- XRP’s Fear and Greed Indicator Flashes ‘Fear’

- Market indicators and metrics indicated a trend reversal

Most cryptocurrencies had a tough week as their weekly charts remained in the red XRP It was no different. The drop in prices may have sparked fear among investors as well. However, things could take a complete turn in the coming days as a bullish pattern appears to be emerging on the daily chart of the token.

Bullish pattern on XRP chart

according to coin market cap, XRP investors did not profit last week as the price of the token fell more than 4%. At the time of writing, the altcoin was trading at $0.4775 with a market cap of over $26.5 billion. Thanks to the price decline, XRP’s dividend supply has also declined sharply.

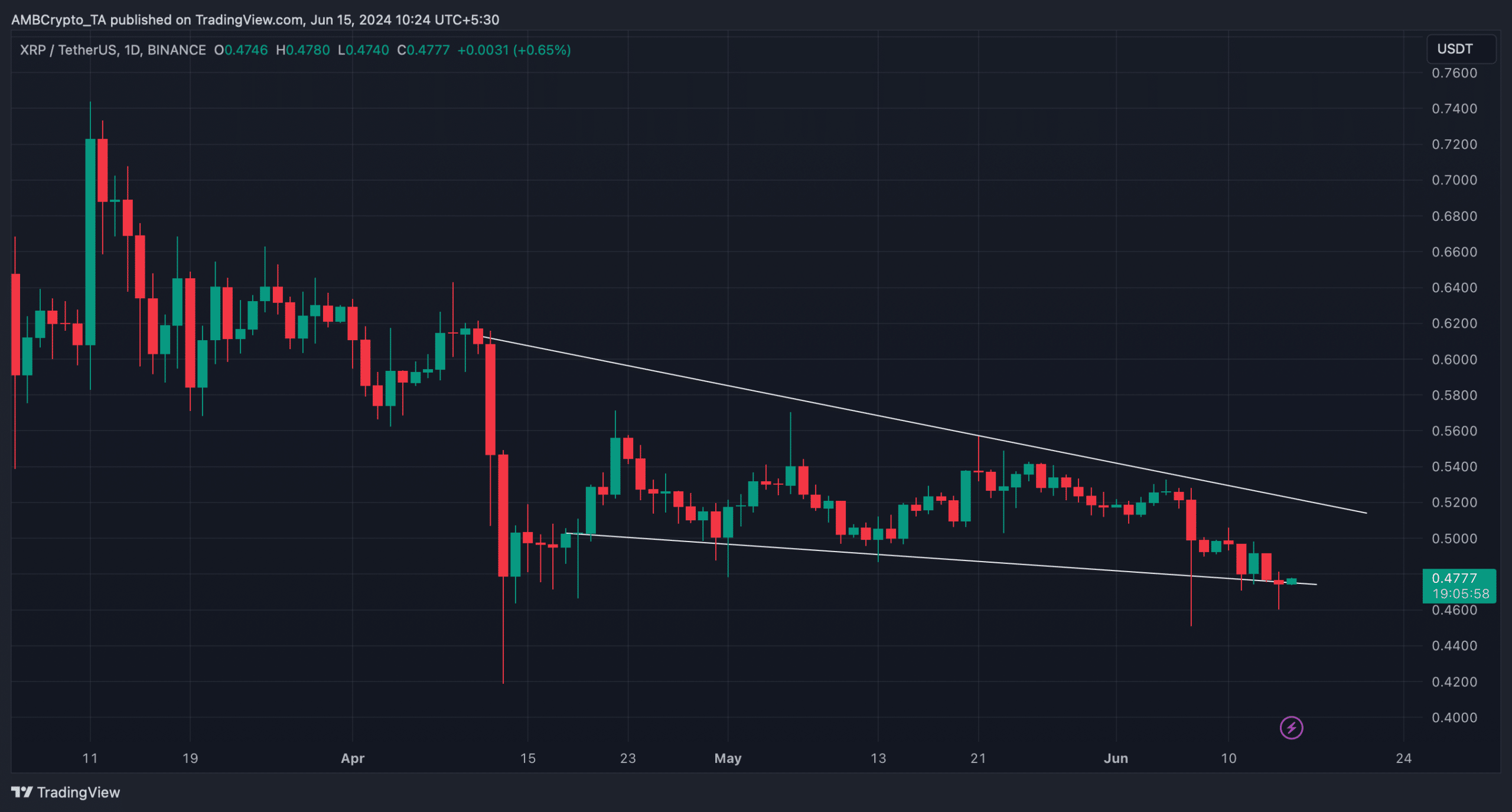

At the time of writing, only 69.8 billion tokens had been generated. However, investors should not lose hope as XRP might be ready for pumping. In fact, AMBCrypto analysis revealed that a bullish falling wedge pattern has emerged on the token’s chart.

Source: Trading View

The price of XRP entered this pattern after its massive price decline in mid-April. Since then, the token has consolidated inside a falling wedge. At the time of writing, it is preparing for an uptrend, which may lead to a breakout of the pattern. A successful breakout may allow XRP to recover April losses.

In fact, if things fall into place, XRP may soon retest its March highs as well.

Is the rise of Taurus inevitable?

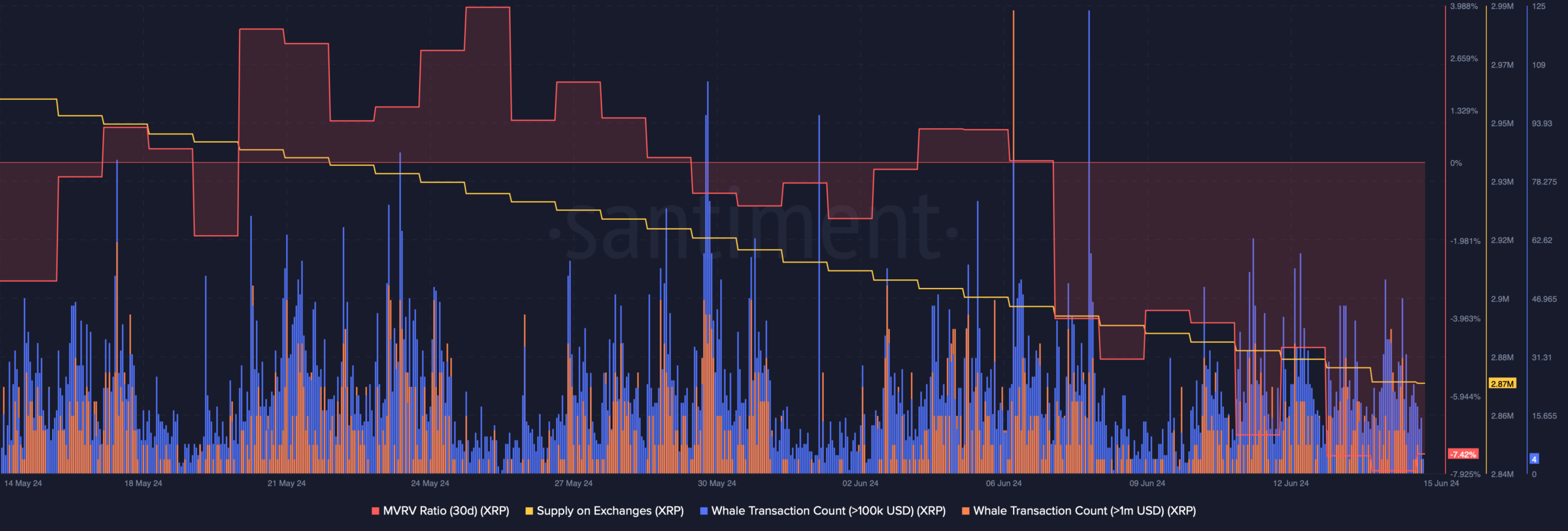

AMBCrypto then analyzed Santiment data to see if metrics support the possibility of an upward breakout. We found that XRP’s MVRV ratio was at its lowest levels over the past 30 days, which could lead to a bullish rally.

Their supply on exchanges also decreased, meaning investors took advantage of the opportunity to buy more tokens. In addition, whale activity around XRP has remained relatively high, as evidenced by the number of whale transactions.

Source: Santiment

Additionally, AMBCrypto found that at the time of writing, XRP had been found Fear and Greed Index With a value of 37%, meaning that the market was in the “fear” stage. Whenever the gauge reaches this level, it indicates that the chances of a trend reversal are high.

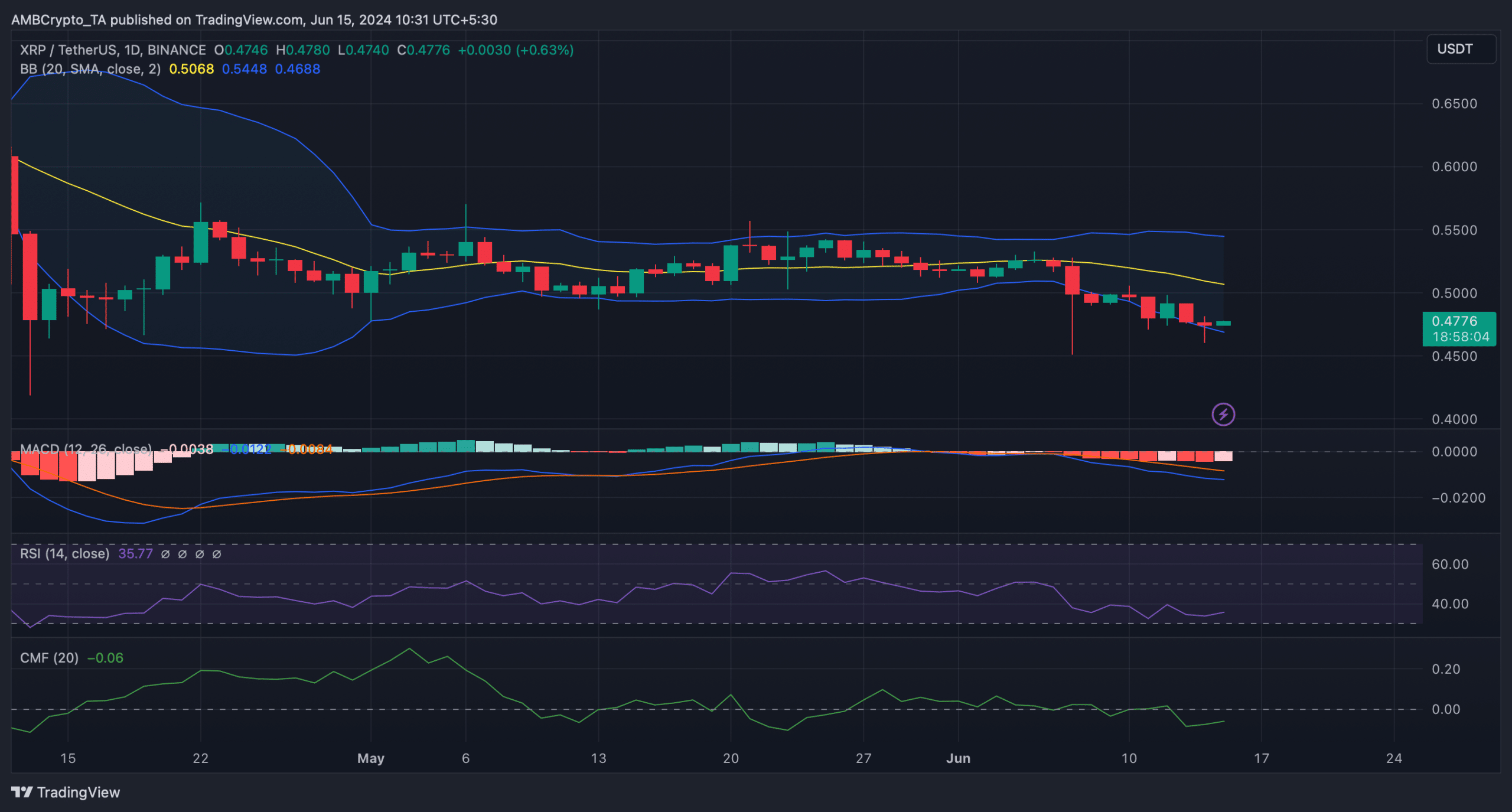

We then analyzed the daily chart of the token to better understand what to expect from it in the coming days. AMBCrypto found that the price of XRP has reached the lower bound of the Bollinger Bands, which often leads to higher prices.

Realistic or not, here it is The market capitalization of XRP in terms of BTC

Moreover, both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) recorded slight increases.

These indicators indicate that the chances of an upward trend reversal were high. However, it should be noted that the MACD remained in favor of sellers as it predicted a bearish edge in the market.

Source: Trading View

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge