Ann Chishus

Pitch elevator

I have a neutral or neutral rating assigned to First Republic Bank’s (New York Stock Exchange: FRC) Involved. FRC’s share price has collapsed nearly 90% in one month, and current valuation multiples are attractive both in absolute and historical terms. Basis. But the outlook for FRC is murky, given uncertainty about future regulatory changes, the attitude of US consumers regarding cash management, and the bank’s ability to hold and grow deposits.

How did the banking crisis affect the First Republic Bank?

In the past month, FRC’s stock price has fallen -89.7%, while the S&P 500 has been flat over the same period. First Republic Bank’s share price decline began on March 9, 2023 as its shares suffered a -16.5% drop on the news that “venture capital investors were reportedly moving their money out of troubled Silicon Valley bank.” by Find Alpha News.

The banking crisis has had a very negative impact on First Republic Bank’s stock price performance recently, as investors fear that FRC will suffer from large deposit outflows and a rising cost of funding.

Key metrics for FRC stock

In this section, I highlight specific metrics that provide an indication of the potential negative effects stemming from Silicon Valley’s banking problems and banking crisis.

according to results A recent study conducted by Morning consultation On March 16-17, 2023, 16% of adults in the United States said they moved their money as a direct result of the Silicon Valley bank failures. It is mentioned among those who transferred money from their banks that 36% of them chose to transfer to a national bank according to Morning consultation reconnaissance. Separately, March 26, 2023 Financial Times condition Adapted from data from EPFR The highlight is that money market funds experienced the highest level of inflows (around $286 billion) in the current month that was previously only surpassed during the worst of the pandemic. These metrics seem to validate market fears that FRC will see lower deposit balances in the future.

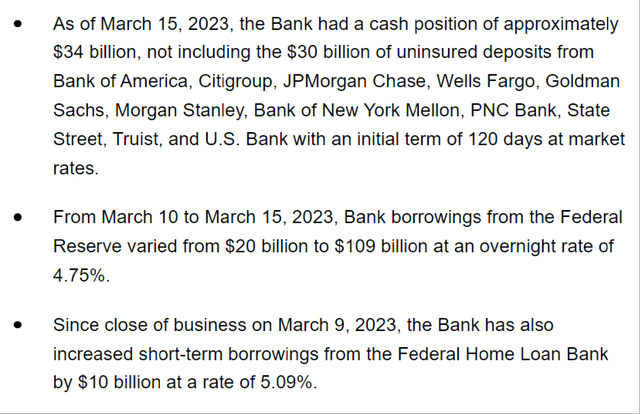

Also, the fiscal 2023 common share earnings or EPS forecast for First Republic Bank in the Wall Street analyst consensus was cut by -85.4% to $0.90 last month. The significant downgrade in the FRC’s agreed bottom line forecast is justified, as the bank had to change its funding mix in an unfavorable way to mitigate the impact of deposit outflows. First Republic Bank issued a press release on March 16, 2023 disclosing that it has received deposits from other banks within a 120-day time frame, and has taken on additional loans at a higher financing cost as shown below.

First Republic Bank’s new deposits and borrowings

FRC press release dated 16 March 2023

In the next section, I discuss whether FRC’s recent share price collapse was fully priced into the headwinds the bank is facing.

Is FRC Stock Undervalued Right Now?

First Republic Bank shares are at best fairly valued right now, rather than undervalued.

According to the evaluation data obtained from Standard & Poor’s Capital IQFRC is valued by the market at 13.7 times the forward-looking consensus of the next 12 months restricted P/E and 0.17 times the historical price-to-tangible book or P/TBV. As a basis for comparison, First Republic’s 19-year average P/TBV and normalized P/E multiples were 2.30 times higher and 19.6 times higher.

Although First Republic Bank shares seem undervalued based on a historical valuation comparison, there are downside risks that could further lower FRC’s share price. A major risk factor is that FRC failed to hold the majority of its clients’ deposits within a few months, after returning $30 billion in deposits from major banks for 120 days. Another major risk factor is that First Republic Bank either undertakes a major capital increase dilution or undergoes a sell-off at a significant valuation discount.

Can the stock of the First Jumhouria Bank rebound?

A rebound in FRC share price is likely in the short term.

Find Alpha News It reported on March 26, 2023 that “US regulators are assessing the expansion of banks’ emergency lending facilities.” This will help boost depositors’ confidence to some extent. This should also provide time for First Republic Bank to consider and explore strategic options such as fundraising or divestment of assets.

But a sustained recovery in First Republic Bank’s share price is less likely. Deposits are not likely to return to the FRC in a significant way, unless all bank deposits are fully covered by FDIC insurance, which regulators are not yet committed to. Also, one needs to take into account the bank’s long-term outlook as detailed in the next section.

What is the long term perspective?

The long-term outlook for First Republic Bank is mixed.

On the one hand, First Republic Bank has built a very strong brand, as evidenced by specific metrics disclosed at the bank 2022 Investor Day Hosted on November 9 last year. It was your FRC or NPS Net Promoter Result for the year 2021 79, which is well above Apple’s (AAPL) NPS of 60 and the average NPS of 34 for local banks. Furthermore, FRC revealed at the previous Investor Day of the Year that its existing clients and their referrals generate nearly 90% of the bank’s new loans.

It’s reasonable to assume that First Republic Bank is well positioned for long-term growth by leveraging its brand equity, assuming it weathers this banking crisis without permanently losing deposit customers in droves.

On the other hand, the current banking crisis may have led to structural changes that will make it difficult for First Republic and other regional banks to maintain a similar pace of deposit growth that they achieved in the past.

back to Morning consultation In the survey I mentioned earlier, more and more American consumers are considering new banking services with a preference for national banks, and many are diversifying where they keep their money. The share of US consumers willing to look for a new bank rose from 15% in February to 23% for March; Others chose to withdraw part of their funds from banks and invest in financial investments, commodities and digital assets.

Competition for consumer funds will intensify in the future, and it will become more difficult for First Republic Bank to attract deposits in the future. First, confidence in banks, especially non-national banks, would have been greatly damaged by the recent banking crisis. Second, the FRC’s strategy of earning deposits at attractive rates may be less effective in “higher for longerinterest rate environment.

Is FRC stock to buy, sell or hold?

FRC shares are rated as hold. First Republic Bank’s ratings are now low, based on a comparison of its current multiples with its historical averages. But there is a lot of uncertainty regarding the outlook for the US banking industry and the bank for an upward rating of First Republic Bank. As such, I think Hold’s rating for FRC is fair and appropriate.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25550621/voultar_snes2.jpg)

More Stories

Bitcoin Fees Near Yearly Low as Bitcoin Price Hits $70K

Court ruling worries developers eyeing older Florida condos: NPR

Why Ethereum and BNB Are Ready to Recover as Bullish Rallies Surge