Four stocks collapsed more than 90% from their highs. Others are not far behind. SPAC-Hype-boom leaves a trail of SEC and DOJ investigations and class action lawsuits.

by Wolf Richter to Wolf Street.

The SPAC boom starting in 2020, along with a whole host of other ridiculous wealth transfer schemes, are exploding on a larger scale, not limited to EV SPACs. These special purpose buyouts made tons of money, often including celebrities who pumped this nonsense into social media for stupid retail investors to swallow up. After SPAC started public trading, they bought up startups with huge valuations. The merger caused the startup to be a public joint stock company. Insiders committed murders in the process no matter what happened.

This scheme for an IPO via SPAC avoids many of the disclosure and other requirements that traditional IPOs are subject to. Soon, a number of these companies were investigated by the Securities and Exchange Commission and the Ministry of Justice. And the deception of retail investors was swift and astounding.

All nine electric car makers and electric battery makers here are losing huge amounts of money. All of them are competing with the biggest companies out there: global car, truck and battery makers. The shares of four of them have collapsed by more than 90% from their highs. The ones that collapsed the least were as low as 60%. Some of them will probably go to $0.

| EV SPACs and IPOs | Price $ | % of peak | Peak date | |

| Nicola | [NKLA] | 7.79 | -90.3% | 9-Jun-20 |

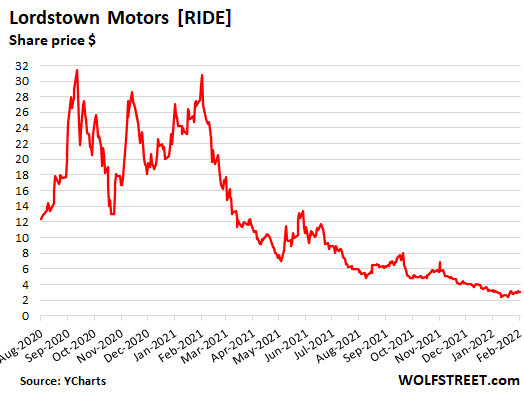

| Lordstown | [RIDE] | 3.04 | -90.4% | February 11 21 |

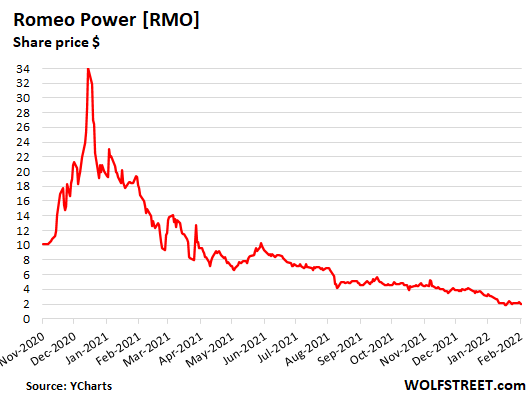

| Romeo Power | [RMO] | 2.06 | -93.9% | December 24 20 |

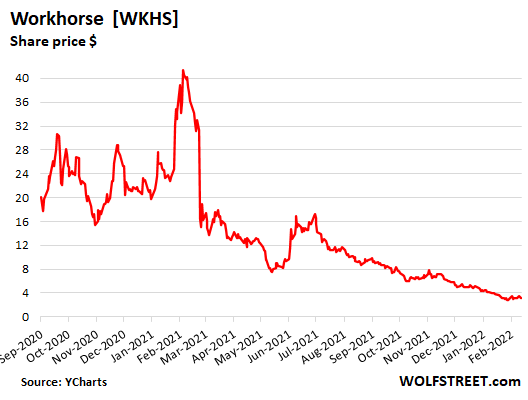

| Horse used in farms | [WKHS] | 3.23 | -92.5% | 4-Feb-21 |

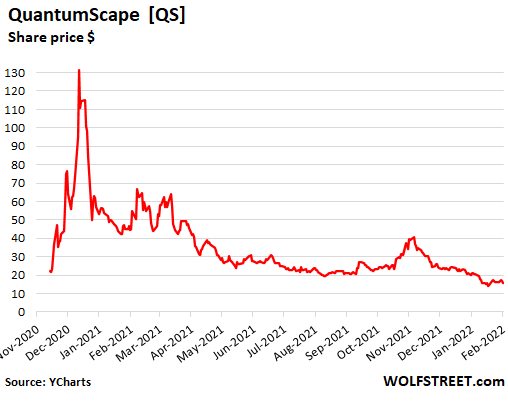

| Quantum | [QS] | 15.87 | -88.0% | December 22 20 |

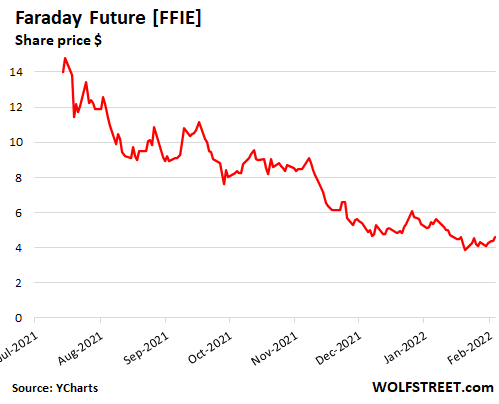

| Faraday future | [FFIE] | 4.59 | -77.9% | 1 February 21 |

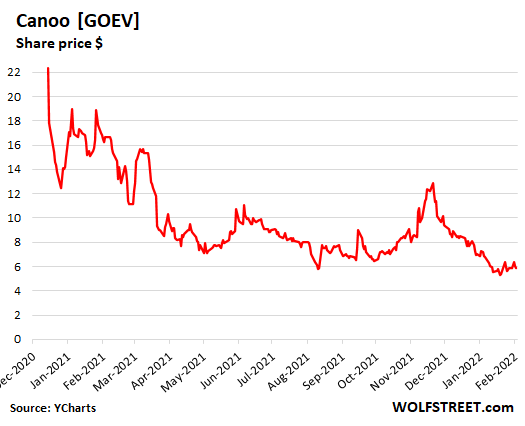

| Kano | [GOEV] | 5.85 | -73.9% | December 7 20 |

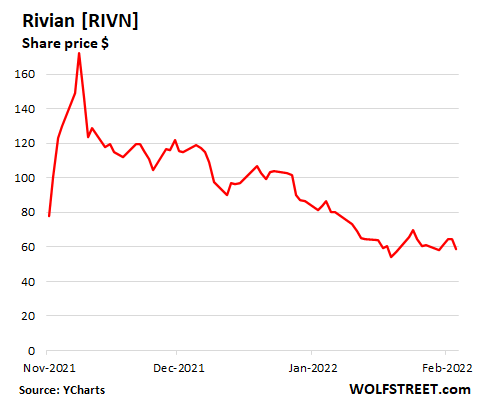

| Rivian | [RIVN] | 58.85 | -67.2% | 16 November 21 |

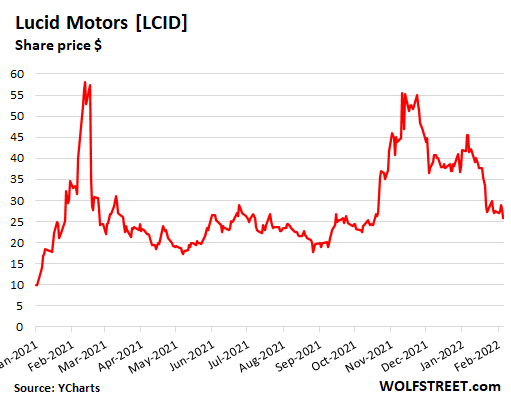

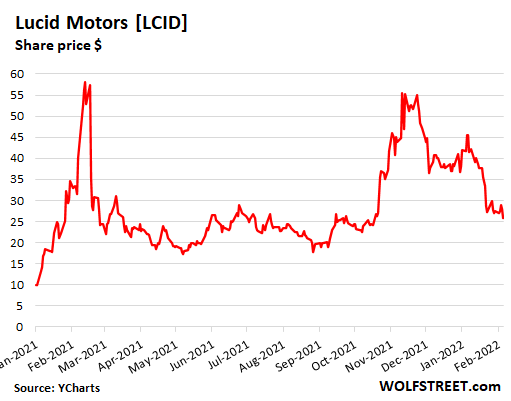

| Lucid Motors | [LCID] | 25.84 | -60.2% | 18-Feb-21 |

These aren’t small amounts of dollars either. For example, the fortune of Nicola, one of those under 90%, was $34 billion. Now it’s worth $3.2 billion – more than $30 billion has gone into smoke.

Nicola It was introduced to the public through a merger with SPAC. The deal was approved by shareholders in March 2020. Post-merger stock trading began in June 2020. In November 2020, the company revealed that it and its founder Trevor Melton were under investigation by the Securities and Exchange Commission and the Department of Justice shortly after the seller caught them lying to investors. . The company did some house cleaning and swept the founder. In December 2021, the SEC investigation settled for $125 million.

The investors who bought into the hype have been slaughtered. On Friday, shares closed at $7.79, down 90% from their peak in June 2020 (all stock data via YCharts):

Lordstown Motors It was announced through the merger with SPAC, a deal announced in October 2020. In March 2021, the company revealed that the Securities and Exchange Commission was investigating the matter. In July 2021, the company confirmed that the Department of Justice was now investigating its business, its SPAC deal, and its reports of vehicle pre-orders. The company fired its chief executive and chief financial officer.

Its stock closed Friday at $3.04 a share, down 90% from its peak in February 2021:

Romeo Power, which develops batteries for electric vehicles, announced in late 2020 that it would be acquired by SPAC RGM Acquisitions. The deal was approved by shareholders in December 2020. SPAC shares then began trading under the new ticker in January 2021. The share price has more than tripled from about $10 prior to the initial announcement to $34 a share on December 24, 2020, at the time of the approval by shareholders of SPAC to integrate. Then the collapse began amid investigations by collective law firms into its announcement prior to the merger of absurd growth expectations that collapsed.

Shares closed Friday at $2.06, down 94% from the plumber’s boom peak in December 2020.

Horse used in farms It went public through a merger with SPAC on October 22, 2020. Its shares jumped to nearly $43 on February 4, 2021, and then collapsed. In November 2021, the company confirmed that it was under investigation by the Securities and Exchange Commission and the Department of Justice over stock trading and accounting issues. Shares closed Friday at $3.23, down 92% from their February 2021 peak:

Quantumscape Which is trying to develop solid lithium-metal batteries for electric vehicles and counts among its investors Bill Gates and Volkswagen, went public through a merger with SPAC in November 2020. It is now entangled in class action lawsuits, alleging that the company lied about the potential of its batteries, including that the company You may not be able to extend it to electric vehicles.

After rising to a ridiculous hype boom peak of $132, stocks collapsed 88% and closed Friday at $15.87, after spewing nearly $48 billion in 14 months.

Faraday future It was brought to the public through a SPAC acquisition and a private equity investment (PIPE) on July 22, 2021. Then the short sellers’ allegations surfaced. In November, the company launched its own internal investigation into “inaccurate financial disclosures” and postponed the release of its third-quarter earnings report. On February 1, 2022, the commission released the results of its investigation. Among other things, she found that the originally touted report of more than 14,000 reservations on her car was “potentially misleading” because “only several hundred of these reservations were paid, while the others (there are 14,000) were unpaid indications of interest.” “.

Shares closed Friday at $4.59, down 78% from February 1, 2021:

Kano It went public through a merger with SPAC on December 22, 2020. In May 2021, it revealed that the Securities and Exchange Commission was investigating the merger deal with SPAC and its “operations, business model, revenue, revenue strategy, customer agreements, earnings and other topics, along with their recent departure from some Company officials.

Shares closed Friday at $5.85, down 74% from their December 2020 peak:

Rivian SPAC used not to go public, but its regular IPO, at $78 a share, on November 10, 2021. It raised $12 billion in its IPO. Amazon and Ford were major early investors. A week later, the shares were at $179 and the limit was sky. By the end of December, shares were down 41% from their peak, at $103.69.

Ironically, Amazon and Ford booked huge gains in the fourth quarter from their shares in Rivian that they bought as early investors at much lower prices, and for the purposes of fourth-quarter financial reporting valued at the end of the quarter. For Ford, this was a paper gain on Rivian stock worth $9.1 billion.

Sadly, those shares have now collapsed an additional 43%, to $58.85, and if it stays at that level during the first quarter, Ford faces a multibillion-dollar writedown of its Rivian stock. Similar to Amazon. The shares are down 67% from their peak three months ago and are well below their IPO price.

Lucid Motors It went public through a merger with SPAC in July 2021, raising $4.5 billion. On December 6, 2021, it revealed that its SPAC deal along with “certain forecasts and data” is under investigation by the Securities and Exchange Commission. Shares had been dropping for a week prior to the disclosure. On Friday, shares closed at $25.84, down 60% from their peak. A strange-looking scheme of a double implosion in a short time:

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Two children killed, 11 injured in stabbing attack at Taylor Swift dance party in UK, 17-year-old arrested

Fiber optic communications networks are being sabotaged – DW – 07/29/2024

Putin warns US against deploying long-range missiles in Germany | NATO