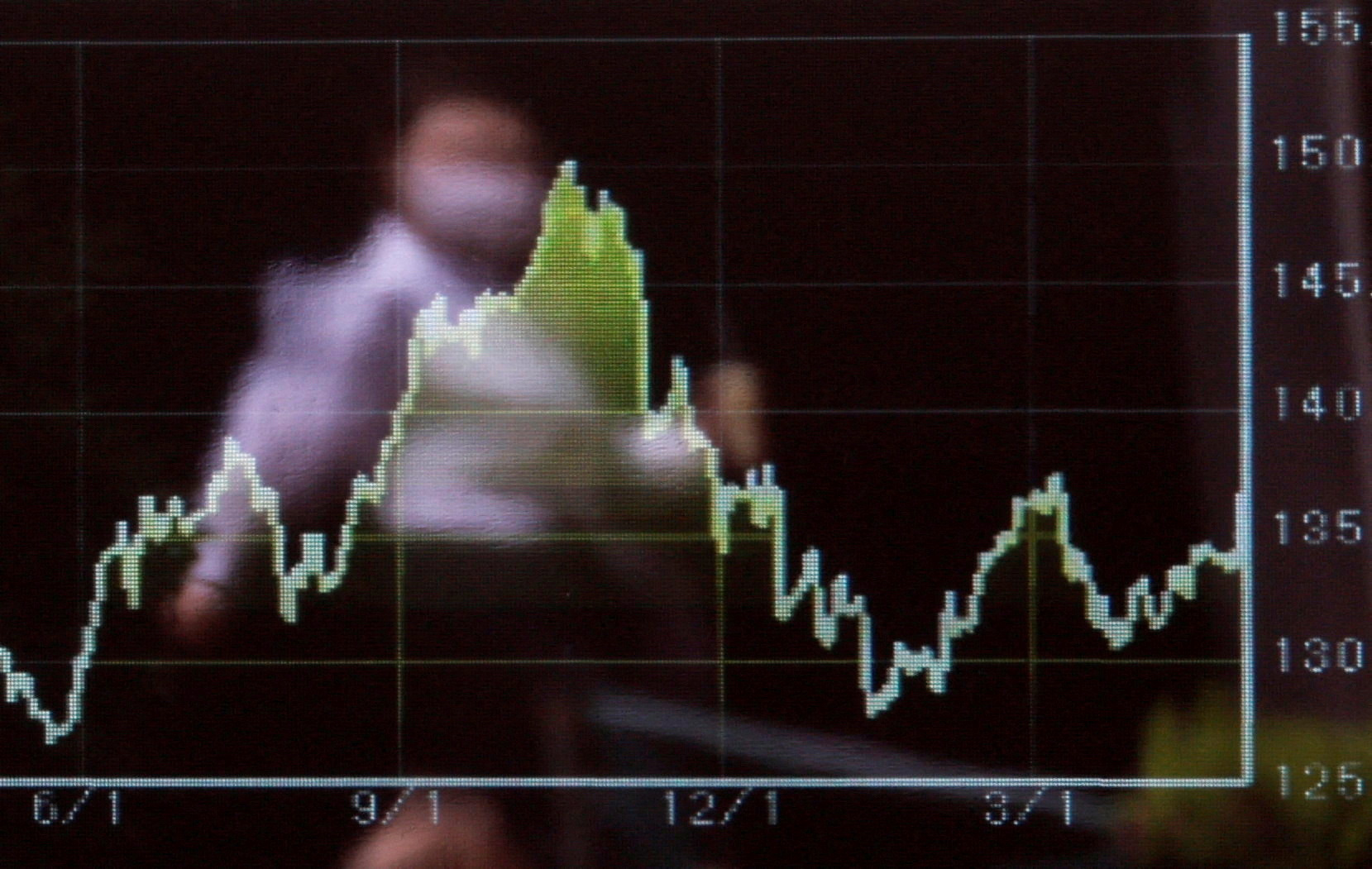

A passerby is reflected on an electric screen displaying a last-minute chart of the Japanese yen/US dollar exchange rate outside a brokerage firm in Tokyo, Japan on May 2, 2023. REUTERS PHOTO/ISEI KATO/File Obtaining licensing rights

TOKYO (Reuters) – Japanese stocks rose on Monday, with the Nikkei 225 index of export-heavy stocks supported by the yen’s fall to its lowest levels in nearly a year and after the United States avoided a government shutdown.

However, stock markets in the rest of the region were mixed, with Australian oil and resources stocks hurt by lower crude oil prices last week.

Trading also declined due to the market holiday in Hong Kong, while mainland China has been closed since Friday for the Golden Week holiday, which continues until the end of this week.

The Nikkei (.N225) jumped 1.6% by 0100 GMT, rebounding from its lowest closing level in more than a month at the end of last week.

US stock futures rose 0.6%, suggesting the S&P 500 rebounded 0.3% on Friday.

A temporary funding bill released at the weekend allowed the government to continue working until November 17, and means key data releases including Friday’s monthly payrolls report can go ahead on time.

“Lockdown risks are only delayed, not eliminated,” strategists at TD Securities wrote in a client note.

“The feeling of reduced uncertainty is likely to bring some relief to markets,” but “market volatility is likely to remain high as investors wait for the next catalyst, which is likely to be top-tier data.”

Japanese stocks also received support from the Bank of Japan’s quarterly Tankan survey, which showed an improvement in business sentiment.

Meanwhile, the yen fell on Monday to its lowest level since October 21 at 149.74 to the dollar, even as the broader rise in the US currency stalled after the dollar index rose to a 10-month high last week.

A weaker yen increases the profits of companies earned abroad when they repatriate them.

Elsewhere in the region, the mood was more muted. South Korea’s Kospi (.KS11) rose 0.1%, while the Australian stock index (.AXJO) fell 0.05%.

In addition to the pressure on energy and other resources stocks, Australian investors were also cautious ahead of the Reserve Bank’s policy decision on Tuesday, the first under new governor Michael Bullock.

New Zealand’s central bank sets policy on Wednesday. The country’s stock index (.NZ50) fell 0.5%.

The decline in Antipodean stocks came despite new signs that the economy of major trading partner China may be stabilizing. Although the private measure of factory activity in the data fell unexpectedly over the weekend, it remained in expansionary territory – a day after official data recorded the first expansion in six months.

Crude oil regained some ground after falling 1% on Friday, as positive news from the US and China improved the demand outlook.

Brent crude futures for December rose 18 cents, or 0.2 percent, to $92.38 per barrel after falling 90 cents at the end of last week. US West Texas Intermediate crude futures gained 23 cents, or 0.3 percent, to $91.02 per barrel, after losing 92 cents on Friday.

(Reporting by Kevin Buckland) Editing by Edwina Gibbs

This is the solution:トムソン・ロイタ「信頼の原則」

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge