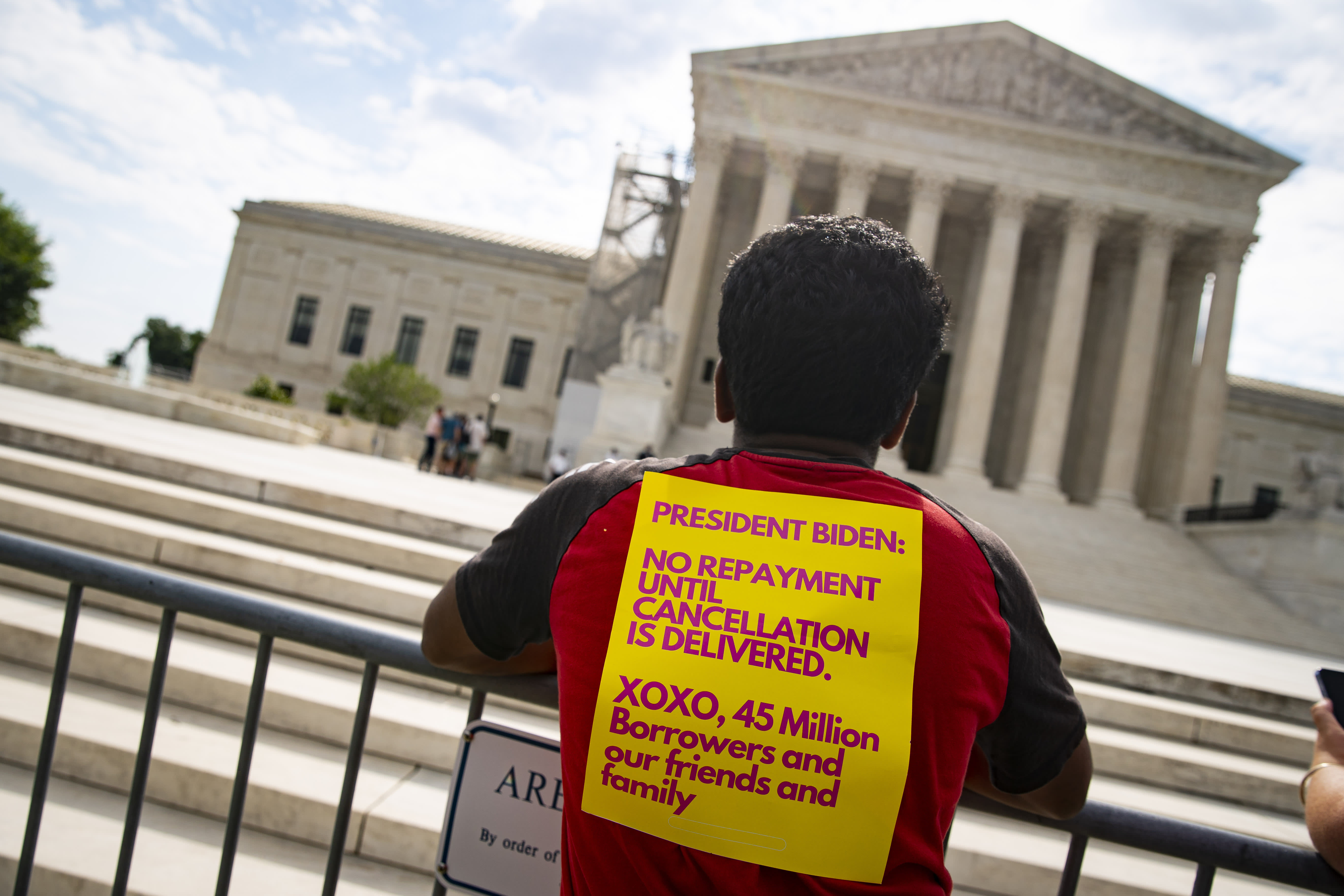

A visitor holds a sign regarding student loan payments outside the U.S. Supreme Court on June 27, 2023.

Bloomberg | Bloomberg | Getty Images

With student loan repayments starting up again after a three-and-a-half-year hiatus, college debt is top of mind for many borrowers who won’t qualify for new relief plans from the Biden administration. This can come at the expense of saving for retirement, as paying down these loans can lead Americans, especially Americans in their best working years, to forego saving through tax-advantaged workplace plans like 401(k)s. But there’s good news: After January 1, more workers may be able to pay off debt and build toward a more secure retirement.

A provision in the Secure 2.0 retirement savings overhaul, which will take effect in January, allows employers to match employees’ student loan payments with tax-advantaged contributions to their retirement accounts. This means that — starting in January — student loan borrowers from a range of employers can get matching funds without putting money into their retirement account.

“Many people have to choose between paying off their student loans and contributing to a 401(k) because they don’t have enough disposable income to do both,” said John Newcomb, senior advisor at Kelly Benefits Strategies. “Not only are they not saving for their future, they are leaving their employers’ money on the table because they are not getting the benefit of the game.”

Here’s what employees and employers need to know about the new opportunity:

Borrowers in prime years dominate $1.6 trillion in debt

About 43 million student loan borrowers owe a total of $1.6 trillion, and borrowers in their prime years hold the bulk of their outstanding student loan dollars. It’s no surprise that student loan debt has a devastating impact on people’s overall finances.

46% of student loan borrowers said their loans affected how much they contributed to their retirement plans, according to a recent study. Recent Morning Consult poll Of about 500 student loan borrowers between the ages of 18 and 39. 94% of young student loan borrowers expressed interest in a 401(k) contribution from their employer while paying off school loans, according to the survey. By Abbott, whose pioneering 401(k) matching program for student debt borrowers, introduced in 2018, paved the way for its broader adoption.

Borrowers ages 35 to 49 have the highest percentage of outstanding student loan dollars, followed by those ages 25 to 34, according to Federal student loan portfolio data. These data underscore the broad benefit that a matching program can bring. Research has shown that employees who have a “strong financial position in the short and long term tend to stay longer with their employer,” said Tom Armstrong, vice president of client analytics and insight at Voya Financial.

How the student loan match will work for the company

The extent of a company’s match will depend on the design of the 401(k) plan, said Melissa Elbert, wealth solutions partner at Aon, a retirement benefits advisor to employers. In the case of Abbott, for example, employees who qualify for the company’s 401(k) and who apply at least 2% of their eligible paychecks to qualifying student loan payments will receive a 5% company contribution to their Abbott 401(k) annually. Employees do not have to put any money into their retirement plan to get this company contribution.

Why more employers should embrace the idea of saving

Benefits consultants said the program aims to help companies attract and retain talent. Those who offer this will have a competitive advantage.

Abbott said her program has achieved meaningful results. For starters, employees who participate in the Freedom 2 Save program are 19% more likely to stay with the company. What’s more, some employees were able to pay off all of their student debt — up to $60,000 over a few years — while accumulating retirement savings, the company said. More than 2,600 employees have enrolled in the program since the program’s inception, according to company data.

To help other companies considering this program, Abbott has created a publicly available program a plan, with suggestions on how to get started. This includes notifying their recordkeeper and determining whether employees will be allowed to self-certify their student loan payments.

“If more employers had a similar program, the impact on student loan debt would be significant,” said Mary Moreland, the company’s executive vice president of human resources.

There have been no formal announcements, but several companies are in the process of evaluating the program with the goal of adopting it as soon as possible, said Joel Shapiro, head of retirement at NFP, a benefits consulting firm. “Almost all of our clients are thinking about this,” Shapiro said. “They realize it’s important for their employees.”

Why would an employer decide not to offer this benefit?

Employers have limited dollars to use for benefits, so they have to decide where best to use them, said Kim Cochrane, a retirement plan consultant and consultant at HUB International. She recommends employers survey their employees about their strongest needs. “Even if you offer a student loan benefit and it only solves a need for 20% of your employees, that doesn’t mean it’s a bad thing,” Cochrane said.

Shapiro said companies will likely incur additional costs since they will presumably be contributing matching funds for employees who have not previously participated in the company’s 401(k). How much more this could cost would depend on several factors, including the number of people involved, which is why modeling is important, he said.

Other options to help workers pay off student loan debt

Some employers have programs to help employees pay off their student loans, without tying them to retirement.

Through the CARES Act and its extension, employers can pay up to $5,250 toward employee student loan payments through December 31, 2025, tax-free for employees and tax-free for the employer. Newcomb predicted that the tax benefit will likely be extended, but even if not, some companies will still help with student debt payments because it is an important benefit for employees “staring down the barrel of debt.”

In fact, recent research by Voya found that 81% of working Americans with a student loan would be interested in participating in an employer-offered student loan repayment program and that 83% agree or strongly agree that they would be more likely to work for an employer if it offered The company helps pay off student loan debt. Furthermore, 83% of working Americans with student loans said they would save more money for retirement if their employer helped pay off their student loan debt, according to the research.

The data reinforces why many employers are looking for ways to help employees address student loan debt. Benefit providers said companies could choose to create a matching program in addition to participating in more traditional repayment assistance.

What employees should do

Employees should ask their companies if they plan to offer a 401(k) matching benefit. If employers know an employee needs a particular benefit, they may be more inclined to provide it, Cochrane said.

Once they are able, employees should commit or recommit to saving for retirement, Elbert said. “If you delay saving for retirement by 10 years, it could reduce your retirement savings by about 30%, so you’ll have to work longer to make up for it. If your employer offers this benefit, it will help a little bit, but it won’t cover the full amount.” “

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge