TheLast week was a bad time being a tech billionaire. When the pandemic led the world to the internet, The Google Microsoft reaped the fortunes described as “pornographic” and cemented their position among the richest group ever to trample the planet. Well, the “good times” are gone. Somewhat.

The world’s largest tech companies reported their latest earnings last week, and for most of them the news was bad. Meta (formerly Facebook), the alphabet (formerly Google and Microsoft) saw billionaires skew their values as investors began to worry that the tech giants’ best days were behind them. With investors close to exit, the five biggest tech stocks collapsed with a total of $950 billion (£820 million) at their lowest point. The slide also hit the fortunes of its creators.

Facebook founder Mark Zuckerberg’s fortune fell by $11 billion on Wednesday after Meta Platforms reported disappointing earnings for the second consecutive quarter. Shares in the company decreased by five A sharp decline in the value of the currency has reduced Zuckerberg’s total wealth this year to more than $87 billion. The numbers may be little more than an arithmetic shift — Fzuckerberg, 38, is still worth about $38 billion, according to Bloomberg — but that’s a staggering drop in the $142 billion he could count on in September 2021. Almost all of his fortune is tied to Meta shares; He owns more than 350 million shares. As of Thursday, Zuckerberg ranked 28th on Bloomberg’s list, down 25 places from his previous position of third.

Meta’s 71% drop in value this year is due to many things, including Apple’s ad tracking controls, easing digital ad spending, the challenge to TikTok’s Facebook-owned Instagram, and Meta’s multibillion-dollar investment in the metaverse – the virtual world that You spend money in it despite the less intimate reception, even from its employees.

This investment has alarmed investors. Zuckerberg said he expects the project to lose “significant” amounts of money over the next three to five years. On Wednesday, he asked for patience.

“I think we’re going to solve each of those things at different intervals of time,” Zuckerberg said. “And I appreciate patience, and I believe those who are patient and invest with us will end up being rewarded.” Wall Street seems impatient.

CNBC anchor Jim Cramer, who was a supporter of deadShe seemed to be on the verge of tears after the latest results were released. “I made a mistake here,” Kramer told viewers. “I was wrong. I trusted this management team. It was unwise. The arrogance here is extraordinary and I apologize.”

Zuckerberg is not alone. According to Forbes, tech billionaires have lost a total of $315 billion since last year.

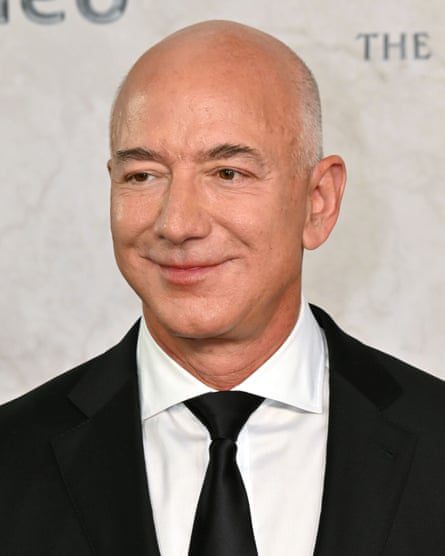

On Thursday, Amazon reported that this Christmas season will be less cheerful From what analysts expected and consumer spending was in “uncharted waters,” sending its stock price down 20%. The downturn hit Amazon founder Jeff Bezos by as much as $4.7 billion a day. Bezos had already lost nearly $60 billion in 2022, still leaving him with a net worth of around $134 billion.

The day before, Microsoft’s earnings report showed dependable cloud computing earnings growth in its Azure division was slowing, resulting in a roughly 8% drop in the company’s valuation. This will affect Bill Gates, whose fortune has fallen this year by nearly $30 billion to about $109 billion.

Even the founder of Tesla Elon Musk, the richest man in the world and now Twitter ownerThey were not immune to an economic downturn. Shares of Tesla, the electric car maker, are down 43.7% in the year to date. This likely reduced Mars colonizer A fortune of $58.6 billion over the past 12 months to $212 billion is still astronomical.

But despite the stock market bloodshed this week, 56 of the 65 tech billionaires survived Forbes The list of magazines — which includes Oracle founder Larry Ellison, Google founders Larry Page and Sergey Brin, Twitter founder Jack Dorsey, and former Microsoft CEO Steve Ballmer — is still richer than it was three years ago.

Earlier this year, Chuck Collins, director of the Institute for Policy Studies who runs its program on inequality, estimated that American billionaires have seen their combined wealth rise by more than $1.7 trillion, representing a gain of more than 58 percent due to the pandemic. Collins now says recent declines have reduced that to $1.5 billion, or 51 percent.

“The gains were very unusual in the two years of the pandemic, and they were almost pornographic,” he said. “Billionaires are fundamentally disconnected from the real world and the real economy. Even if their wealth adjusts now, who has made a 51% gain in their assets in the past two years?”

Billionaires are not the real victims. Tech companies have come to dominate US stock markets, their slump dragging the broader market down, and with them the pensions and savings of Americans who are also struggling with high interest rates and high inflation in 40 years.

The bigger question is: How long will this fall last, and who will be hurt the most? They are not likely to be aristocrats in the big tech companies. “If wealth is going to disappear from the economy, that is the best place to disappear from,” Collins says. “It may slow down the stinging philanthropy, but the truth is that most billionaires donate to their own foundations and to the money that donors advise. But it could mean less dynasty wealth, which I ultimately think is a good thing.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge