Finally, we know more about Aaron Sorkin's long-running follow-up to "The Social Network." He might want to update some of...

Refreshes 2024-04-26T19:42:30.435ZStarliner I astronauts finish training ahead of launch on May 6Astronauts Butch Wilmore and Sonny Williams have completed major...

Liverpool and Feyenoord have agreed a compensation package that will allow Arne Slott to become Jurgen Klopp's successor at Anfield.The...

It may not come as a huge surprise to hear - since we're talking about one of the most wish-listed...

April 26, 2024, 11:33 GMTUpdated 6 hours agoTo play this content, please enable JavaScript, or try another browserVideo explanation, Hamza...

Check the messagesArticle reserved for subscribersWar between Hamas and IsraelcaseVideos show scores of bodies being exhumed near the establishment. If...

Written by Mariko AoiBusiness reporterApril 26, 2024Comment on the photo, Mitsuko Tottori began her career as a flight attendantNot only...

By Vicky Wong and Bonnie McLarenBBC News3 hours agoImage source, Getty ImagesComment on the photo, Drake has removed a track...

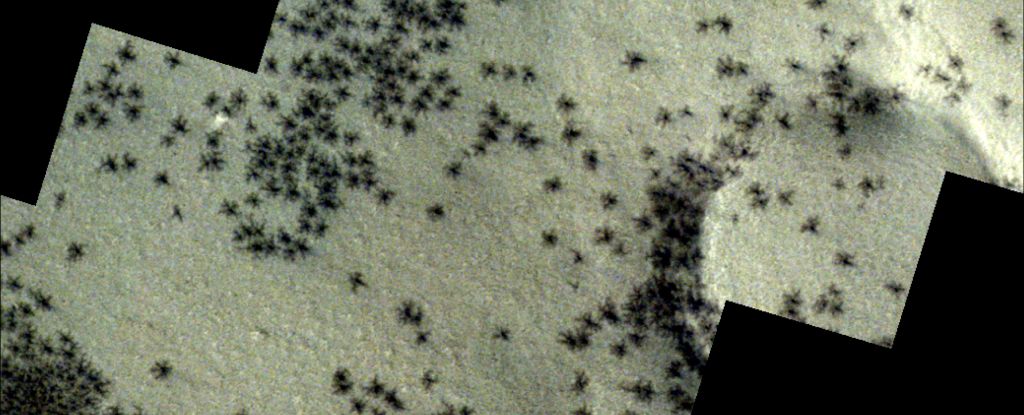

There may not be any insects on Mars, but new images taken by a spacecraft orbiting Mars have revealed a...

The NFL received 32 new players during the first round on Thursday night, but there is still plenty of talent...

:quality(70):focal(1750x495:1760x505)/cloudfront-eu-central-1.images.arcpublishing.com/liberation/U7MV54W2ONCKZHA5BV5OAU37HE.jpg)