When the US first banned the sale of some tech products to Chinese tech company Huawei three years ago, it crippled a once-proud national hero and sent ripples across the US semiconductor industry. In the quarters following the May 2019 export ban, major US chip makers reported an average decline in revenue of 4% to 9%.

The Biden administration’s latest technical controls threaten to accelerate those losses, throwing the global semiconductor sector into disarray. And Chinese companies targeted by the new regulations won’t be the only ones feeling pain.

“If China really wants to be as aggressive as the US and retaliate, there could be a huge impact on other companies in the US,” Edith Young, general partner at Race Capital, said in an interview with Yahoo Finance Live. . “This goes beyond the impact on Intel’s revenue (INTC) or Qualcomm )QCOM) or NVIDIA (NVDA). “

The United States has long been a world leader in semiconductors, with approximately 45% to 50% of the market share. However, this leadership has been built on global demand for its products, with China consuming nearly 75% of the semiconductors sold globally.

Chinese device manufacturers alone accounted for nearly a quarter of global semiconductor demand in 2018, According to the study By Boston Consulting Group (BCG).

More than just a preventive tool

This innovation cycle is in danger of being sundered, with the Biden administration’s sweeping technical controls aimed at freezing semiconductor development in China and drastically reducing exports of critical technology from the United States.

“Technology export controls can be more than just a preventative tool,” National Security Adviser Jake Sullivan said, before the administration’s announcement. “If implemented in a robust, durable, and comprehensive way, it can be a new strategic asset for the United States and the Allied toolkit to impose costs on adversaries, and even over time undermine their capabilities on the battlefield.”

A ‘radical change’ in policy

Specifically, the new measures block sales of semiconductors critical to the development of artificial intelligence, supercomputers and other advanced technologies, unless companies obtain exemptions. It also expanded an existing ban on selling advanced chip-making equipment to Chinese companies.

In a widespread escalation, the Biden administration’s actions are also restricting US companies and citizens, including permanent residents, from supporting China’s development of advanced chips.

The restrictions announced earlier this month have already created a chilling effect.

At least 43 senior executives are US citizens who work with 16 publicly listed Chinese semiconductor companies, According to the Wall Street Journal,. Western companies such as ASML Holding NV have suspended US employees as a precaution, as they seek greater clarity. Moreover, Apple has temporarily halted plans to use memory chips from Yangtze Memory Technologies Co. chinese in products, According to Nikkei Asia.

“This is really a drastic change of policy…the US is imposing a freeze-in-place strategy towards domestic chip development in China,” said Riva Goujon, director of the Rhodium Group. “[The semiconductor sector] It is an interconnected and interconnected ecosystem where all parts have to be in place for things to work to be able to upgrade to more and more advanced levels. So if you cut the legs off from under that production cycle, you can really cause a lot of disruption, which is exactly what the United States intends to achieve.”

Impact on US chip makers

The disruption may not be limited to Chinese companies. A 2020 BCG study estimated that American companies can lose 18% of its global market share and 37% of its revenue over the same period if the United States completely bans semiconductor companies from selling to Chinese customers.

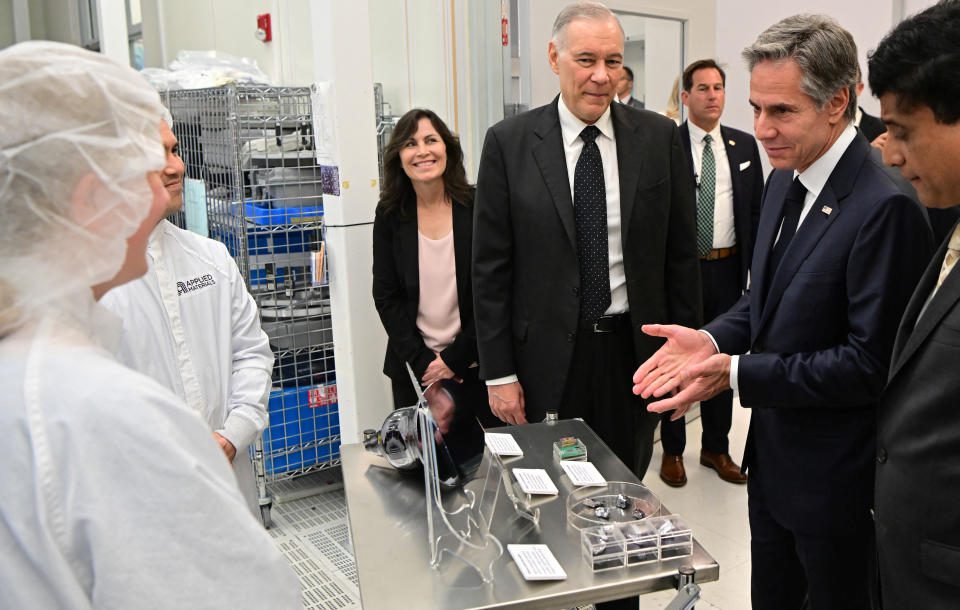

Those actions have already prompted chip equipment maker Applied Materials to cut its fourth-quarter net sales estimate by about $400 million. Adjusted and unadjusted diluted earnings per share for the fourth quarter are expected in the range of $1.54 to $1.78, compared to the previous range of $1.82 to $2.18.

While the restrictions are now limited to next-generation chips, NVIDIA, the largest US chip maker by market value, warned in August that new licensing requirements for shipments of advanced chips to China could cost the company up to $400 million in quarterly sales.

“There is certainly a chance that this could have a much greater impact, but I think these companies have already looked at the situation, and are evaluating it,” said Daniel Neumann, co-founder and principal analyst at Futurum Research. “I am not overly bothered that it will be the entire wallet [of chips]… I think this is about leading the arms race for the next generation of technology in areas such as supercomputing, high performance computing, and artificial intelligence. “

Containing Technology “Where It Should Be”

This has been repeated frequently by Secretary of State Anthony Blinken, highlighting in a recent speech at Stanford University that “only a few countries” manufacture or make tools for manufacturing high-quality semiconductors.

“We want to make sure we retain those who need to be,” Blinken said, without singling out China.

But Goojun argues that US companies, especially equipment makers, risk losing market share and revenue to competitors in countries that have historically had friendly relations with the United States, including Japan and South Korea. If companies there find a solution to the Biden administration’s actions, Goujon said the new controls could eventually backfire on the United States.

“Foreign competitors of the United States [equipment makers] We have an opportunity here, of course, to try to get a bigger market share in China if they can displace American people and American connections, which is possible in some areas,”

“The United States is putting heavy bilateral and multilateral pressure on partners to follow the lead, and it is sending a signal that looks like, this package contains extraterritorial measures and we will add more if needed. But here is the window to try to basically align our controls. So it will be That’s a really important question now.”

Akiko Fujita is a broadcaster and reporter at Yahoo Finance. Follow her on Twitter Tweet embed

Follow Yahoo Finance on TwitterAnd the FacebookAnd the InstagramAnd the FlipboardAnd the LinkedInAnd the Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge