(Bloomberg) — Employment growth in the world’s largest economy may have slowed and wage increases eased in August, pointing to further mitigation of inflation risks and lessening the urgency to raise interest rates by the Federal Reserve again.

Most Read from Bloomberg

Friday’s US jobs report is expected to show that employers raised payrolls by around 170,000 in August, while the unemployment rate remained at a historic low of 3.5%. The average increase in job growth over the past three months will be the smallest since the start of 2021.

Fed Chairman Jerome Powell said Friday at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming, that lowering inflation to 2% is expected to require softer labor market conditions and a period of off-trend economic growth.

Read more: Powell signals that the Fed will raise interest rates if needed, and keep them high

Other labor market data next week show fewer job openings in July than in the previous month, indicating a better balance between labor supply and demand. This may help reduce wage pressures and, ultimately, inflation.

“This rebalancing has eased wage pressures. Wage growth across a combination of measures continues to slow, albeit incrementally,” Powell said in Jackson Hole.

On Thursday, Fed officials will also get a new reading of their favorite measure of inflation – the personal consumption expenditures price index minus food and energy. The median forecast calls for a second consecutive monthly increase of 0.2% in July, marking the smallest consecutive advance in the core inflation measure since the end of 2020.

What Bloomberg Economics says:

One of the more interesting points Powell made in his Jackson Hole speech was that he thinks the Phillips curve may have steepened: “There is evidence to suggest that inflation has become more responsive to labor market tightness than it has been in recent decades.” The Nonfarm Payroll report – which includes average hourly earnings – and the JOLTS data would reinforce this belief, with wage growth declining rapidly with a slight downturn in the labor market.

— Anna Wong, Stuart Ball, and Eliza Winger, economists. For the full analysis, click here

Elsewhere, focus will be on Eurozone August inflation readings, while Chinese PMI data is expected to reinforce that the economy is going from bad to worse.

Click here to find out what happened in the past week, and below is a summary of what will happen in the global economy.

The US and Canadian economy

In addition to US jobs and PCE price data, there are reports on personal income and spending as well as consumer confidence, as with the first revision of Q2 GDP.

In Canada, the second quarter GDP will reveal if the economy is trending downward enough for the Bank of Canada to keep interest rates steady the following week. Preliminary data indicates growth at an annual rate of 1%, which is weaker than the 3.1% increase in the first quarter.

Asia

Investors will be watching China’s PMI data on Thursday to gauge the latest jitters in the world’s second-largest economy and its effects on the rest of the world.

Sunday’s figures showed that the decline in industrial profits in China eased in July, although a slowing economic recovery and deflationary risks still weighed on the sector.

Trade figures from South Korea, Thailand and Vietnam are also expected in an additional check of the state of global trade.

Meanwhile, data due out on Thursday is likely to show that the Indian economy expanded in the second quarter at the fastest pace in a year, supported by strong growth in the services sector and a recovery in manufacturing.

In Japan, a wide range of data from jobs to industrial production should reflect the state of domestic and external demand. Bank of Japan board members Naoki Tamura and Toyuki Nakamura speak in the middle of the week, in the wake of last month’s decision to widen the yield on 10-year bonds, a move that shook markets around the world.

On Tuesday, new RBA Governor Michelle Bullock will deliver her first speech since her appointment to the top job at the central bank, while the latest Australian consumer price data on Wednesday may give investors an idea of the RBA’s potential next move.

Europe, Middle East, Africa

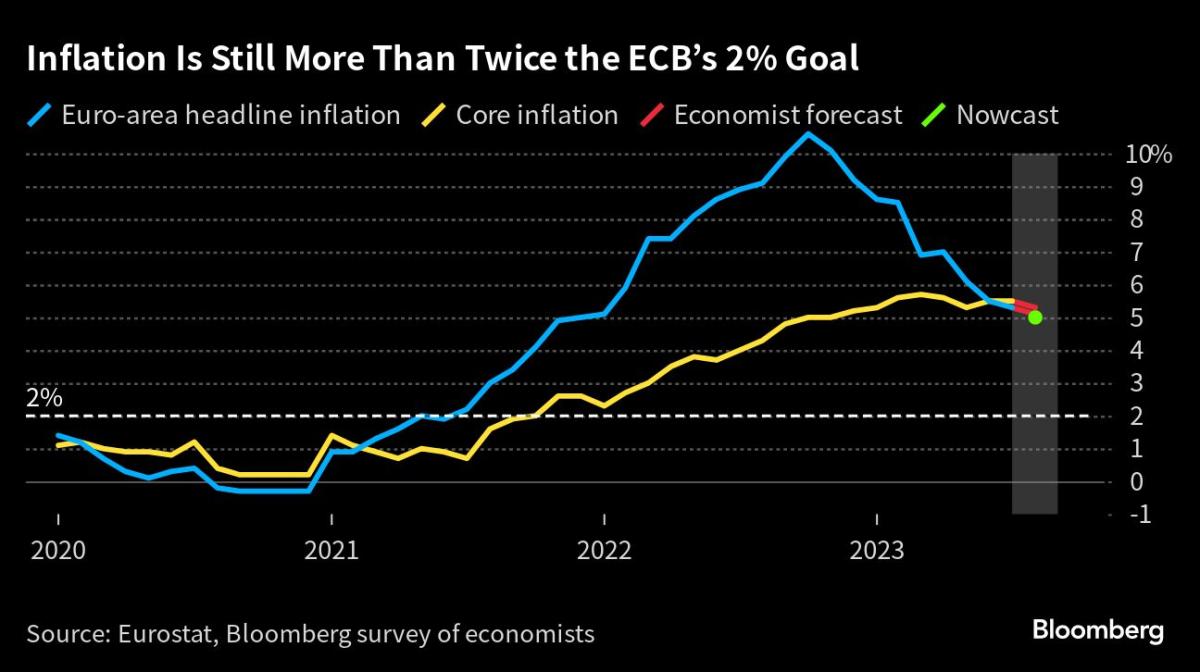

Eurozone inflation readings will provide a key data point ahead of the ECB’s highly anticipated interest rate decision in September.

It is possible that core inflation in the Eurozone has eased slightly, which could strengthen the arguments in favor of an eventual rate hike.

Ahead of that data on Thursday, the week begins with board hawks Joachim Nagel and Robert Holzmann speaking in the Austrian Alps. Executive Board Member Isabelle Schnabel and Vice President Luis de Guindos speak after the inflation figures. Also due are the July interest rate decision and the latest set of confidence measures in the Eurozone.

To the north, new UK housing figures are likely to highlight how aggressive the Bank of England continues to reflect on interest rates.

Meanwhile, Sweden’s GDP numbers on Tuesday are expected to show that the economy contracted in the second quarter, which is likely to mark the beginning of a major recession.

In Eastern Europe, the Hungarian Central Bank is poised to continue its monetary easing cycle, taking another percentage point off the EU’s main benchmark rate as inflation rates decline further. Later in the week, the country’s credit rating will be in focus at Moody’s, with expectations downgraded to negative from a stable result.

On Thursday, Polish inflation is expected to show another slowdown.

On Tuesday, Türkiye will publish its trade balance for the month of June. Investors will be watching for signs of whether the lira’s depreciation, a month after President Recep Tayyip Erdogan’s re-election, has caused imports to fall and helped exporters.

Two days later, the nation will release a report on GDP for the second quarter. Traders are keen to see if additional government spending ahead of the elections boosted growth.

And in Kenya, annual inflation data for August will be the first since the court lifted a new government tax freeze, pending a ruling on the matter. The central bank will be watching the numbers closely for the effects of the fees on inflation, which fell back to its target range of 2.5% to 7.5% in July, three months earlier than expected.

Also on Thursday, the South African Reserve Bank will start its biennial two-day conference. Speakers include Bank Governor Lasetia Kganyago, Federal Reserve Bank of Atlanta President Rafael Bostick, and IMF Senior Deputy Managing Director Gita Gopinath.

latin america

A series of indicators this week will highlight the magnitude of the economic slowdown in Latin America.

On Tuesday, Mexico will publish final GDP data for the second quarter that is expected to confirm the resilient performance of the region’s second largest economy, which continues to benefit from strong exports to the United States.

Chile on Thursday published industrial, manufacturing and copper production figures for July, after a GDP report showed its economy contracted less than expected in the second quarter.

Also on Thursday, Brazil, Mexico and Colombia will release their unemployment figures for July.

On Friday, Brazil will publish second-quarter GDP data that will show the delayed impact of higher interest rates on growth. Latin America’s largest economy is expected to slow sharply after a better-than-expected performance in the first quarter of 2023.

–With assistance from Walter Brandimarty, Laura Dillon Keene, Andrea Dudek, Paul Jackson, Monique Vanek, and Paul Wallace.

(Updates on Chinese industrial profits in the Asia section)

Most Read from Bloomberg Businessweek

©2023 Bloomberg LP

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge