The Colorado Rockies made a move Tuesday in the three-way race for worst team in baseball.The Chicago White Sox opened...

Media Exclusive by Alexandra Stegrad published May 1, 2024 at 5:04 PM ET Ousted meteorologist Rob Marciano's stormy tenure at...

Photograph of a T. rex skeleton at the Senckenberg Museum in Frankfurt, Germany. Tyrannosaurus rex lived at the end of...

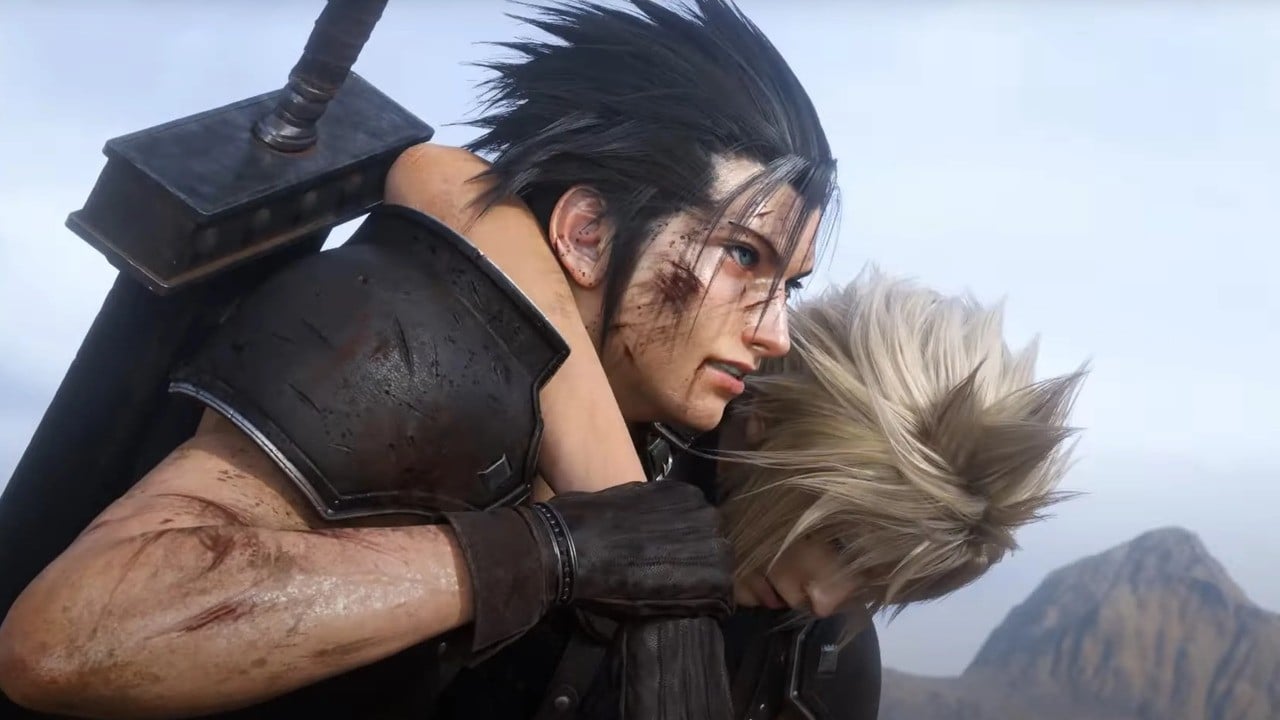

There has been a lot of discussion about the commercial success of Final Fantasy 7 Rebirth. The PS5 launched exclusively...

Written by Dominic CascianiHome and Legal CorrespondentMay 1, 2024, 12:53 GMTUpdated 7 minutes agoComment on the photo, Rwanda's scheme is...

Published On 01/05/2024 20:48 Video Length: 2 min War in Ukraine: In Moscow, the Russian army shows off its spoils...

Earnings per share: 23 cents – It was not immediately clear whether this was comparable to the expected loss of...

"American Idol" may be known for hosting the battle to become the next music star, but even the judges love...

This coronal mass ejection, captured by NASA's Solar Dynamics Observatory, exploded onto the Sun on August 31, 2012, traveling at...

Getty Images 2024 NFL draft It's in the books, but there's still a lot to discuss. Now that 257 players...