- Whales lost interest in XRP as prices fell.

- Development activity has also decreased significantly.

ripple [XRP] He's been in the news for all the wrong reasons in the past few weeks. From battles with regulators to scathing reviews by analysts, XRP has not had a good time.

The whales are moving away

To make matters worse, whales have begun to make moves in the XRP market, raising questions about the future path of the cryptocurrency.

Recent blockchain data highlighted a large transfer of 24,118,600 XRP, equivalent to about $12.46 million, from Bitvavo to an unknown wallet.

Such large-scale movements for whales often indicate a lack of confidence in the asset's short-term prospects, adding to the bearish sentiment surrounding XRP.

Source: X

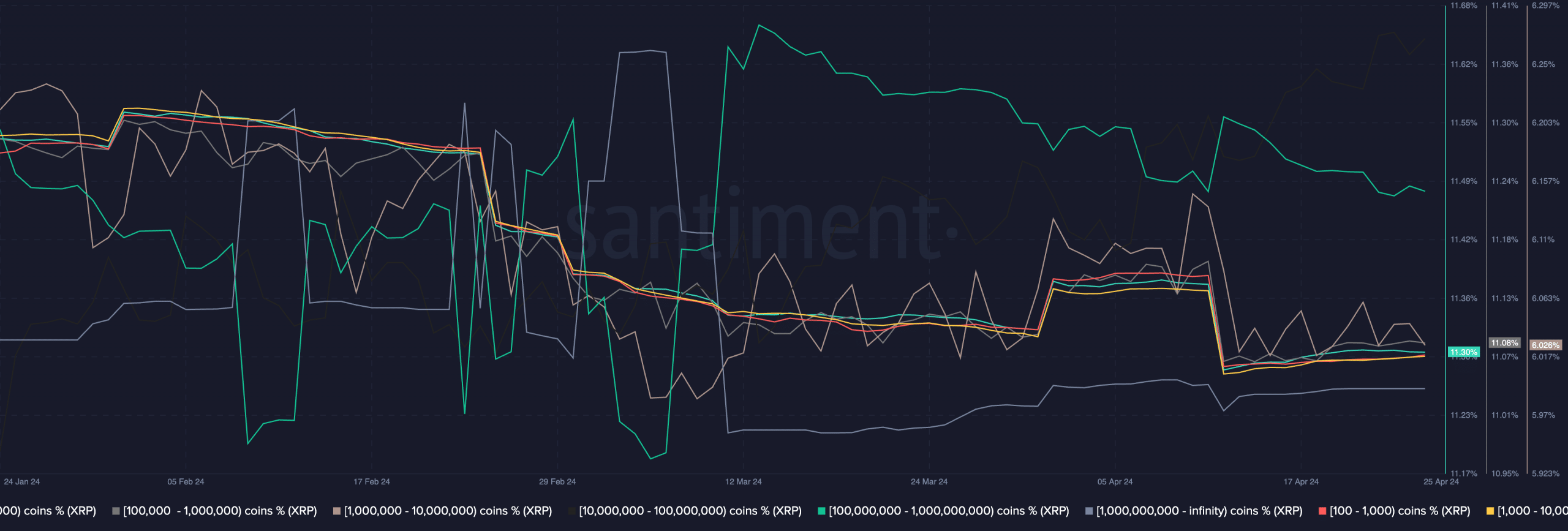

Adding to the concerns, insights from Santiment data reveal that addresses holding between 100 and 100,000 XRP are starting to show signs of disinterest.

This trend among larger addresses indicates declining confidence among institutional or high-net-worth investors, which could further weaken XRP's market appeal.

Source: Santiment

Consider the data

Reflecting these negative sentiments, the price of XRP has seen a significant decline, trading at $0.5198 at the time of writing, representing a 16.02% drop in value over the past month.

This downward movement was part of a larger downtrend that began since May.

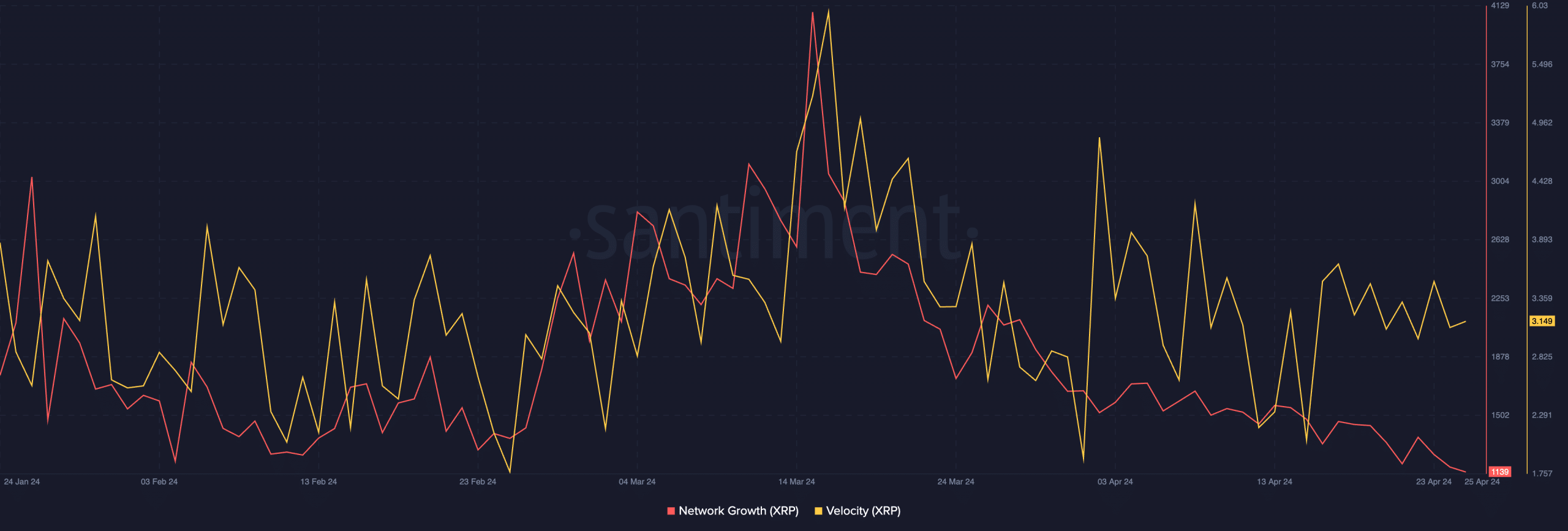

Further analysis of on-chain XRP metrics revealed a decline in network growth and speed.

A decrease in network growth indicates a slowdown in the acquisition or adoption of new users, while a decrease in speed indicates a decrease in the frequency of transactions, which may indicate a loss of trading interest among investors.

Source: Santiment

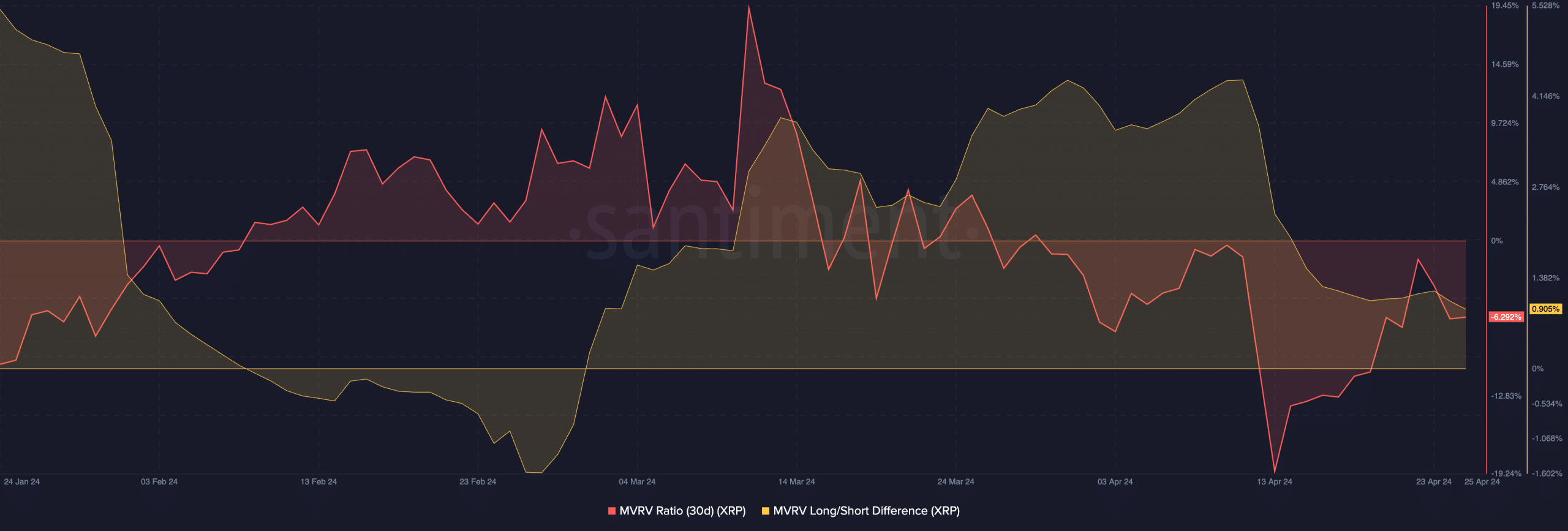

Furthermore, metrics like the MVRV ratio paint a worrying picture for XRP holders.

The low MVRV ratio indicates that a significant portion of XRP addresses were holding XRP at a loss at the time of publishing, compared to their initial investment.

Additionally, there was a significant long/short spread observed for XRP. This indicates a higher number of long-term holders, which is positive as these holders are not selling due to short-term market movements.

Only time will tell if the faith of long-term holders will be enough for XRP to maintain its current levels.

Source: Santiment

Realistic or not, here is the market cap of XRP in terms of BTC

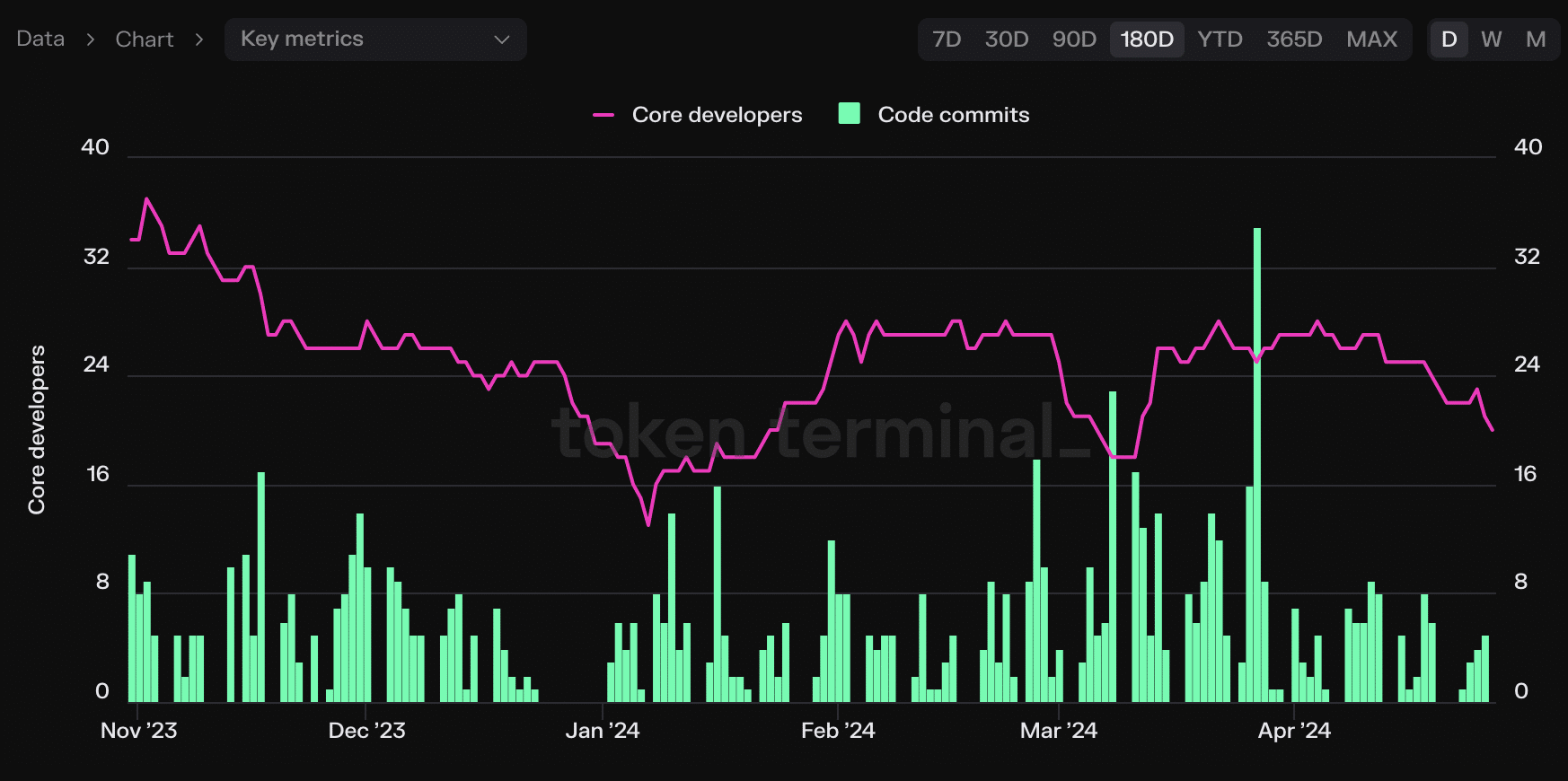

On the development front, indicators such as code commits and the number of active developers working on XRP-related projects also saw a decline.

This decline in developer activity may indicate a lack of innovation or progress in the XRP ecosystem, eroding investor confidence and market sentiment.

Source: Token Station

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge