish with positive market sentiment. Therefore, many analysts are expecting a rise in the market cap. KAS’s 30-day market cap has risen, outperforming PEPE and ICP.

Cryptographer @Suki He shared his predictions on X (formerly Twitter), noting that,

“It is no exaggeration to say that $KAS is worth over $100 billion. In 2017, $XRP’s bull market value reached $130 billion when there was much less money in the market. In the last bull market, $BNB went from $3 billion to $108 billion. No other cryptocurrency outperforms Kaspa’s fundamentals.”

Based on historical data, KAS is expected to see massive growth in market cap. Overall, the market cap growth means that KAS price and user activity will continue to rise in the foreseeable future.

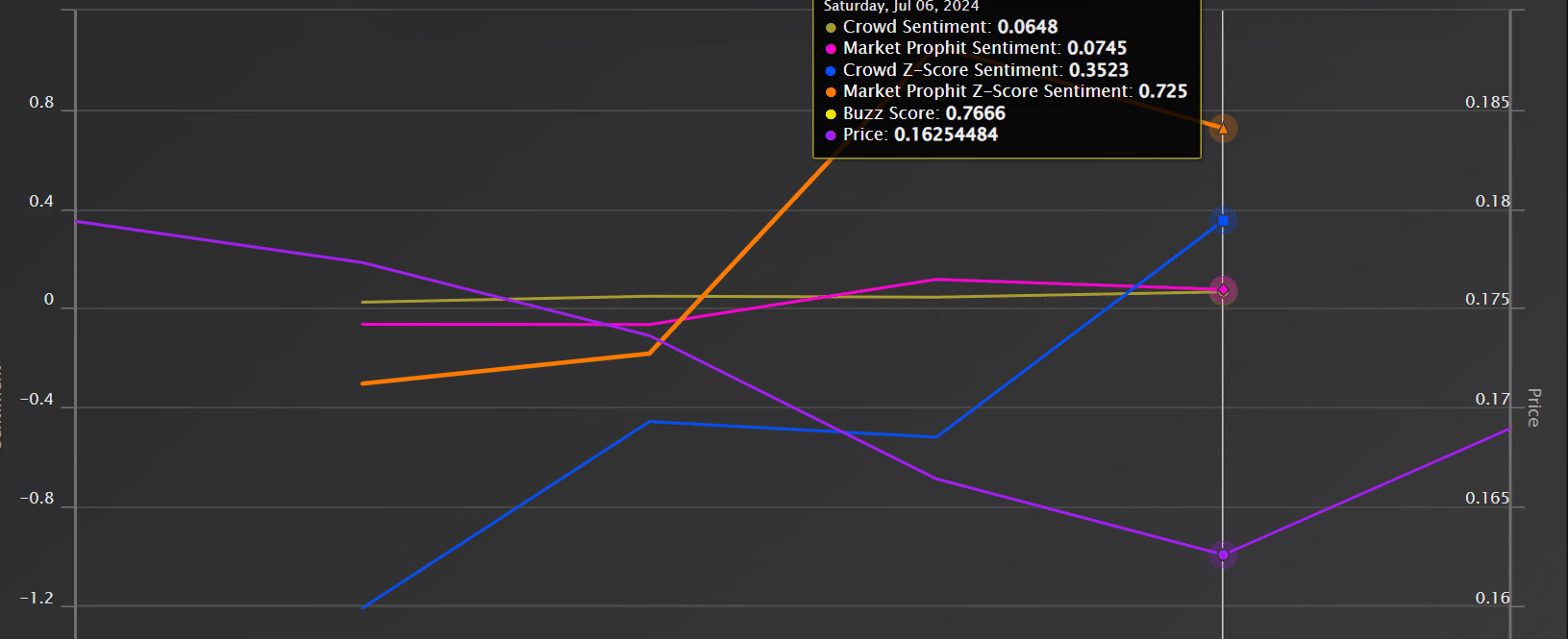

Market sentiment

Source: Market Prophit

According to Market Prophit, KASPA consistently enjoys positive market sentiment.

In fact, the public sentiment was 0.06 with a Z-score of 0.35, while the overall market sentiment was 0.07. The positive market sentiment shows that users and investors are optimistic about the future potential of KASPA.

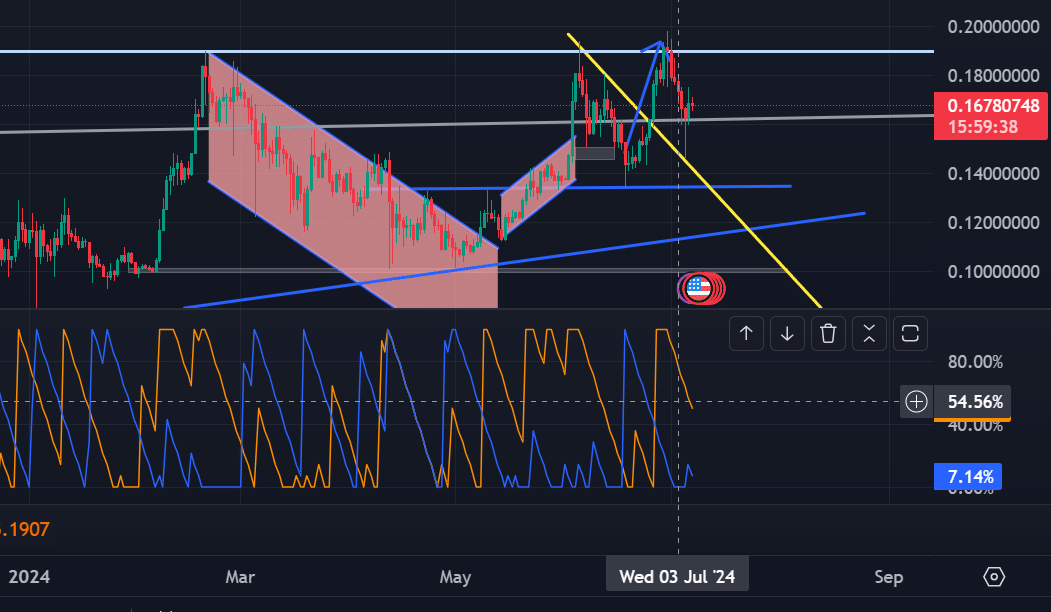

What KAS price charts indicate

At the time of writing, KAS’s Aroon line is showing a strong uptrend. Specifically, the Aroon Up line at 50 is above the Aroon Down line at 7.

When the Aroon line is set like this, it indicates that the uptrend is strong and ready to continue. Likewise, it indicates that prices are within market value.

Source: Tradingview

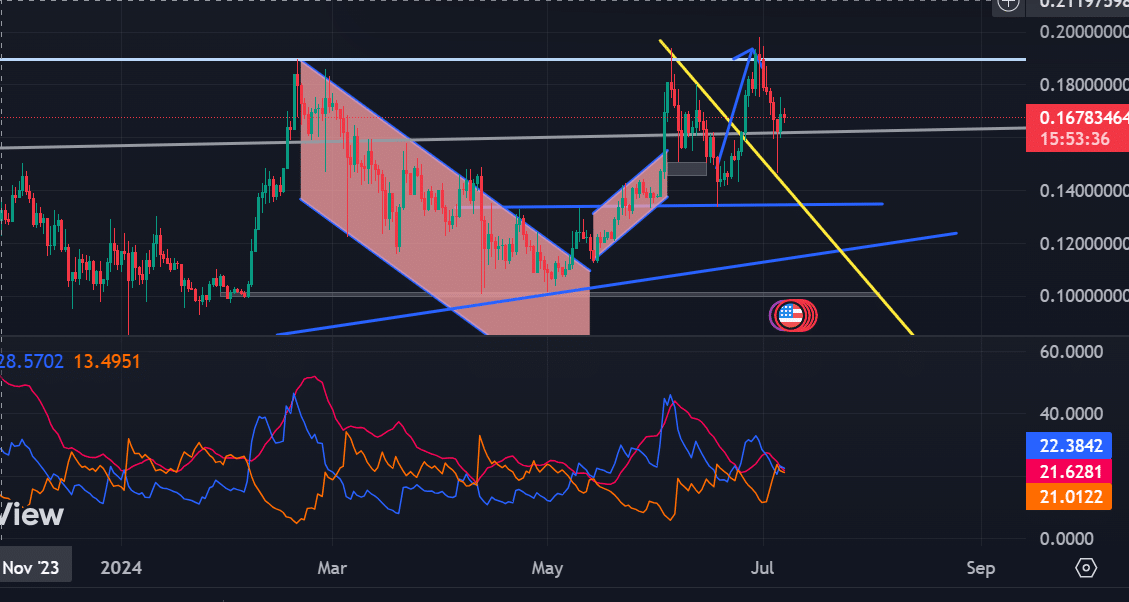

The directional movement indicator also supports this. At the time of writing, the positive indicator at 22 (blue) is above the negative indicator (red) at 21.

This setup indicates that KASPA is in a good position, and the continued positive sentiment in the market is putting it in another uptrend.

Source: Tradingview

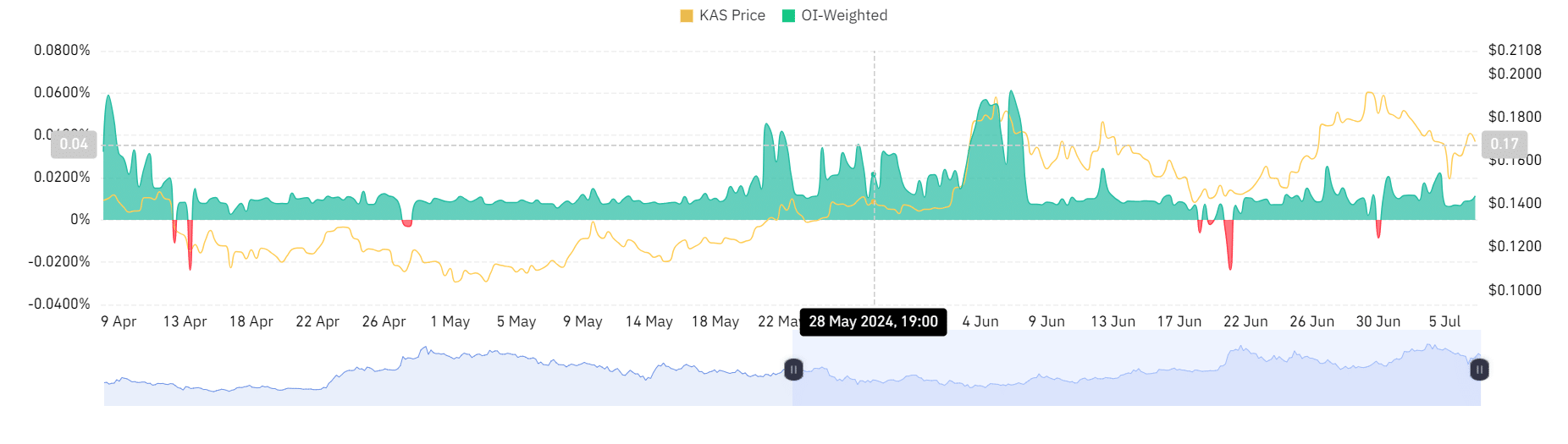

Looking at OI’s weighted funding rate, AMBCrypto’s analysis suggests that it has been largely positive over the past seven days.

Positive weighted funding ratios indicate that demand for long positions is higher than demand for short positions. Therefore, traders are paying a premium to hold their positions, which represents a bullish sentiment.

Source: Coinglass

Can KAS Stock Maintain Its Uptrend?

Kaspa analysis by AMBCrypto indicates that the price action remains largely in an upward trend. After reaching an all-time high of $0.194, KAS saw a short-term price drop while the trend remained unchanged.

At the time of writing, KAS is trading at $0.1688 after gaining 1.64% in 24 hours. Having previously reached the $0.194 resistance level, a breakout from the area would see the price surge to an all-time high of $0.23.

Therefore, if the losses continue on the weekly charts, the price will drop to the $0.15 support level.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge