- XRP has faced high selling volume, but there is a reason for the bulls to be optimistic.

- Traders may smell an opportunity with prices at the key HTF level.

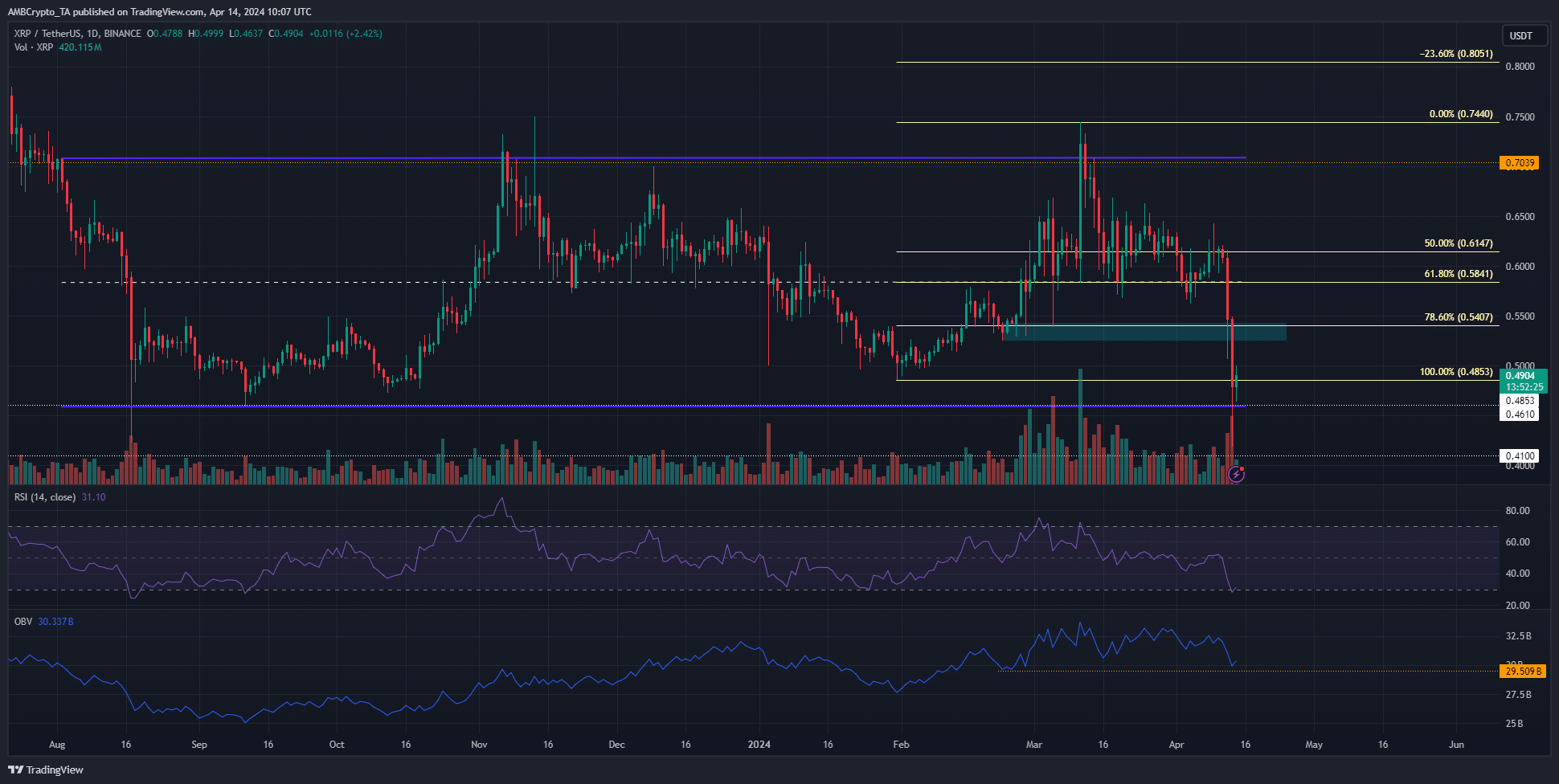

ripple [XRP] It saw a dump of massive proportions – a 32% drop in the period from April 11 to 13. This was the largest and fastest decline of 2024, taking prices well below the $0.54 demand zone.

Despite the intense pressure, the bulls may have reason to be optimistic.

Swing traders and investors should note that XRP was trading just above the upper time frame support level at $0.46. Could this see a resilient XRP rise, even if Bitcoin [BTC] Decided to drop again later this month?

The low range was retested again

Source: XRP/USDT on TradingView

XRP saw its market structure fluctuate bearishly when prices fell below the $0.525 level. Selling pressure forced it below the $0.485 swing low as well.

There was good news for buyers amid all this chaos.

The 8-month range (in purple) is as low as $0.46 and has not been reached since September 2023. Therefore, it likely represents a good buying opportunity from a risk-to-reward perspective.

OBV agreed, indicating that the low hit in late February has yet to be breached. He pointed out that the volume of selling did not exceed the volume of buying in recent months.

Until that happens, the bulls have reason to hope for a recovery.

The RSI was at 31 and was an inch away from falling into oversold territory. This does not indicate an imminent reversal but it confirmed the intense selling momentum in recent days.

XRP sentiment was bleak, to put it mildly

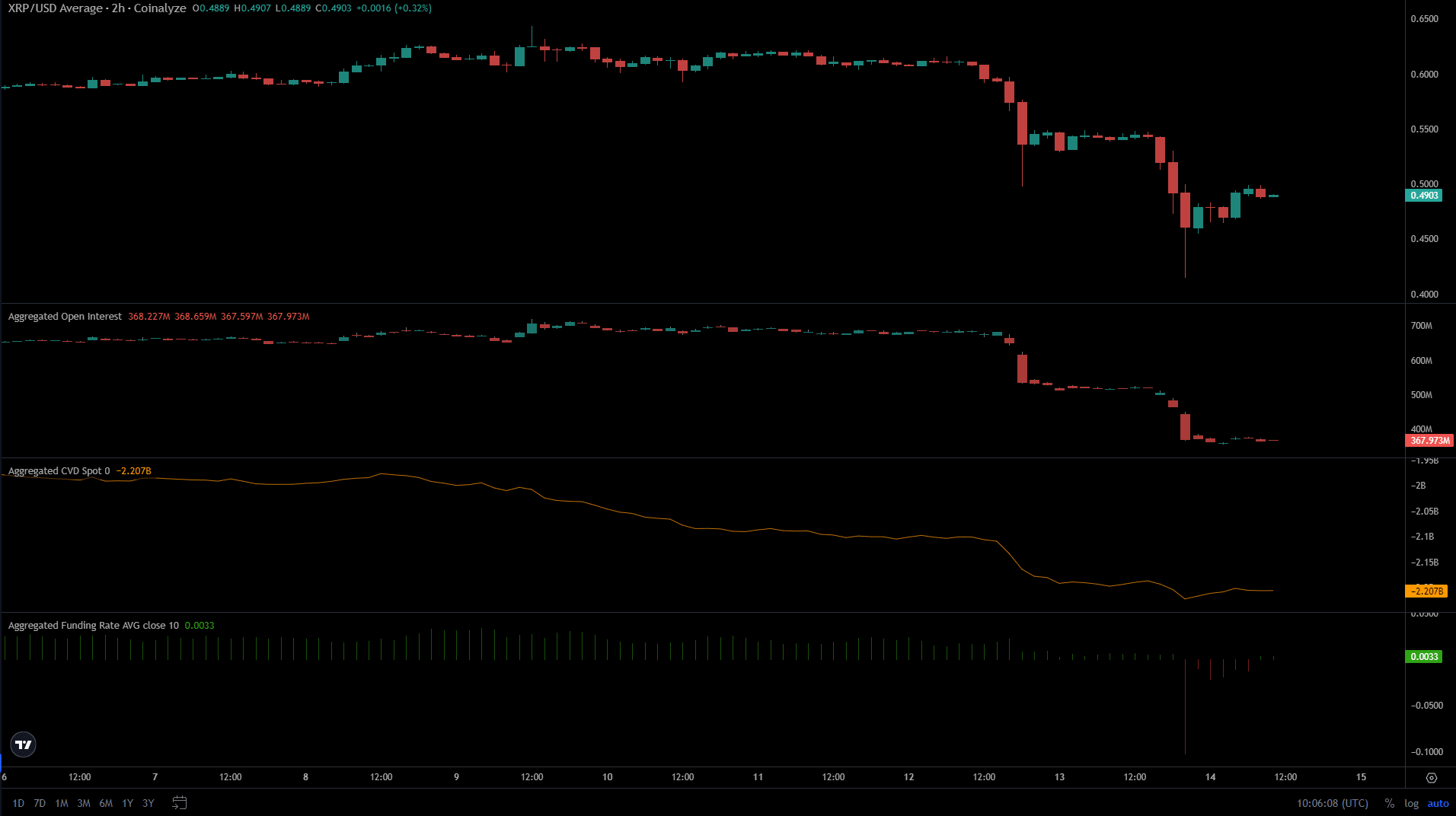

source: Currency analysis

Coinalyze data revealed that the bears were in control in April. Open interest fell from $680 million on April 12 to $367 million at press time.

The funding rate has been negative for the past 24 hours, but has been slowly rising above 0.

Meanwhile, the CVD spot price has been on a downtrend over the past week, and the recent losses have accelerated this trend.

Realistic or not, here is the market cap of XRP in terms of BTC

Market sentiment does not indicate the possibility of a quick recovery. The lack of demand in spot markets was particularly discouraging for investors.

A change in CVD and spot OI to the downside could be a sign of a bullish spark.

Disclaimer: The information provided does not constitute financial, investment, trading or any other type of advice and represents the opinion of the writer only.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge