CNBC’s Jim Cramer on Wednesday highlighted technology and real estate stocks that he believes could do well in 2023, after a dismal year for both sectors.

Rising interest rates posed challenges for the technology and real estate industries in 2022. IT is down 27% year-to-date, as of Wednesday’s close, while real estate is down 28.4% on the same scale. The only S&P 500 sectors that performed worse were consumer discretionary, down 36.2%, and communications services, down 40.3%.

Cramer said he believes technology and real estate will continue to struggle next year; However, tech may start to see its fortunes improve after the first half of 2023.

Selected technologies for 2023

Oracle Earnings for the second quarter of the fiscal year 2023 Last week, Kramer said, was “amazing”. Shares are selling for less than 17 times the forward earnings. While enterprise software is hardly Kramer’s favorite industry right now, he said Oracle’s business looks “very durable.”

Cramer said he likes Broadcom’s diversification strategy, including its pending deal to acquire VMware. Broadcom shares carry a dividend yield of about 3.3%, he said, allowing investors to be patient while this acquisition passes through regulatory review. The company also recently announced a $10 billion stock repurchase program.

Palo Alto Networks is not in the S&P 500. However, Kramer said he believes it is the best-run cybersecurity company in an industry with long-term staying power in the digital age. While you mentioned Palo Alto Networks Better than expected results last monthCramer noted that the stock is not too far from its 52-week closing low of $142.21 on Nov. 4. “I would recommend picking up some stocks now here and maybe further doubling down,” he said.

Real estate picks for 2023

Cramer said he likes Realty Income because the big retail tenants — like Dollar General, Walgreens and 7-Eleven — have businesses that can hold up during a potential recession. “Best of all, this company is a dividend machine; it pays a dividend monthly, and tends to increase it several times a year. Currently, the stock yields 4.6%,” he said.

While Federal Realty shares are down about 25% in 2022, Kramer said the stock has been a strong performer over the long term. The current dividend yield is 4.25%. Cramer said Federal Realty specializes in mixed-use real estate, many of which are in affluent suburbs. This is notable given fears of a possible recession.

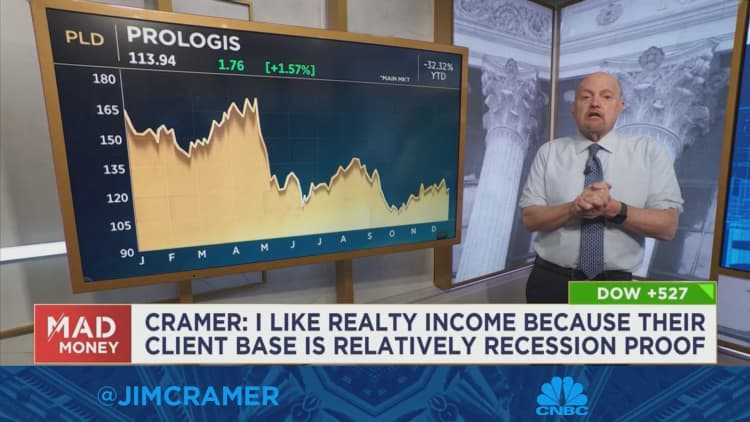

The logistics-focused real estate investment fund, or REIT, continued to deliver strong results even as its stock is down about 31% year-to-date, Cramer said. Cramer said he thinks Prologis shares have fallen enough to look attractive.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge