The Dow Jones Industrial Average declined after a stronger-than-expected jobs report. apple (AAPL) were the most affected. Tesla (TSLA) by 9% after CEO Elon Musk announced a workforce adjustment. Amazon (AMZN) was also declining after the resignation of a key executive.

A couple of stocks are still trying to make bullish moves amid the painful move. New Fortress Energy (NFE) And the Northrop Grumman (NCC) Both have been PPO tested after formation bullish bases.

X

Volume was lower on both the Nasdaq and New York Stock Exchanges than at the same time on Thursday, which is part of the relief.

Meanwhile, the yield on the benchmark 10-year Treasury bond rose four basis points to 2.96%. West Texas Intermediate crude futures rose nearly 2% to just under $119 a barrel.

Stocks were punished after new data from the Labor Department showed the US economy It added 390,000 jobs in May. This exceeded the estimate of 325,000 economists. The unemployment rate came in at 3.6%.

“The latest employment report showed a slowdown in job growth (versus the April figure) and the potential for inflation to ease, but still keeps the door open for the Fed to continue its drive to raise rates beyond the summer,” said Edward Moya, chief market analyst at Oanda. Note to customers.

Swipe the Nasdaq while fighting the Little Hats

At 1:30 PM ET, the Nasdaq was down more than 2.4%, but it moved away from its lows for the day. micron technology (mo) was lagging significantly as it fell around 7%.

The S&P 500 was far from its lows, sliding about 1.5% lower. American Airlines (AAL) suffered here as it fell by about 7%.

Syrian Pound The sectors were mainly negative. Consumer discretion and technology have been the hardest hit areas. Energy was the only positive factor as oil continued to rise.

Small-cap investors were battling hungry bears. Russell 2000 was less than 1%.

However, growth stocks have remained fairly resilient by comparison. The Innovator IBD 50 ETF (fifty), which is a leader in growth stocks, is far from its lows as it slipped partially lower.

Dow Jones today: Apple shares fell

The Dow Jones Industrial Average was the best performing among the major indexes but still shed about 279 points, or just under 1%.

Apple stock was the worst performer on the blue-chip index, down nearly 4%. It was low for the day, though. AAPL stock is still below its major moving averages and is now testing the support at the 10-day line, According to MarketSmith.

Giant chip Intel Corporation (INTC) was also badly behind, down more than 2%.

Larva (cat) was brighter as it gained more than 1%. Construction machinery maker stock aims to rise and move away 50 day moving average.

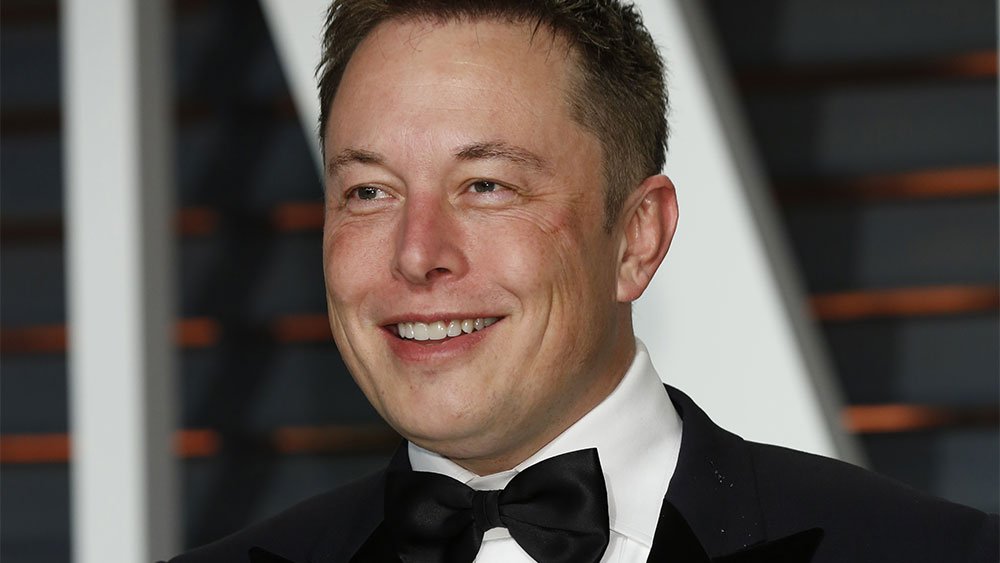

Tesla stock crashes as Elon Musk cuts jobs

Tesla’s slump in 2022 became even worse on Friday as the stock plunged 9%. This step came in a big way.

Electric vehicle stock was hit hard after CEO Elon Musk told employees by email that 10% of salaried employees would be fired, Reuters reported.

“Tesla will cut the number of paid employees by 10% because we are becoming overcrowded in many areas,” Musk said in his letter. “Note that this does not apply to anyone who actually builds cars, batteries, or installs solar energy.”

He also said the company would increase the number of its hourly wage employees.

It comes after Musk said he had a “very bad feeling” about the economy.

He also previously said on Twitter that employees who are unwilling to spend at least 40 hours in the office per week can “pretend to work elsewhere”.

Tesla stock crashed underneath 21-day exponential moving average It is now testing the support at the 10-day line. It is miles below its main moving averages.

Even Tesla stock is far from its current trend merge entry 1,208.10, MarketSmith analysis shows.

Amazon stock fall as key executive levels

Amazon shares took a hit after it announced that a key CEO would be stepping down.

The company said in a statement that Dave Clark, CEO of the company’s worldwide consumer business, will be resigning effective July 1. He has been in the e-commerce giant for the past 23 years.

Clark was an important right hand for company CEO Andy Gacy. He has been a key figure in expanding Amazon’s sprawling logistics network. An alternative that has not yet been named.

“The past few years have been among the most challenging and unpredictable we have encountered in the history of Amazon’s consumer business, and I especially appreciate Dave’s leadership during that time,” Gacy said in a blog post.

Clark said in a tweet on Twitter that it was time to “rebuild” after a productive tenure at Amazon. He also said he was confident his team was “prepared to succeed” in his stead.

Amazon stock fell about 2.5%. At 2441, shares are trading 35% off their 52-week high at 3773. It looks like AMZN is poised to end a six-session winning streak. AMZN is still shy of its major moving averages, specifically the 50-day average and the 200-day line.

Out Dow Jones: 2 leaderboard stock test entries

A couple of Leaderboard shares managed to pass buy points In the middle of hard work.

The natural gas game New Fortress Energy is playing a breakout phase, although it is now trading almost flat. This means that it is now sitting below the buying zone after crossing it to enter the consolidation pattern at 49.40.

However, exposure to the stock has been raised on the leaderboard’s list of largest stocks. It’s among the top 2% of stocks by price performance over the past 12 months.

NFE aims to become the world’s number one zero-carbon energy supplier by helping customers convert or build gas-fired facilities

Northrop Grumman’s defensive play is also just below his entry after off a cup base with handle. The ideal buy point is 477.36.

Big Money has been grabbing the stock lately. In all, the funds currently own 49% of the shares.

Please follow Michael Larkin on Twitter at Tweet embed Learn more about growth stocks and analysis.

You may also like:

MarketSmith: Research, charts, data, and training in one place

These are the 5 best stocks you can buy and watch right now

This is Warren Buffett’s ultimate stock, but should you buy it?

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

More Stories

How were the genetically modified purple tomatoes mixed with an organic variety? : screenshots

Shiba Inu Price Prediction – All about the latest SHIB buying opportunity

Bob Bakish is out as CEO of Paramount Worldwide