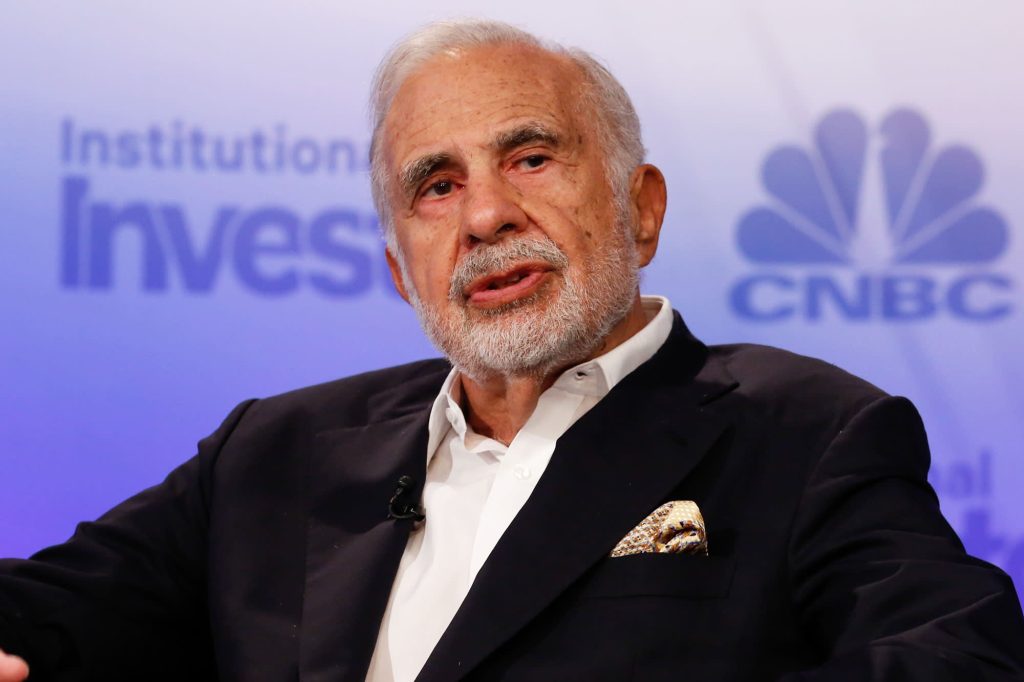

Carl Icahn speaks at Alpha Delivery in New York on September 13, 2016.

David A. Grosjean | CNBC

Icahn, criticizes Occidental’s bid for chevron In a deal concluded in May 2019 to buy Anadarko Petroleum with $10 billion financing from Warren Buffetthad been campaigning to oust CEO Vicki Hollub for nearly a year when Occidental shares plummeted in March 2020 — allowing Icahn to increase his stake to 10% from 2.5%, according to the newspaper.

Now, Occidental’s shares are up more than five times their value since dropping below $10 per share in 2020, thanks in large part to the recent surge in oil prices. Its shares closed Friday at $56.15 per share. That’s slightly less than they were before the Anadarko deal was finalized, according to the newspaper.

Recently, Icahn cut his position at Occidental and sold the rest in recent days, according to a letter Icahn sent to Occidental’s board of directors on Sunday. The letter indicated that Icahn’s representatives on Occidental’s board would also resign, as required by settlement agreement He had contacted the company two years ago this month.

Citing sources “with knowledge of the matter”, the magazine reported that Icahn made a profit of nearly $1 billion on the Occidental investment. Meanwhile, Buffett was recently buying Occidental. As of Friday, Buffett Berkshire Hathaway I mentioned owning it Nearly 5 billion dollars From Occidental stock.

Icahn has recently focused on Smaller utility company Southwest Gas, according to the magazine. Last week, the energy company announced plans to separate a subsidiary of Icahn it called for its sale.

For more details, read the full Wall Street Journal report here.

“Amateur organizer. Wannabe beer evangelist. General web fan. Certified internet ninja. Avid reader.”

More Stories

Exploring the XRP sell-off: When whales start exiting, should they do the same?

Tesla CEO Elon Musk visits China to attend FSD after Nixing trip to India

How were the genetically modified purple tomatoes mixed with an organic variety? : screenshots