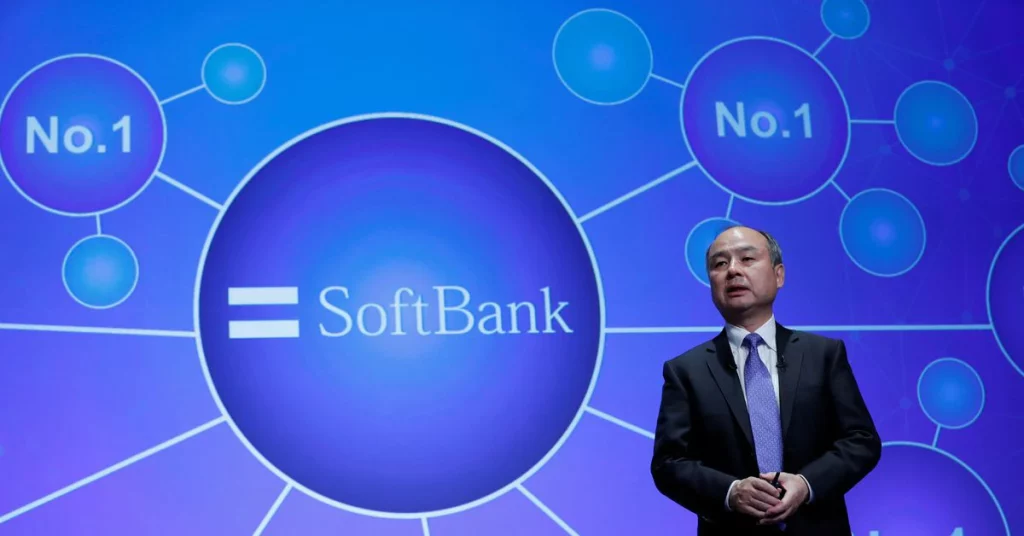

Japan’s SoftBank Group CEO Masayoshi Son attends a press conference in Tokyo, Japan, November 5, 2018. REUTERS/Kim Kyung-hoon

Register now to get free unlimited access to Reuters.com

LONDON, Aug 10 (Reuters) – Masayoshi Son is thinking the unimaginable at SoftBank Group (9984.T). His $63 billion tech and telecommunications empire will cut its stake in Alibaba (9988.HK) to 15% from 24%. The long-awaited downturn offers a blueprint for what to do next: break up the agglomeration.

This year’s tech sell-off has punished the Japanese holding company, sending it to a net loss of $23 billion last quarter. Son’s new mantra is discipline: his vision funds, which are giant venture capital mechanisms, just invested 600 million dollars In the three months to June, compared to about $21 billion a year earlier.

The same focus on preserving criticism seems to have informed the decision Unveiled on Wednesday Severing the ownership of Alibaba, which is of great importance to SoftBank as one of the most lucrative technology investments in the world. Through derivative deals with banks, Son was able to hold Alibaba’s stake by settling so-called prepaid futures contracts in cash. Instead, he handed over the stock. SoftBank is significantly reducing its position in order to “eliminate concerns about future cash outflows”.

Register now to get free unlimited access to Reuters.com

It’s the reasonable move. The Chinese e-commerce giant that Jack started has lost nearly two-thirds of its value over the past two years amid Beijing’s sweeping tech crackdown, distracting SoftBank investors as Sun tries to redirect attention to Vision Fund’s stable unicorns. and other startup companies. Alibaba Holdings, as of June 30, was worth $33 billion in net worth and represented more than one-fifth of SoftBank’s total asset value of $160 billion. Liquidating it all would help narrow SoftBank’s 55% discount to the theoretical total of its parts.

The same could be said of the sale of Japan’s eponymous mobile phone company SoftBank, which was worth $18 billion in June after deducting the parent company’s margin loan, and $7 billion from T-Mobile US (TMUS.O) are holding. Ditching chip designer Arm, rather than pursuing plans to include a small stake, would also simplify the group and raise its valuation. What remains is Vision Funds, which makes SoftBank a way for public market investors to gain knowledge primarily of Son’s mix of private technology groups.

It may not look very attractive under the current circumstances, but at least SoftBank will have a clear purpose. Selling to Alibaba may be the first step to breaking some devastating taboo.

Follow Tweet embed on Twitter

(The writer is a columnist for Reuters Breakingviews. The opinions expressed are his own.)

context news

SoftBank Group said on August 10 that it will settle derivative contracts held against its stake in Alibaba by handing over part of the shares to banks. The move effectively reduces its stake in the Chinese e-commerce company to 14.6% from 23.7%.

The technology conglomerate controlled by billionaire Masayoshi Son said early settlement of contracts in the form of shares would “eliminate concerns about future cash flows, as well as reduce costs associated with these prepaid futures contracts.”

Register now to get free unlimited access to Reuters.com

Editing by Jeffrey Goldfarb and Amanda Gomez

Our criteria: Thomson Reuters Trust Principles.

The opinions expressed are those of the author. They do not reflect the views of Reuters News Agency, which is committed under the principles of trust to impartiality, independence and freedom from bias.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge