US stocks posted their longest streak of quarterly losses since the 2008 market crash, weighed down by central banks’ determination to tame inflation by raising interest rates.

The leading S&P 500 index fell 1.5 percent on Friday, taking the loss for the June-September quarter to 5.3 percent. The S&P has now fallen for three consecutive quarters, the biggest drop since the long bear market that accompanied the global financial crisis.

The heavy Nasdaq Composite also fell 1.5 percent on Friday, hitting the index’s worst close since July 2020 to end the quarter down 4.1 percent.

The heavy selling in US assets continued this week after Bank of England intervention To calm the turmoil in the British government bond market.

The year has been tough for stocks, as central banks including the US Federal Reserve have indicated they will continue on a path of raising interest rates, and reducing support for economic growth, in an effort to contain inflation. Lyle Brainard, Vice President, Friday morning He reaffirmed this opinionacknowledging that while the Fed was aware of the market turmoil, it remained committed to tighter monetary policy.

Peter Cher, head of macro strategy at Academy Securities, said investors are accepting of the Fed’s dedication to calming inflation, even if stocks are hurt in the process.

“Today, I think the market recognizes that the economy may be slowing quickly, but the Fed may do nothing to stop it. With volatility in gold bonds and deteriorating liquidity across all markets in the US, more investors are becoming concerned about the possibility of a rapid and significant downturn in Stock and bond prices.

“Central bankers tell us they are going to tame inflation, and that will come in [the] To the detriment of the economy, we don’t care about the markets at the moment.”

US bonds sold out on Friday, but remained above their lows early in the week. Prices fell last Friday and Monday after the UK announced a £45 billion unfunded tax cut. British and US bonds subsequently stabilized after the Bank of England intervened this week with a new long-term debt purchase program.

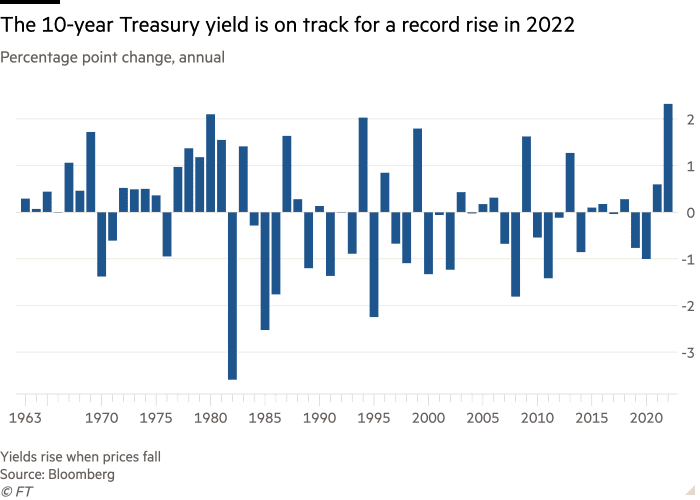

The yield on 10-year US Treasury bonds, the global benchmark for borrowing, rose 0.03 percentage point to 3.81 percent after topping 4 percent on Wednesday for the first time since 2010. Yields are rising as their prices fall.

But despite some recovery in Treasury debt since the BoE intervened, the rapid tightening of monetary policy this year has a two-year note, which is highly sensitive to policy expectations, and the ten-year note, on track for the biggest annual selloff. Outside in the record.

On Friday, the yield on the UK’s 10-year debt fell 0.05 percentage point to 4.08 per cent. UK yields across all maturities have swung by historic amounts in recent sessions, with a 10-year gain of more than 0.4 percentage point on Monday before falling by about 0.5 percentage point on Wednesday.

Cao said the central bankers made an effort to tell the market that the BoE’s action should not be seen as the beginning of a broader return to support policy. “The [Federal Reserve] It was very clear that what the Bank of England is doing should be seen as insular, and the Fed will stick to its plan. The [European Central Bank] He does the same thing.”

London’s FTSE 100 rose 0.2 percent on Friday, while Europe’s regional Stoxx 600 rose 1.3 percent.

In Asian stock markets, Japan’s Topix index fell 1.8 percent on Friday. China’s CSI 300 Index of shares listed in Shanghai and Shenzhen fell 0.6 percent, while the Hang Seng Index in Hong Kong rose 0.3 percent.

Additional reporting by Hudson Lockett in Hong Kong

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge