LONDON (Reuters) – Global stocks tried to rally on Friday after four days of losses caused by mounting fears of an economic slowdown, although growth concerns were heightened by data showing a sharp slowdown in China.

Markets enjoyed some respite from the selling after two Federal Reserve policy makers on Thursday cut bets for a sharp 100 basis point rate hike this month.

But they did not dispel fears that central banks’ drive to control accelerating inflation would disrupt the global economy.

Register now to get free unlimited access to Reuters.com

Recession fears are further fueled by data showing a sharp slowdown in the second quarter in China, reflecting the massive blow from the widespread coronavirus lockdowns. The 0.4% annual growth was the worst since at least 1992, with the exception of early 2020 when the COVID pandemic hit. Read more

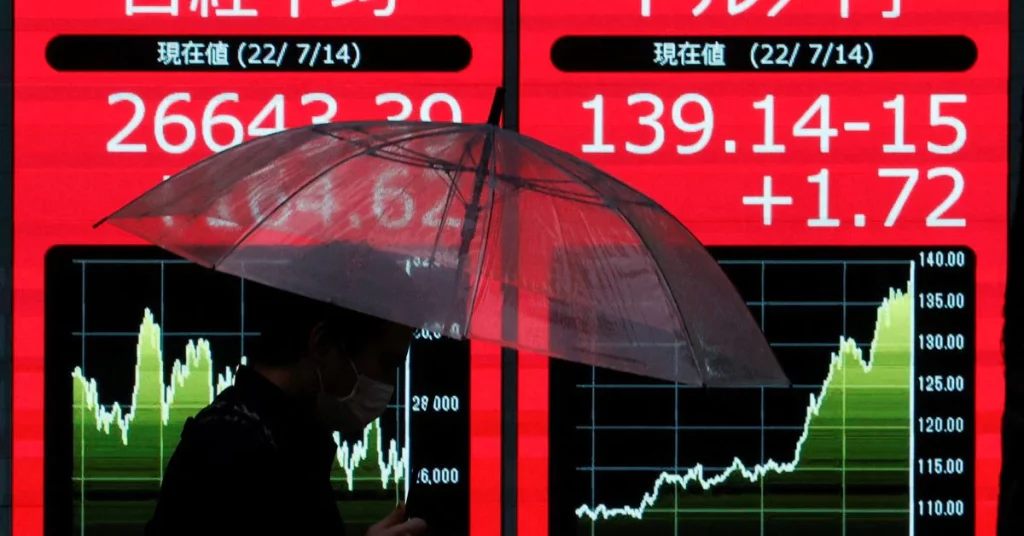

The data pushed Chinese stocks down 1.7% and pushed Japan’s former Asian index to two-year lows (.CSI300)And the (MIAPJ0000PUS.)While signs of pressure on the real estate sector weighed on listed developers in Hong Kong (.HSMPI).

“The recession angle is getting stronger, backed by data that shows things are cracking beneath the surface,” said Salman Ahmed, global head of macro at Fidelity International.

He was referring to weak economic data almost everywhere, in contrast to high inflation and tight labor markets.

“We’ve moved quickly from stagflation to more stagflation-dominated, and very strong inflation is raising concerns that the Fed will need to tighten further up front.”

Bets grew that the Federal Reserve could raise interest rates by a full percentage points this month, after US data showed an inflation reading of 9.1%. But Fed Governor Christopher Waller and St. Louis Fed President James Bullard, who are generally considered political hawks, said Thursday they favored a move of 75 basis points.

Markets still set aside about 45% chance of a bigger increase, but comments eased a heavy sell-off on Wall Street and futures contracted back to a flat open in New York on Friday.

European stock index rose 0.7% (.stoxx)This was also helped by news that the Italian president had rejected the resignation of Prime Minister Mario Draghi. Italian stocks rebounded 0.9%, although they remained down 5% for the week (.FTMIB).

Meanwhile, signals from corporate earnings in the second quarter are not encouraging yet; A large group of European companies reported downbeat results on Friday, after numbers that came in below expectations on Thursday from major US banks.

Bonds and oils

Chinese data sent iron ore prices down 9.1%, while Brent crude futures fell $1 to $94.8 a barrel.

mining index in australia (.AXMM) It touched a nine-month low, weighed down by a warning from Rio Tinto of a labor shortage. Read more

Bond demand remained unchanged, with US Treasury yields down about three basis points across the curve. Two-year yields were flat 17 basis points above the 10-year bracket, the so-called inversion of the curve that often foreshadows recession.

Moves have been sharper in Europe, due to Italian political turmoil but also with money markets scaling back some bets that the European Central Bank will tighten policy by the end of the year.

German 10-year bond yields fell 11 basis points to 1.071%, the lowest since May 31.

Borrowing costs in Italy fell after jumping on Thursday by about 20 basis points, but the yield premium on Germany was at its highest level in a month.

Peter McCallum, interest rate analyst at Mizuho, said the latest developments put Italy in a “no-man’s-land,” with no clarity on whether a new confidence vote could be scheduled.

“Until then we basically have uncertainty.”

The euro was flat, rebounding slightly from two-decade lows around $0.9952, having slipped 1.5% this week and reached parity against the dollar for the first time in 20 years.

Meanwhile, the yen rose around 140 against the dollar, last trading at 138.8, and the dollar index slipped slightly.

US retail sales data later on Friday will show how consumers are reacting to higher prices and signs of weak growth.

Register now to get free unlimited access to Reuters.com

Additional reporting by Tom Westbrook in Singapore and York Bahceli in London; Editing by Mark Potter

Our criteria: Thomson Reuters Trust Principles.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge