Dow futures rose overnight, along with S&P 500 futures and Nasdaq futures. The stock market correction had a mixed session on Tuesday, as Treasury yields continued to rise sharply. Investors are focused on the announcement of the Federal Reserve’s meeting on Wednesday, where policymakers are set to approve either a very large or a very large increase in the Fed rate.

X

Quanta Services (PWR), the health (HQY), Cheniere Energy (liquefied natural gas), dollar tree (DLTR) And the Lee Otto (LI) are the stocks to watch. Everyone looks strong Lines of relative forceeven if stock prices are struggling to hold.

LNG stocks running IBD Leaderboard. There is a PWR stock in the leaderboard watchlist and on IBD Big Cap 20. Li Auto is in stock at defect 50. HealthEquity was Tuesday’s stockpile of the IBD.

The video included in the article discusses market action and analyzes Cheniere Energy, Li Auto and DLTR stocks.

while, Tesla (TSLA) reversed modestly higher after moving towards the low of May 24th at 620.54. Tesla stock closed up 2.4% at 662.67, but is far from its November peak of 1,243.49. The National Highway Traffic Safety Administration is likely to release collision data that includes driver assistance systems within the next few days, noting the high number of autopilot accidents in Tesla. NHTSA has expanded the Tesla Autopilot probe.

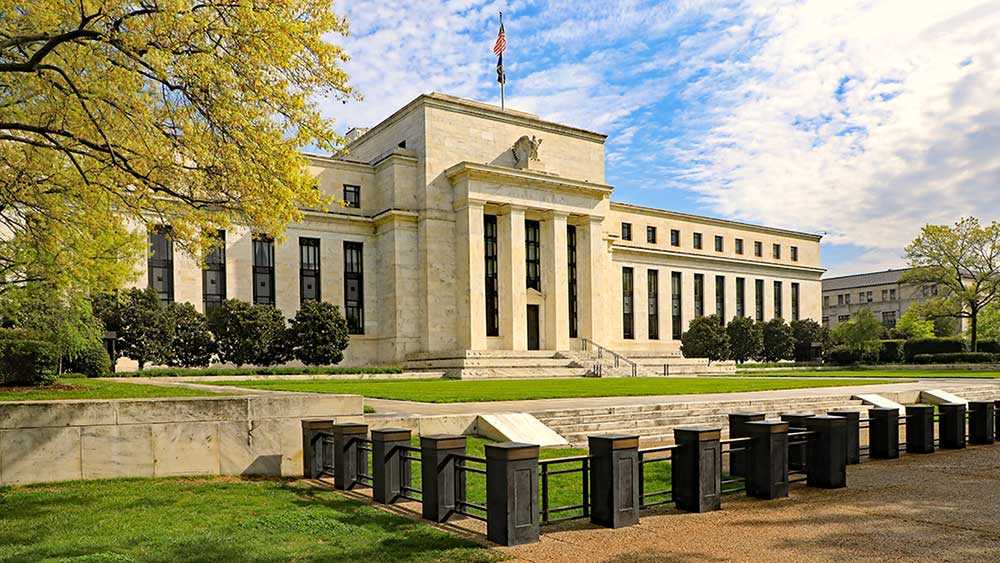

Fed meeting

The Fed’s two-day meeting ends on Wednesday with an announcement at 2 p.m. ET, followed by Fed Chairman Jerome Powell’s press conference. In the wake of Friday’s heated CPI report that showed inflation reached a 40-year high of 8.6%, speculation grew that Fed policy makers would raise interest rates by 75 basis points on Wednesday, not just 50 basis points.

The Fed doesn’t like to be surprised, and Powell said after the Fed’s May meeting that 75 basis points were off the table. The central bank could still raise rates by 50 basis points, with Powell then indicating that 75 basis points are on the table for July and September.

But after Fed officials apparently leaked to The Wall Street Journal On Monday, a significant rate hike is being considered. You see the market moving 75 basis points probably.

Dow jones futures contracts today

Dow Jones futures are up 0.5% against fair value. S&P 500 futures rose 0.7%. Nasdaq 100 futures rose 0.9%.

The 10-year Treasury yield fell 6 basis points to 3.42%.

Bitcoin price is trading near $22,000, slightly above the 18-month Monday night low below $21,000.

China’s economic data for May came in slightly better than expected amid the still heavy COVID restrictions. Retail sales fell 6.7% from a year earlier, outpacing views for a 7.1% decline. Industrial production rose 0.7% versus expectations for a 0.7% decline and April’s 2.9% decline. With Shanghai ending its lockdown on June 1, economic activity should rebound this month.

Remember to work overnight in Dow Jones futures contracts and anywhere else that does not necessarily translate into actual circulation in the next regular session Stock market session.

Join IBD experts as they analyze actionable stock market actionable shares on IBD Live

stock market tuesday

The stock market traded mixed in the Tuesday session, with light on volume ahead of the Fed’s meeting announcement on Wednesday.

The Dow Jones Industrial Average fell 0.5% on Tuesday stock market trading. The S&P 500 fell 0.4%. The Nasdaq Composite Index rose 0.2%. Small Russell 2000 sank 0.4%.

The 10-year Treasury yield jumped 12 basis points to 3.48%, after massive moves in recent days. The two-year yield jumped 15 basis points to 3.43% The 30-year Treasury yield rose 6 basis points to 3.43%, but is now lower than the 10-year yield and even with a two-year yield. If the two-year yield moves above the 10-year yield, the curve will be inverted from the two-year yield to the 30-year yield. A rising and flat yield curve reflects the risks of stagflation, with the potential for a recession rising as inflation rises and Fed rates raise.

US crude oil prices fell to close down 1.7% to $118.93 a barrel.

Natural gas prices fell by 16%. The Freeport LNG terminal, which was shut down due to a fire on June 8, will not reopen for 90 days and not be fully operational until late in the year. This means fewer exports of natural gas.

between the Best ETFsThe Innovator IBD 50 ETF (fifty) rose 0.8%, while the Innovator IBD Breakout Opportunities ETF (fit) sank 0.6%. iShares Expanded Technology and Software Fund (ETF)IGV) rose 0.6%. VanEck Vectors Semiconductor Corporation (SMH) advance 0.7%.

SPDR S&P Metals & Mining ETF (XME) is down 1.3% and the US Global X Fund for Infrastructure Development (cradle) decreased by 0.7%. US Global Gates Foundation (ETF)Planes) give up 1%. SPDR S&P Homebuilders ETF (XHB) down 0.8%. SPDR Specific Energy Fund (SPDR ETF)XLE) up 0.2% and the Financial Select SPDR ETF )XLF) down 0.9%. SPDR Healthcare Sector Selection Fund (XLV) gave up nearly 1%.

Shares reflect more speculative stories, the ARK Innovation ETF (see you) is up 1.1% and the ARK Genomics ETF (ARKG) 1.3%. Tesla stock continues to lead across ETFs on Ark Invest.

Top 5 Chinese stocks to watch right now

stock to watch

Quanta Services stock fell 1.8% to 123.55 on Tuesday, just above the 50-day streak. PWR stock in file cup base with handle With 138.56 buy points.

HealthEquity stock rose 5.9% to 68.42 on Tuesday, rebounding from the 50-day line, breaking some short-term levels and breaking the trend line. In a better market, Tuesday’s move could have provided an early entry. At this point, HQY stock is now extended from this entry. Closes at an official 72.80 buy point from A cup base. HealthEquity nearly doubled as of early December after a long slump, while earnings trended lower for several quarters.

LNG stocks rose 2.2% to 130.40, still below the 50-day moving average. Cheniere stock pared its consolidation lows on Monday, likely setting the stage for a double bottom base at 146.45 buying points. Cheniere Energy, with its LNG export terminal, should take advantage of the problems of the Freeport LNG terminal, which lowers domestic natural gas prices and raises global LNG prices.

DLTR stock rose 0.65% to 156.02, hitting resistance at the 50-day line. according to MarketSmith Analysis. Stocks fell and rebounded in the second half of May at first targeting (TGTEarnings Mistakes and Warnings, followed by solid earnings and guidance from Dollar Tree.

Li Auto stock rose nearly 11% to 32.22, hitting its best level since Jan. 3. Shares jumped from 18.82 on May 9, rebounding above the 200-day line on June 6. Deep consolidation with a buy probability of 37.55 pips. But stocks can use a long handle or even a separate base within deep consolidation to allow the major averages to catch up, especially the 50 day line. Li Auto sees rise with shares of other electric car companies in China New (NIO), Exping (XPEV) And the BYD (BYDDF), as the headwinds of Covid waned, local governments are expanding subsidies for electric cars.

All carmakers have new models in the coming weeks, with Nio launching the ES7, an all-electric SUV, on Wednesday. Li Auto unveiled a new hybrid SUV, the L9, on June 21. More broadly, US-listed Chinese stocks, including Internet, have risen in recent weeks.

market analysis

The Dow Jones, S&P 500 and Nasdaq Composite all jumped lower on Monday, but closed mixed. Russell 2000 cut its lowest in May, marking its worst level since November 2020. The small business index is below pre-Covid highs.

Given the Fed’s massive meeting on Wednesday afternoon, Tuesday’s low-volume market move is not meaningful.

Whether the Fed raises rates by 50 basis points or 75 basis points on Wednesday, the macroeconomic climate is not favorable for the market, and may not be favorable for some time to come. Recession risks are high, while inflation will remain high for the foreseeable future.

However, what really matters is the reaction to the news. The stock market may rebound after Wednesday’s rate hike and Powell’s comments, but that won’t signal a change of character per se. Investors need to see a Follow-up day To confirm any rally attempt. Even then, a confirmed uptrend could be another short-term bear market rally.

At the moment, the Nasdaq Composite and S&P 500 are in bearish markets, while the Dow is in a sharp correction.

Time to Market with IBD’s ETF Market Strategy

What are you doing now

The bear market is not a time for courage. Investors should be on the sidelines. The only exceptions may be long-term winners or some positions in the energy sector, but even here investors should consider taking at least partial profits.

For now, investors should work on their watch lists, reviewing past trades and historical bear markets.

Read The Big Picture Every day to stay in sync with the trend of the market, stocks and leading sectors.

Please follow Ed Carson on Twitter at Tweet embed For stock market updates and more.

You may also like:

Do you want to get quick profits and avoid big losses? Try SwingTrader

Best growth stocks to buy and watch

IBD Digital: Unlock IBD Premium Stock Listings, Tools & Analysis Today

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge