Big drops in San Diego, Los Angeles, Dallas, Portland and Phoenix, Boston. Prices are falling faster than they were rising? No way. Oops.

by Wolf Richter for Wolf Street.

This is the first month in this cycle that the S&P CoreLogic Case-Shiller Home Price Index, which is 4-6 months behind reality on the ground, shows a decline in home prices in all central areas of the index.

In Seattle, the month-to-month decline was the steepest on record (-3.8%). In San Francisco, the month-to-month drop (-4.3%) was the third-largest drop ever, surpassed only by the worst two months during the 1 housing bankruptcy period in 2008. In San Diego (-2.8%), Los Angeles (-2.3 %) and Phoenix (-2.1%) and other metro stations, the declines were the worst since the housing crash 1. The declines are spreading across the country to other metro areas, including Dallas, Boston, Washington DC, and Las Vegas.

These are serious declines for Case-Shiller home price indexwhere each month is a three-month rolling average that determines the variance from month to month.

Today’s index release was for August, which consists of a three-month average of closed-home sales that were entered into public records In June, July and August. Due to the delay between the time the deal was concluded and the time the “closed sale” was entered into public records, the time period for “August” roughly covers deals made in May through June. During that time, the average 30-year fixed-rate mortgage has reached the 6% range. today, We’re at 7%, and mortgage bankers are confused.

In the San Francisco Bay Area, home prices fell 4.3% The “August” (three-month moving average of June, July, and August) of July was the third-largest drop on record, outpaced only by the two slightly steeper declines during the depth of the housing crash 1 in 2008. The downturn in August was the acceleration of declines in July (-3.5%) and June (-1.3%).

The index is down 8.9% from its peak. During those three months, the index fell faster (-35 points) than prices that rose during the last three months of the rally (+27 points). Home prices are falling faster than they rose? Impossible, impossible. Oops.

This turn of events cut annual gains to +5.6%, from +24% earlier this year, so far only in the final stages of a ludicrous rally over the past two years. The index is now at its lowest level since January.

The Case-Shiller Index for “San Francisco” covers five of the nine-county San Francisco Bay Area: San Francisco, part Silicon Valley, part East Bay, and part North Bay.

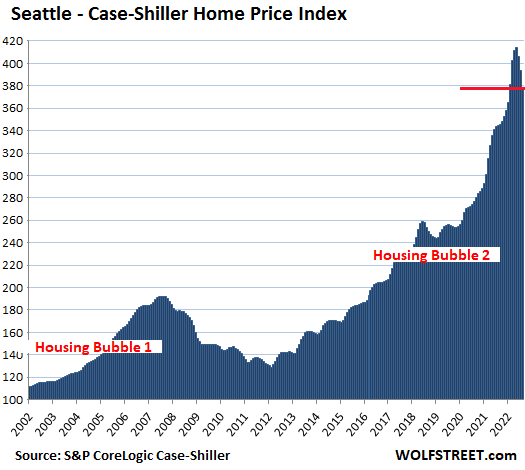

In the Seattle metro, home prices fell 3.9% In August, the biggest monthly drop ever, as well as a 3.1% drop in July, and a 1.9% drop in June. The index is down 8.6% from its peak.

During the last three months of the rally, the index rose by 33 points; During the first three months of decline, the index fell 36 points, like San Francisco dismantled faster than it had been rising. The index is now at its lowest level since January. Year-over-year gains narrowed to +9.9% from +27% earlier this year.

The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to the time when the same homes were sold previously. Price changes within each sales pair are incorporated into the metro index, and adjustments are made for home improvement and other factors (methodology). By tracking the change in dollars needed to purchase same Over time, the index is a measure of home price inflation.

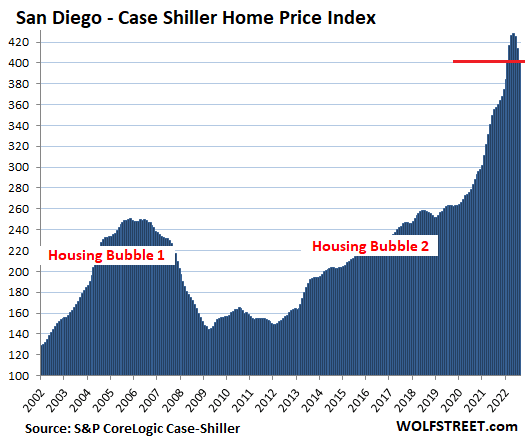

In metro San Diego, home prices fell 2.8% In August, the biggest month-to-month decline since the 1 housing bankruptcy period, after a 2.5% drop in July, and a 0.7% drop in June, to the lowest level since January.

The index is down 5.9% from its peak and has retreated at equal speed in the last three months of the rally. This cut annual gains to 12.7% from 29% earlier this year.

The index’s current value of 403 for San Diego means that home prices have risen 303% since January 2000, when the index was set at 100. Based on the increase since 2000, San Diego used to be the #1 coolest housing bubble in America, but it’s now plummeting Below Miami (+309%) and Los Angeles (+305%).

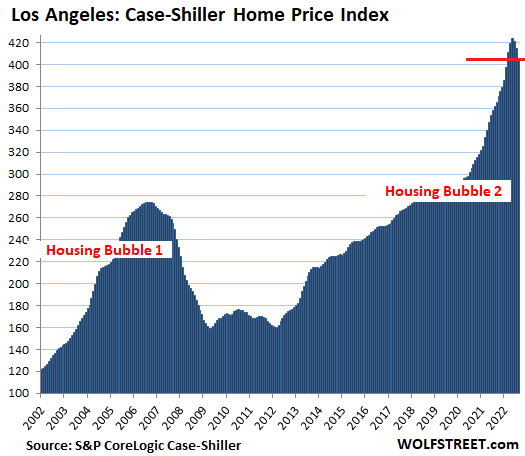

In Los Angeles metro, home prices fell 2.3% In August of July, the largest decline since the 1 housing bankruptcy, after falling 1.6% in July, and 0.4% in June. This cut year-over-year price gains to +12.1%, from +23% a few months ago. The index is down 4.3% from the peak.

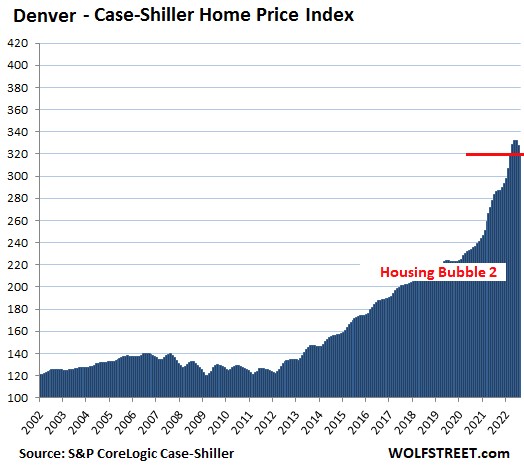

In metro Denver, home prices fell 2.3% August from July – the second biggest drop ever after January 2009 – after a 1.4% drop in July, and a 0.1% drop in June.

The index is down 3.7% from its peak, halving its year-over-year gain to 12.0%.

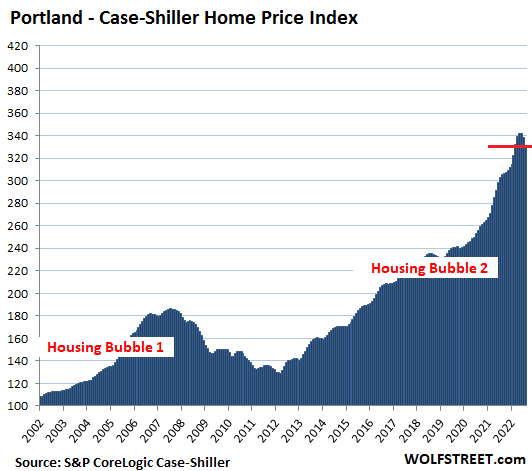

In Metro Portland, home prices fell 1.9% In August, after a decline of 1.1% in July, and a decline of 0.1% in June, after a ridiculous rise.

The index is down 3.1% from its peak, cutting its year-over-year gain to +8.6%, from +19% earlier this year.

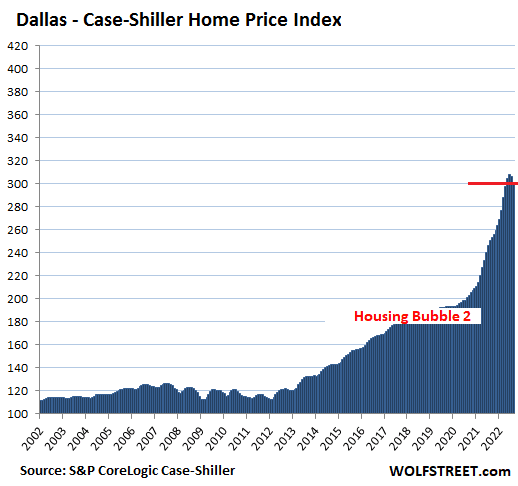

In the Dallas metro:

- Month after month: -2.3%, after declining -0.4% in July.

- YoY: +20.2%, down from +30% earlier this year.

- From the peak: -2.3%.

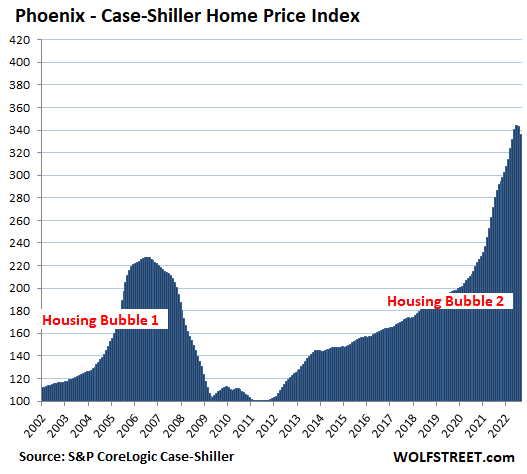

In metro Phoenix:

- Month after month: -2.1% after -0.2% in July.

- YoY: +17.1%, down from +32% earlier this year.

- From the peak: -2.3%.

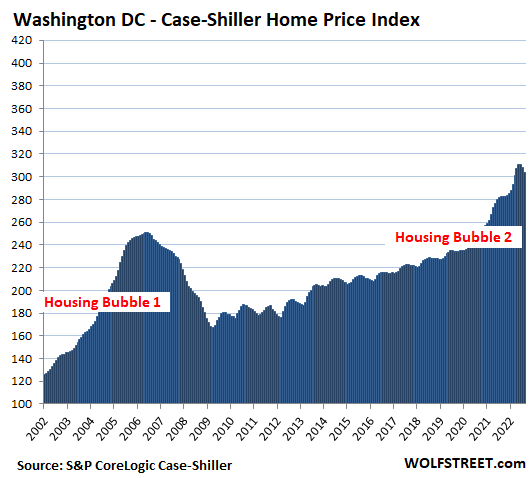

In the Washington DC metro:

- Month after month: -15% after declining 0.7% in July.

- YoY: +7.4%, down from +13% earlier this year.

- From peak: -2.2%.

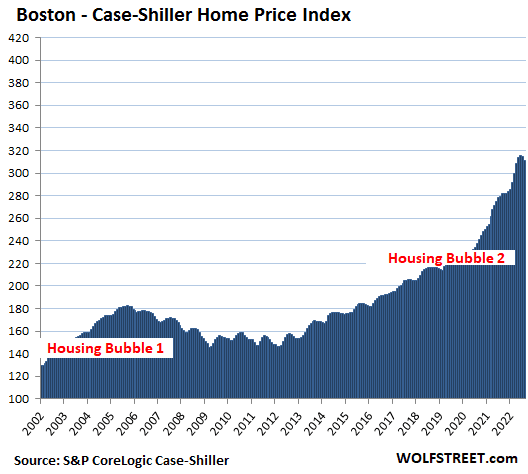

In the Boston metro:

- Month after month: -1.2% after -0.3% in July.

- Compared to last year: 11.4% from +15% earlier this year.

- From peak: -1.5%.

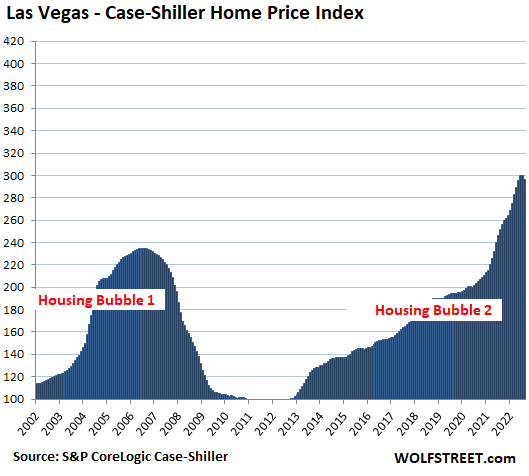

Las Vegas metro:

- Month after month: -1.3% of the record in July.

- YoY: +17.5%, down from +28% earlier this year.

- From the peak: -1.3%.

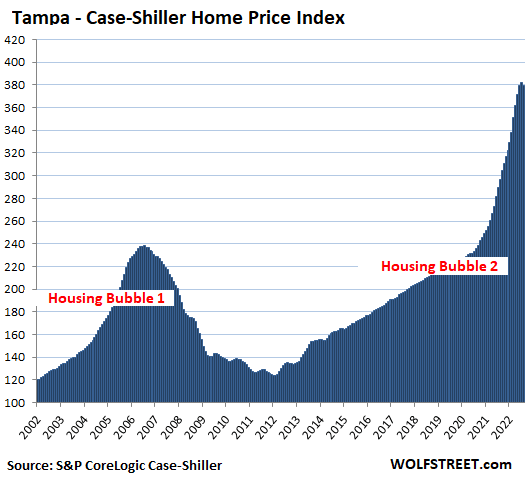

Metro Tampa:

- Month by month: -0.5% of the record in July

- YoY: +28.0%, down from +36% earlier this year

- From Peak: -0.5%

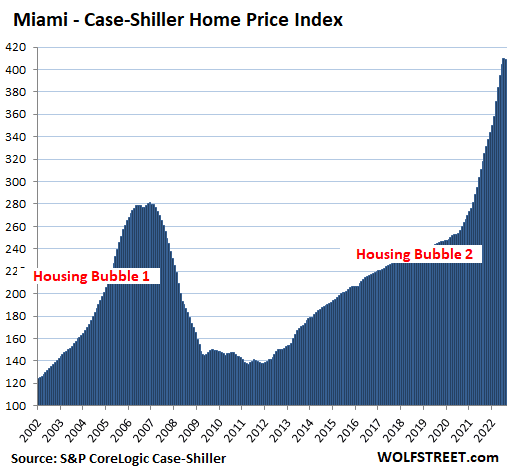

Miami Metro:

- Month after month: -0.1% of the record in July.

- YoY: +28.6%, down from +34% earlier this year.

- From the peak: -0.1%.

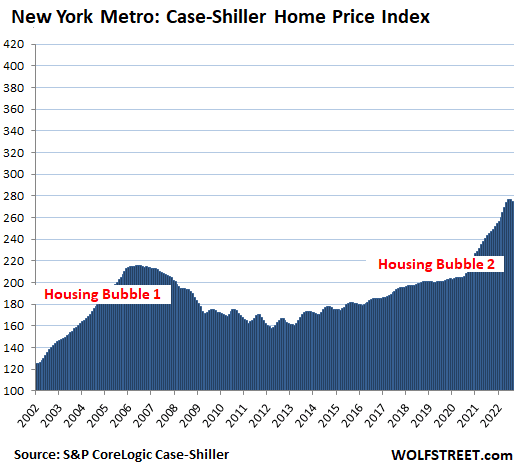

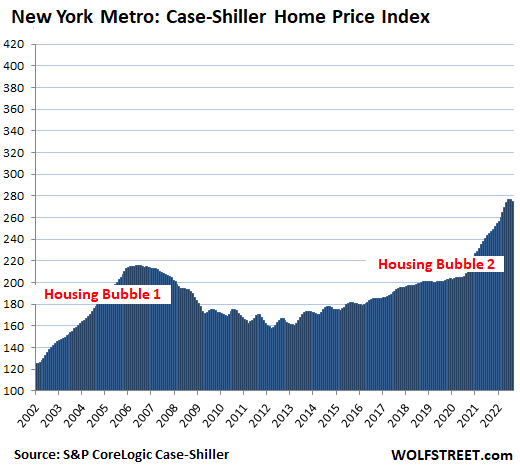

In the New York metro:

- Month by month: -0.5% of the record in July

- YoY: +12.3%, down from +15% earlier this year

- From Peak: -0.5%

The New York metro has seen home price inflation of 175% since January 2000, based on the Case-Shiller Index value of 275. The remaining cities in the 20-City Case-Shiller Index (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) have experienced inflation. Lower house prices and don’t qualify for this glossy list of the coolest housing bubbles. But they all booked a monthly drop in August.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge