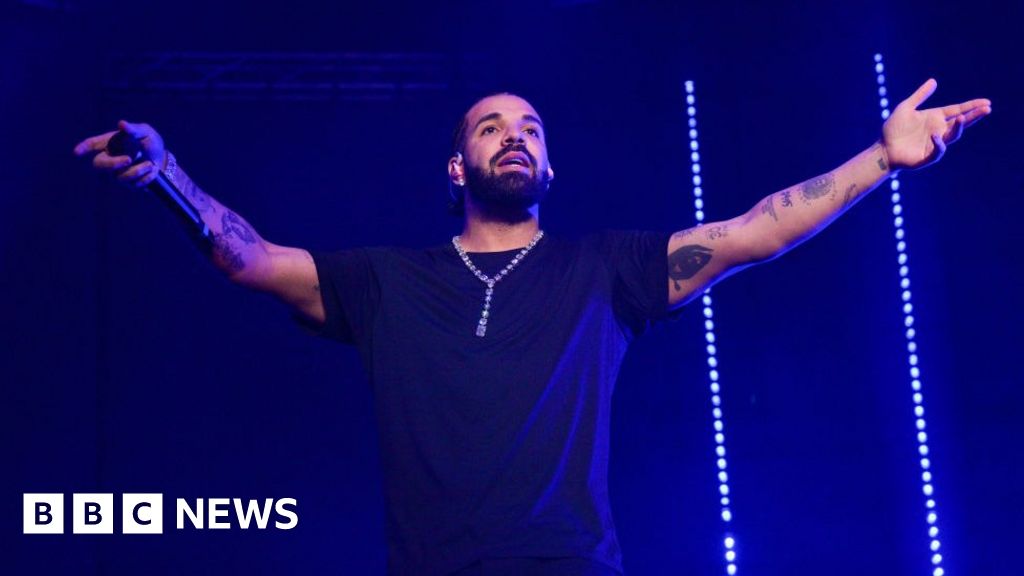

By Vicky Wong and Bonnie McLarenBBC News3 hours agoImage source, Getty ImagesComment on the photo, Drake has removed a track...

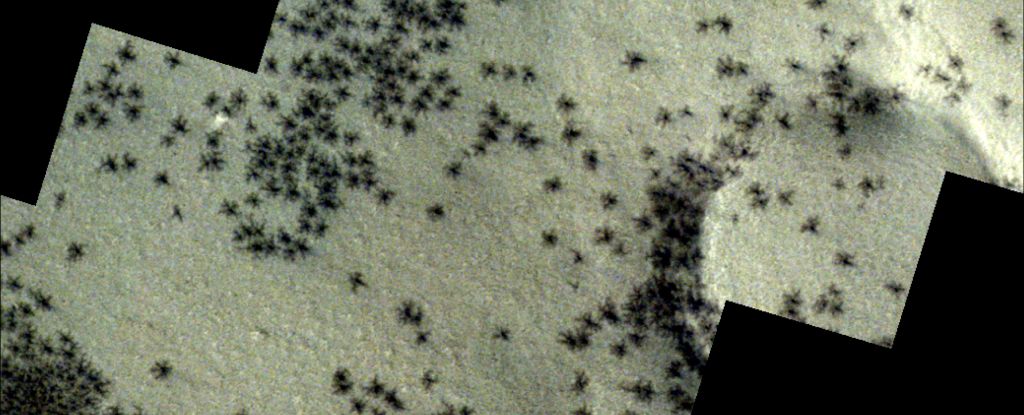

There may not be any insects on Mars, but new images taken by a spacecraft orbiting Mars have revealed a...

The NFL received 32 new players during the first round on Thursday night, but there is still plenty of talent...

Apple has scheduled its next product showcase for May 7, a few weeks before the Worldwide Developers Conference, making way...

Beijing (AFP) - US Secretary of State Anthony Blinken met on Friday with Chinese President Xi Jinping and senior Chinese...

View of Mount Fuji, Japan from the small town of Fujikawaguchiko. Philip Fong/AFP A Japanese town near Mount Fuji has...

Including food and energy, the PCE price measure for all items rose 2.7%, compared to estimates of 2.6%.On a monthly...

This was Ben Goessling's live report on the first round of the NFL Draft from Vikings headquarters at the TCO...

Palestinian officials in Gaza on Thursday raised the number of bodies discovered in a mass grave on the grounds of...

Donald Trump arrives for his arraignment in Manhattan Criminal Court on April 25, 2024 in New York. Jeana Moon /...