A few months ago, Mike Washburn’s investment in cryptocurrency looked like a winner.

Now he is only hoping to get his money back.

Mr. Washburn, a 35-year-old plumber in Otsego, Minnesota, had $100,000 in an account with Celsius Network LLC, one of the largest lenders in the cryptocurrency world. Mr. Washburn, who is recently widowed, said he and his two children had moved in with his parents, and he was planning to buy a home with his savings. A Celsius account offered him a higher return than a traditional bank account, and the company was well known in the crypto community.

Sunday evening, Celsius said so Customers are no longer allowed to withdraw cash from their accounts. Tuesday evening, the Wall Street Journal reported that Celsius hired lawyers for restructuring To help deal with her mounting financial problems.

Now, Mr. Washburne is anxiously waiting to hear what will happen to his account.

“If I don’t see this money again, it will set me and my children back for years,” said Mr. Washburn.

“Deep down I don’t think there will be a good result, but I hope I’m wrong,” he said.

Bitcoin and other cryptocurrency prices It was declining as interest rates rose and risky assets became unpopular. The tough market It forces formerly crypto-currency companies to cut jobs, halt mergers and prevent customers from withdrawing digital investments, shocking investors.

Individual investors may not have realized when they put in the percentage money that they were giving the company an unsecured loan with little legal protection. Crypto companies like Celsius look like banks in some ways, but they lack the investor oversight and legal protections built into banking and brokerage.

In a blog post on Sunday night, Celsius said it was temporarily halting all withdrawals, swaps and transfers between accounts, citing “harsh market conditions.” The move froze $11.8 billion in customer assets, based on the company’s May report. On Wednesday afternoon, assets were still frozen, and Celsius founder and CEO Alex Mashinsky tweeted that the company was “working nonstop” on the issue.

It is one of dozens of unregulated lenders that have emerged in recent years promising high returns for investors willing to lend their digital assets. Celsius, which has around 1.7 million clients, has paid clients an annual return of up to 18.6% on cryptocurrency deposits. Higher interest rates were available for those willing to accept payment in CEL’s CEL currency.

Mr. Mashinsky launched the company in 2017, marketing Celsius as a safe alternative to banks. Mr Mashinsky, the Ukrainian-born, criticized banks for paying low interest rates to customers, preferring them to T-shirts that emphasized his message, including the one that reads: “Banks are not your friends.”

Like other lenders, Celsius accepts customer deposits of cryptocurrencies and lends them to other users, including market makers and exchanges, to earn a return. Celsius also places clients’ deposits in high-return, high-risk decentralized financing investments.

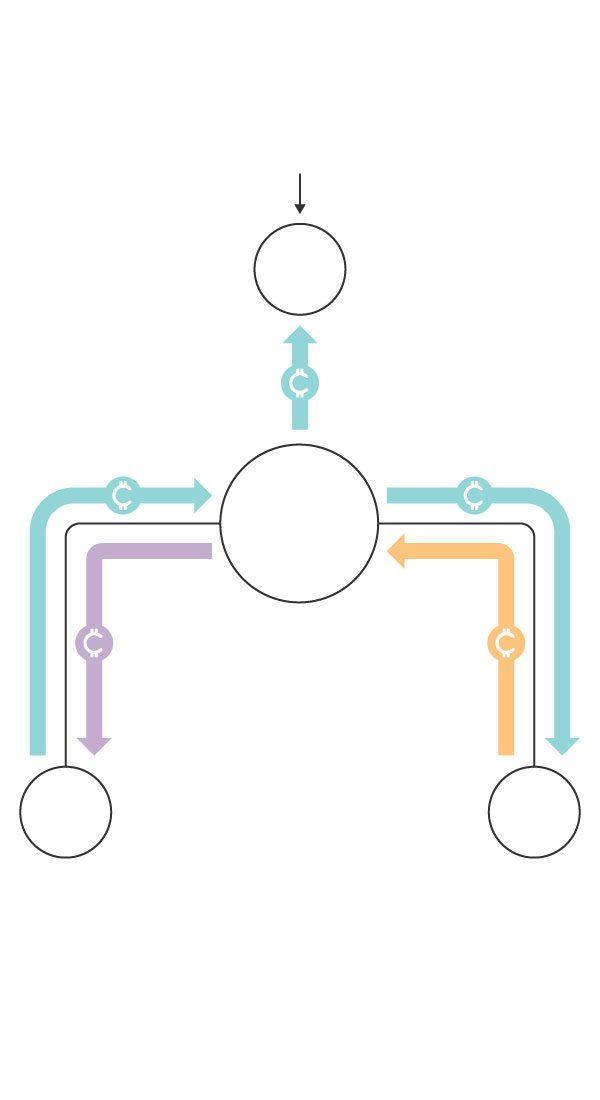

How Celsius Cryptocurrency Lending Works:

puts a percentage Customer deposit In decentralized finance investments and lending money to other users (including exchanges and market makers).

Client Lending money To Celsius vs. fruit. (This is basically an unsecured loan).

Percentile score A return of borrowers and investments.

puts a percentage Customer deposit In decentralized finance investments and lending money to other users (including exchanges and market makers).

Client Lending money To Celsius vs. fruit. (This is basically an unsecured loan).

Percentile score A return of borrowers and investments.

Celsius was challenged, however, in earning a higher than promised return for customers while allowing them to withdraw their crypto investment immediately. Celsius has put at least $470 million into an investment that has gone down in value, according to blockchain data and a person familiar with the matter. The terms of the investment product, which is operated by Lido Finance, prevent Celsius from removing its assets quickly, adding to the difficulties.

Vasily Shapovalov, the developer of Lido, said he does not think the token is too risky.

Celsius has accepted ether from customers and used it to purchase at least 409,000 Lido staked ether tokens, according to a person familiar with the material and blockchain data, which in turn provided them to earn a high return. Historically, these tokens have had nearly the same value as ether because it represents the ether used on the Ethereum platform to process transactions and maintain the security of the chain. Celsius cannot exchange its Ether holdings pegged to Ether until Ethereum has made the transition to the “Proof of Stake” model, but the deadline for this move has been constantly pushed back.

Recently, though, Lido-staked ether has been trading at a discount of around 5%, according to analytics firm Dune Analytics. The chapter begins with the cryptocurrency TerraUSD recently collapsedwhich motivates investors to withdraw from more speculative assets.

The drop in the value of these tokens caused a problem in percentage terms. If its customers were to withdraw ether deposits en masse, the company would have to sell its pegged ether holdings at a significant loss.

Celsius’ fortunes seem to be changing rapidly. The company said on Friday that it had not had any problems fulfilling withdrawal requests and that it was holding enough ether to meet its commitments.

Matt Novak, 35, of Sacramento, California, first became anxious over the weekend when he had trouble logging into his centenary account. Tried again a few hours later with no luck.

WSJ’s Dion Rabouin explains why Wall Street is now betting so heavily on cryptocurrencies and what this means for the new asset class and its future. Composite photo: Elizabeth Smiloff

Mr. Novak said his investments in cryptocurrencies in his percentile, about 5% in bitcoin and the rest in cryptocurrency Polygon, represent about 60% of his retirement funds. He said that its value was about 93,000 dollars early last week, but it fell to about 28 thousand dollars earlier this week.

Novak, who runs a mortgage marketing firm, said he was drawn to the 17.5% rate of return on offer on Polygon’s C deposits at the time. Prior to this week’s crypto crash, he estimated that he had earned at least 50% of his initial investment.

“Looking back, it sounds too good to be true,” he said.

Celsius’ decision to freeze accounts sparked tension across the crypto world, helping to drop bitcoin and ether by about 15% on Monday. Digital assets are down 53% and 68% in the last year to date.

“Stopping customer withdrawals is a huge deal,” says Matthew Siegel, head of digital asset research at Van Eck Associates, which operates three crypto funds. “It’s testing the market.”

Individual investors in other cryptocurrencies are feeling the pressure as prices drop, with some Receive margin calls To provide more guarantees for their trading in leveraged digital currencies. On Tuesday, data provider CoinGlass said that about $690 million of collateral pledged by some 160,223 retailers has been liquidated over the past 24 hours.

By Tuesday, the CEL token for CELIUS was down 81% in the year to date, according to crypto research firm Messari. When the coin plunged on Friday, Celsius said, “The price of CEL is often influenced by market factors that are not related to the company’s performance.”

Later that day, news broke that Celsius had hired restructuring lawyers from the law firm Akin Jump Strauss-Heuer & Feld LLP to explore potential financing options from investors and other strategic alternatives, including financial restructuring.

Securities owned by clients by a registered brokerage firm, such as Fidelity Investments, are untouchable in bankruptcy proceedings. However, Celsius is not a registered brokerage firm.

Securities and Exchange Commission Chairman Gary Gensler warned that investors who own cryptocurrency through trading platforms such as the largest US crypto exchange,

Coinbase Global a company ,

They are not protected in the same way they would be if they invested through a registered brokerage. In March, the Securities and Exchange Commission issued guidelines Directing publicly traded crypto companies to record the digital tokens they hold to customers as assets and their obligation to customers as liabilities.

In April, Celsius stopped offering products to “unaccredited” investors, or those who do not meet a certain wealth threshold, after they came under pressure from regulators.

In May, Coinbase told customers They may lose access to their digital assets It is held in the stock exchange in the event of bankruptcy of the company. The biggest uncertainty facing the cryptocurrency industry is whether digital tokens are securities like stocks and bonds. the question It is being fought in court.

Some of the major investors and founders of cryptocurrency have been selling their investments over the past year, turning a profit before the recent sell-off. Billionaire Mike Novogratz

And the He was a seller of many cryptocurrenciesAccording to the company’s filings and people close to the subject. Earlier this year, Mr. Novogratz got a tattoo on his biceps from cryptocurrency Luna and spoke positively about various cryptocurrencies at industry events.

Mr. Novogratz told the newspaper that while he was publicly optimistic about the future of Luna and other cryptocurrencies, he was careful to include words of caution.

In recent days, crypto and blockchain companies have been laying off employees. On Monday, crypto lender BlockFi said it has reduced the number of people by about 20%. On Tuesday, Coinbase said it will cut nearly a fifth of its employees because the company has grown too quickly and that a possible recession “may lead to a new crypto winter.” Four Senior Coinbase Officials Raised over a billion dollars By selling shares since the public listing of the cryptocurrency exchange in the spring of 2021. So far this year, the company’s shares are down 78%.

“These Coinbase executives retain significant positions with the company, reflecting their commitment to our long-term opportunities,” a Coinbase spokesperson said last month.

On Thursday, Joseph Rotunda, the council’s director of enforcement, said the Texas State Securities Board has opened an investigation into Celsius over its decision to freeze customer accounts. The Board of Directors works with New Jersey, Kentucky, Alabama and Washington. Reuters reported earlier about the opening of the investigation.

The drop in cryptocurrency prices also complicates the plans of companies dealing in bitcoin and related fields. So far this year, 42 acquisitions of crypto-related companies have been announced, according to Dealogic. But it’s been about two months since the last deal was announced, which indicates some companies You may find it difficult to access or complete mergers Until the markets are clear.

– Orla McCaffrey and Paul Vigna contributed to this article.

write to Gregory Zuckerman at [email protected]

Copyright © 2022 Dow Jones & Company, Inc. all rights are save. 87990cbe856818d5eddac44c7b1cdeb8

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge