(Bloomberg) — European stocks rose ahead of a widely expected interest rate cut by the European Central Bank, as markets reassessed their bets on policy easing this year.

Most read from Bloomberg

Technology stocks led gains in the Stoxx 600 after the sector hit all-time highs on Wall Street on Wednesday. US stock futures were flat after the S&P 500’s 25th record close this year. Nvidia, a major beneficiary of the massive flood of investment in artificial intelligence, has become the first computer chip company to reach a market value of $3 trillion.

“Behind a lot of the optimism we’re seeing in the markets, technology continues to lead the pack,” said Matt Stuckey, senior portfolio manager at Northwestern Mutual Wealth Management. “If you look at earnings reviews to see what’s working and what’s not, technology is the leader.”

Focus turns to the ECB later, when traders look for guidance on the future course of monetary policy, particularly from President Christine Lagarde at the press conference. Views on additional interest rate cuts this year have become more cautious in the wake of data showing stronger-than-expected economic growth, inflation and wage increases.

While investors awaited the US jobs report on Friday, the private payrolls reading on Wednesday showed that corporate employment grew at the slowest pace since the beginning of the year. Meanwhile, the services sector expanded by the most in nine months, helped by the biggest monthly gain in a measure of business activity since 2021.

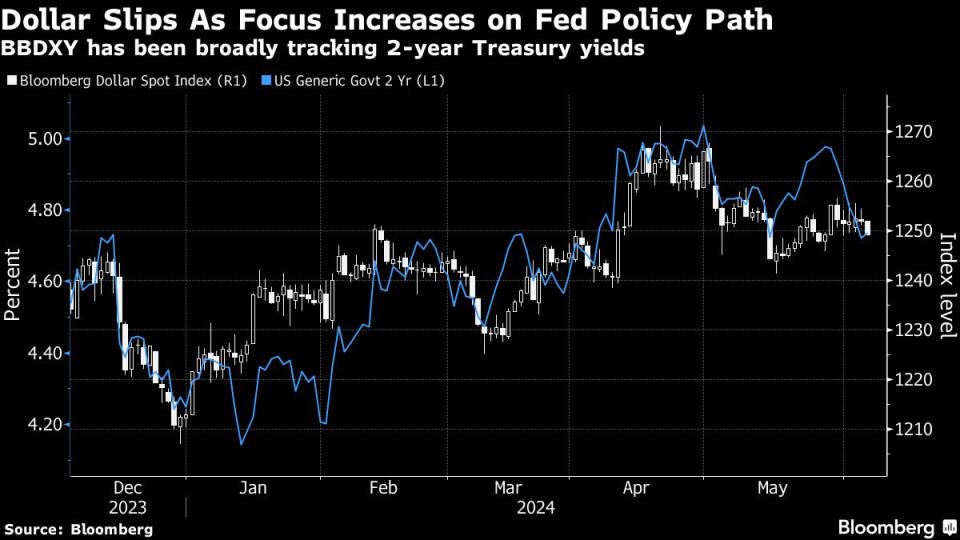

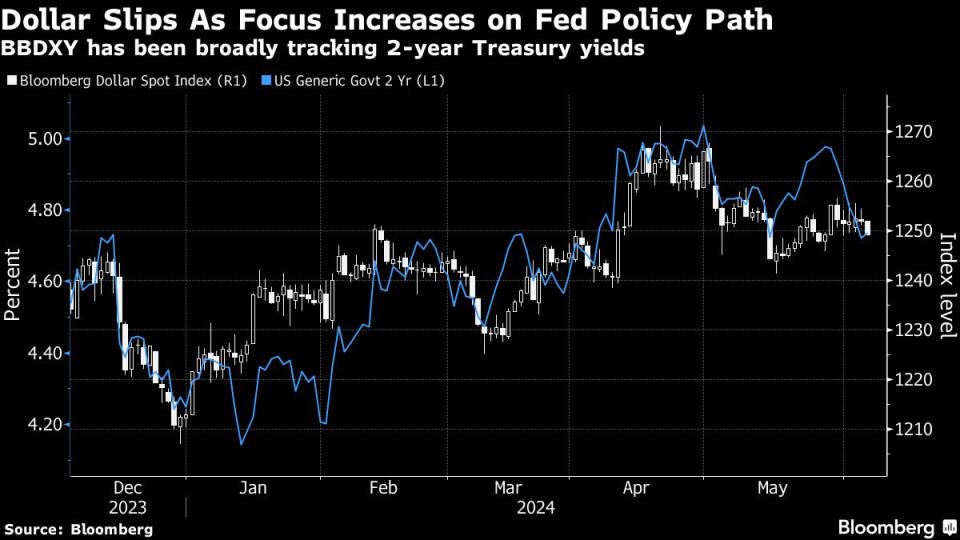

The Bloomberg Global Government Bond Index rose for a fifth straight session on Wednesday, its best performance since December, as traders ramped up interest rate cut bets. The dollar fell after Canadian policymakers cut borrowing costs on Wednesday, putting more focus on the path of the US interest rate.

“There is more optimism surrounding the Fed’s ability to cut interest rates in the latter half of this year,” Northwestern Mutual’s Stuckey said. “With the Bank of Canada cutting interest rates and expectations that the European Central Bank will do so, the momentum behind a coordinated global easing cycle is starting to gain some momentum.”

Treasury yields rose after falling in the previous session, with markets almost fully pricing in two interest rate cuts from the Fed in 2024.

In Asia, stocks rose for the first time in three days, with Indian stocks extending gains after Prime Minister Narendra Modi received crucial support from two key allies in his coalition.

In Japan, the yen trimmed its previous gains after Bank of Japan board member Toyuki Nakamura said it was appropriate to maintain the current policy for the time being. The Japanese currency recovered from an overnight sell-off during what was a volatile week for the yen thanks to its role in carry trades in emerging markets.

Elsewhere, real estate stocks in China were on track to enter a technical bear market as doubts persisted about Beijing’s efforts to boost the sector. A Bloomberg Intelligence gauge of the country’s developer stocks extended losses from a mid-May high to about 20%.

In commodities, oil rose for a second session even as Saudi Arabia signaled concerns about the demand outlook through cuts in crude oil prices. Copper led the rise in industrial metal prices, rising 1.5%, while zinc and nickel also rose more than 1%.

Main events this week:

-

Eurozone retail sales, European Central Bank interest rate decision, Thursday

-

US Initial Jobless Claims, Trade, Thursday

-

Chinese trade, foreign exchange reserves, Friday

-

Eurozone GDP, Friday

-

US Unemployment Rate, Nonfarm Payrolls Report, Friday

Some key movements in the markets:

Stores

-

The Stoxx Europe 600 Index was up 0.6% as of 8:30 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.1%.

-

Dow Jones Industrial Average futures were little changed

-

The MSCI Asia Pacific Stock Index rose 0.8%.

-

MSCI Emerging Markets Index rises 0.9%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1 percent to $1.0881

-

There was little change in the Japanese yen at 156.17 to the dollar

-

There was little change in the yuan in external transactions at 7.2609 to the dollar

-

There was little change in the pound sterling at $1.2794

Digital currencies

-

Bitcoin fell 0.5% to $70,894.4

-

Ethereum fell 0.6% to $3,841.85

Bonds

-

The yield on 10-year Treasury bonds rose two basis points to 4.30%.

-

There was little change in the yield on 10-year German bonds at 2.52%.

-

The yield on British 10-year bonds rose one basis point to 4.19%.

Goods

-

Brent crude rose 0.6 percent to $78.89 a barrel

-

Spot gold rose 0.4 percent to $2,365.63 per ounce

This story was produced with assistance from Bloomberg Automation.

-With assistance from Matthew Burgess and Toby Alder.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge